Aging Population

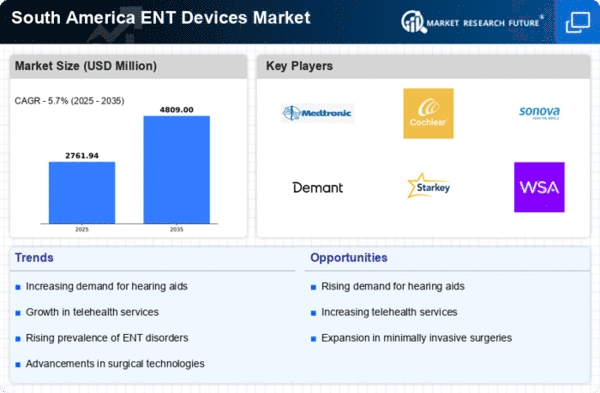

The demographic shift towards an aging population in South America is a crucial factor influencing the ent devices market. As the population ages, the prevalence of age-related ENT disorders, such as hearing loss and sinusitis, is expected to rise. According to recent statistics, approximately 15% of the South American population is over 65 years old, a figure that is anticipated to increase in the coming years. This demographic trend suggests a growing need for specialized ENT devices to address these health issues. The ent devices market is likely to see increased demand for hearing aids, nasal devices, and other related technologies tailored for older adults. Consequently, manufacturers may focus on developing user-friendly and technologically advanced devices to cater to this expanding segment of the population.

Rising Awareness of ENT Health

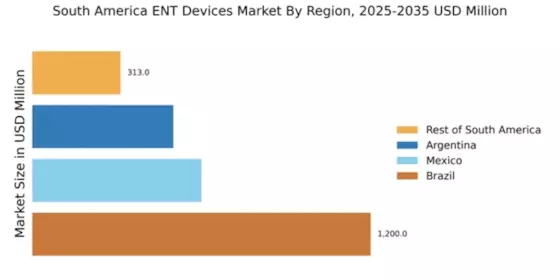

There is a notable increase in awareness regarding ENT health among the South American population, which serves as a significant driver for the ent devices market. Educational campaigns and health initiatives are being implemented to inform the public about the importance of early diagnosis and treatment of ENT disorders. This heightened awareness is likely to lead to more individuals seeking medical attention for their symptoms, thereby increasing the demand for ENT devices. For example, Brazil has launched several public health campaigns aimed at promoting hearing health, which has resulted in a 20% increase in hearing aid sales over the past year. The ent devices market is poised to capitalize on this trend, as more patients become proactive in managing their ENT health.

Increasing Healthcare Expenditure

The rising healthcare expenditure in South America is a pivotal driver for the ent devices market. Governments and private sectors are allocating more funds towards healthcare, which includes investments in advanced medical technologies. For instance, Brazil's healthcare spending is projected to reach approximately $200 billion by 2025, indicating a growing commitment to improving healthcare infrastructure. This increase in funding is likely to enhance the availability and accessibility of ENT devices, thereby stimulating market growth. Furthermore, as healthcare budgets expand, there is a greater emphasis on acquiring innovative ENT devices that can improve patient outcomes. The ent devices market stands to benefit significantly from this trend, as healthcare providers seek to adopt cutting-edge solutions to meet the rising demand for effective treatments.

Government Initiatives and Support

Government initiatives aimed at improving healthcare access and quality are playing a vital role in the growth of the ent devices market in South America. Various countries are implementing policies to enhance healthcare infrastructure, which includes the procurement of advanced medical devices. For example, Argentina has introduced subsidies for healthcare facilities to acquire modern ENT devices, thereby facilitating better patient care. Such initiatives not only increase the availability of ENT devices but also encourage manufacturers to invest in the region. The ent devices market is likely to experience growth as these supportive measures create a conducive environment for innovation and expansion.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is transforming the ent devices market in South America. Innovations such as telemedicine, artificial intelligence, and minimally invasive surgical techniques are becoming increasingly prevalent. These technologies not only enhance the efficiency of ENT procedures but also improve patient outcomes. For instance, the use of AI in diagnostic tools has shown to increase accuracy by up to 30%, leading to better treatment plans. As healthcare providers adopt these technologies, the demand for compatible ENT devices is likely to rise. The ent devices market must adapt to these technological advancements to remain competitive and meet the evolving needs of healthcare professionals and patients alike.