Rising Prevalence of ENT Disorders

The increasing incidence of ENT disorders is a significant driver for The Global ENT Devices Industry. Conditions such as hearing loss, sinusitis, and sleep apnea are becoming more prevalent, particularly among aging populations.

According to recent estimates, nearly 466 million people worldwide suffer from disabling hearing loss, which underscores the urgent need for effective ENT solutions. This rising prevalence is likely to propel the demand for diagnostic and therapeutic devices, including hearing aids, nasal endoscopes, and surgical instruments.

As healthcare systems prioritize the management of these disorders, the market is expected to witness substantial growth, with a focus on developing innovative solutions to address these challenges.

Integration of Digital Health Solutions

The integration of digital health solutions into The Global ENT Devices Industry is reshaping the landscape of patient care. Telemedicine, mobile health applications, and remote monitoring tools are becoming increasingly prevalent, allowing for enhanced patient engagement and improved access to care. This trend is particularly relevant in the management of chronic ENT conditions, where continuous monitoring can lead to better health outcomes.

The market for digital health solutions is anticipated to grow significantly, with projections indicating a potential increase of over 20% in the next few years. This integration not only streamlines workflows for healthcare providers but also empowers patients to take an active role in their treatment, thereby driving the overall growth of the industry.

Aging Population and Increased Awareness

The aging population is a significant factor influencing The Global ENT Devices Industry. As individuals age, they become more susceptible to various ENT disorders, including hearing loss and balance disorders. This demographic shift is prompting a greater demand for ENT devices tailored to the needs of older adults.

Additionally, increased awareness regarding ENT health and the importance of early diagnosis is driving more individuals to seek medical attention. Educational campaigns and outreach programs are contributing to this heightened awareness, leading to an uptick in the utilization of ENT devices. The combination of an aging population and increased awareness is likely to create a sustained demand for innovative solutions within the industry.

Technological Advancements in ENT Devices

The Global ENT Devices Industry is experiencing a transformative phase driven by rapid technological advancements. Innovations such as minimally invasive surgical techniques, advanced imaging systems, and robotic-assisted surgeries are enhancing the precision and efficacy of ENT procedures.

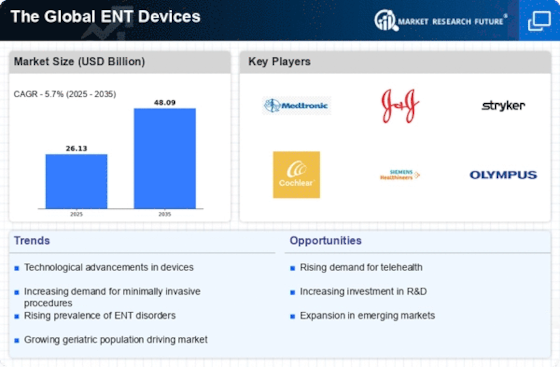

For instance, the introduction of endoscopic techniques has revolutionized sinus surgeries, leading to quicker recovery times and reduced patient discomfort. Furthermore, the market is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, indicating a robust demand for technologically advanced devices.

These advancements not only improve patient outcomes but also expand the range of treatable conditions, thereby driving the overall growth of the industry.

Growing Investment in Healthcare Infrastructure

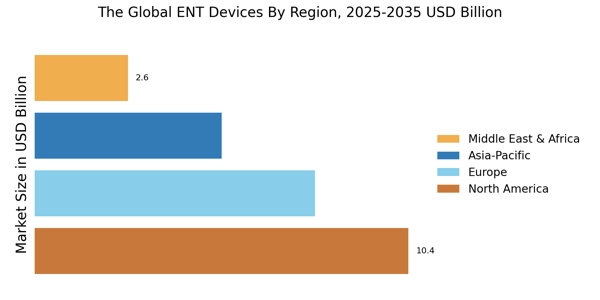

Investment in healthcare infrastructure is a crucial driver for The Global ENT Devices Industry. Governments and private entities are increasingly allocating funds to enhance healthcare facilities, particularly in emerging economies. This investment is aimed at improving access to advanced medical technologies, including ENT devices.

For instance, the establishment of specialized ENT clinics and hospitals is on the rise, which is likely to boost the demand for a wide range of ENT devices. As healthcare systems evolve, the focus on improving patient care and outcomes will further stimulate market growth. The anticipated increase in healthcare spending is expected to create a favorable environment for the ENT devices market, fostering innovation and expansion.