Emergence of 5G Technology

The Embedded Die Packaging Technology Market is poised for growth due to the emergence of 5G technology. As telecommunications companies roll out 5G networks, there is a heightened demand for devices that can support higher data rates and lower latency. Embedded die packaging technology facilitates the integration of multiple functions into a single package, which is essential for meeting the performance requirements of 5G applications. Analysts predict that the 5G market will reach trillions of dollars in the next decade, creating substantial opportunities for embedded die packaging solutions to thrive in this rapidly evolving landscape.

Growing Focus on Energy Efficiency

The Embedded Die Packaging Technology Market is increasingly focused on energy efficiency, driven by both regulatory pressures and consumer demand for sustainable products. As energy consumption becomes a critical concern, manufacturers are seeking packaging solutions that minimize power loss and enhance thermal performance. Embedded die packaging offers a pathway to achieve these goals by reducing the distance between components, thereby lowering resistance and improving overall efficiency. Reports suggest that energy-efficient technologies could account for a substantial share of the electronics market, indicating a strong potential for embedded die packaging to play a pivotal role in the development of greener electronic solutions.

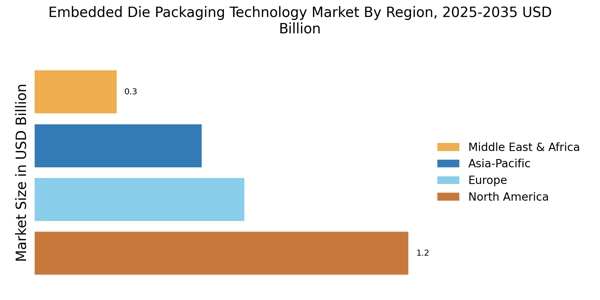

Expansion of Automotive Electronics

The Embedded Die Packaging Technology Market is significantly influenced by the expansion of automotive electronics. With the automotive sector increasingly integrating advanced electronic systems for safety, navigation, and entertainment, the demand for compact and efficient packaging solutions is on the rise. Embedded die packaging technology is particularly suited for automotive applications due to its ability to withstand harsh environments while providing reliable performance. The automotive electronics market is projected to grow at a robust pace, with embedded die packaging expected to capture a notable share as manufacturers seek to enhance vehicle functionality and connectivity.

Rising Demand for Compact Electronics

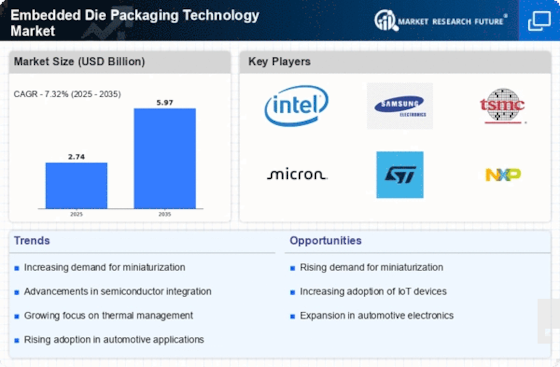

The Embedded Die Packaging Technology Market is experiencing a surge in demand for compact electronic devices. As consumer preferences shift towards smaller, lighter, and more efficient gadgets, manufacturers are compelled to adopt advanced packaging solutions. This trend is particularly evident in sectors such as smartphones, wearables, and IoT devices, where space constraints are paramount. The market for embedded die packaging is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is driven by the need for enhanced performance and reduced form factors, making embedded die packaging an attractive option for manufacturers aiming to meet consumer expectations.

Increased Adoption of Advanced Semiconductor Technologies

The Embedded Die Packaging Technology Market is witnessing increased adoption of advanced semiconductor technologies. As the semiconductor landscape evolves, manufacturers are integrating more complex functionalities into smaller packages. This shift is largely influenced by the demand for high-performance computing and the proliferation of artificial intelligence applications. The embedded die packaging approach allows for better thermal management and improved electrical performance, which are critical in high-speed applications. Market analysts indicate that the semiconductor sector is expected to reach a valuation of several hundred billion dollars, further propelling the embedded die packaging technology as a preferred choice for innovative designs.