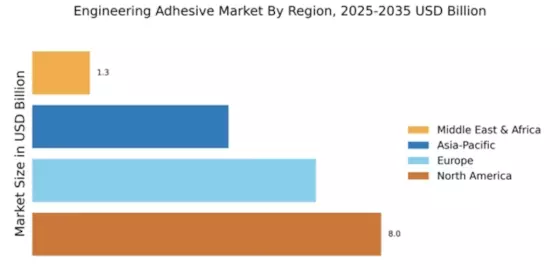

North America : Market Leader in Adhesives

North America is poised to maintain its leadership in the engineering adhesive market, holding a significant share of 8.0 in 2024. The region's growth is driven by robust demand from automotive, aerospace, and construction sectors, alongside stringent regulations promoting high-performance materials. The increasing focus on sustainability and innovation further propels market expansion, with companies investing in eco-friendly adhesive solutions to meet regulatory standards.

The competitive landscape in North America is characterized by the presence of major players such as 3M, H.B. Fuller, and Dow. These companies leverage advanced technologies and extensive distribution networks to cater to diverse industry needs. The U.S. remains the largest market, supported by a strong manufacturing base and continuous R&D efforts. As the demand for high-performance adhesives grows, these key players are well-positioned to capitalize on emerging opportunities.

Europe : Innovation and Sustainability Focus

Europe's engineering adhesive market is projected to reach 6.5 by 2025, driven by increasing demand for sustainable and high-performance materials. Regulatory frameworks, such as REACH, are pushing manufacturers to innovate and develop eco-friendly adhesive solutions. The automotive and construction industries are significant contributors to this growth, as they seek adhesives that enhance product performance while adhering to environmental standards.

Leading countries in this region include Germany, France, and the UK, where companies like Henkel and BASF are at the forefront of innovation. The competitive landscape is marked by a strong emphasis on R&D, with firms investing heavily in developing advanced adhesive technologies. As the market evolves, the focus on sustainability and compliance with stringent regulations will shape the future of engineering adhesives in Europe.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing significant growth in the engineering adhesive market, projected to reach 4.5 by 2025. This growth is fueled by rapid industrialization, urbanization, and increasing demand from sectors such as automotive and electronics. Countries like China and India are leading this trend, supported by government initiatives aimed at boosting manufacturing and infrastructure development, which in turn drives adhesive consumption.

The competitive landscape in Asia-Pacific is evolving, with both local and international players vying for market share. Companies like Sika and Momentive are expanding their presence in the region, focusing on innovation and customer-centric solutions. As the market matures, the emphasis on quality and performance will become crucial, positioning key players to leverage emerging opportunities in this dynamic environment.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa (MEA) region, with a market size of 1.32, presents untapped opportunities in the engineering adhesive sector. The growth is driven by increasing construction activities and infrastructure development, particularly in countries like the UAE and South Africa. Government initiatives aimed at enhancing industrial capabilities are also contributing to the rising demand for high-performance adhesives in various applications.

The competitive landscape in MEA is characterized by a mix of local and international players. Companies are focusing on expanding their product offerings to cater to diverse industry needs. As the region continues to develop, the demand for innovative adhesive solutions is expected to rise, providing significant growth opportunities for key players in the market.