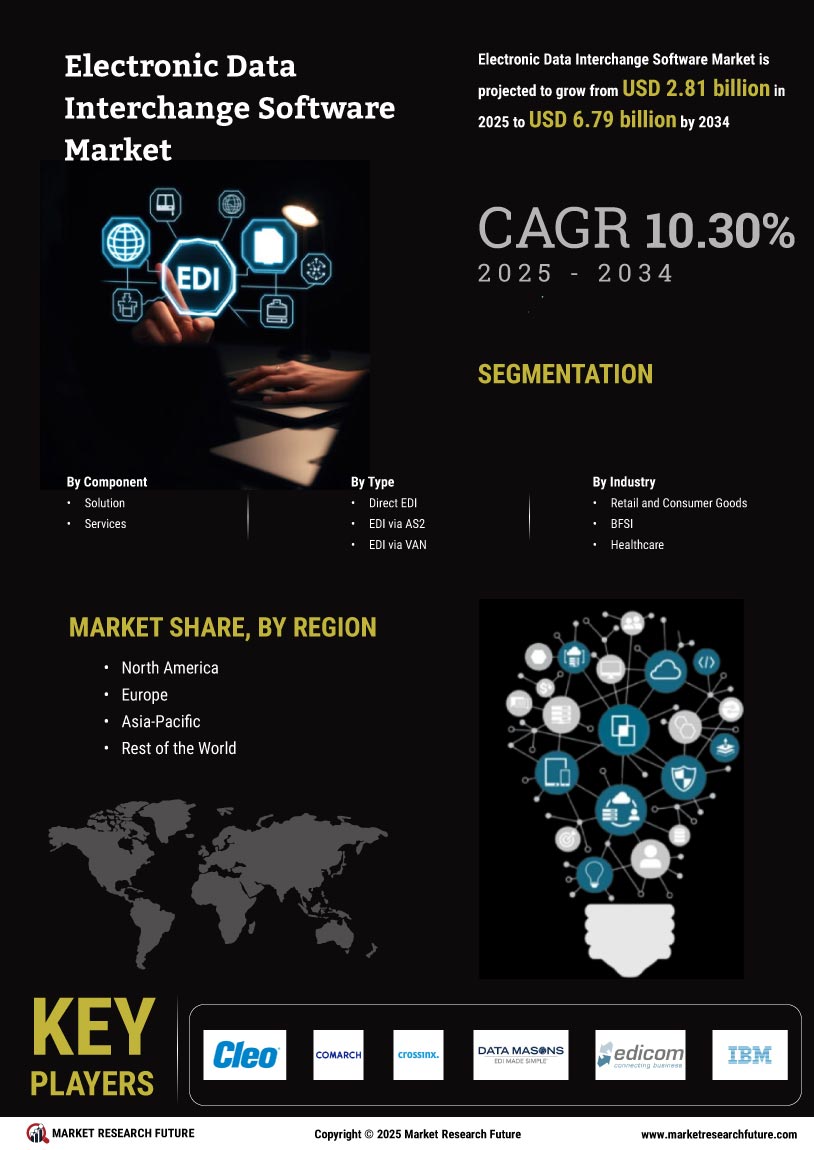

Rising E-commerce Activities

The Electronic Data Interchange Software Market is significantly influenced by the rise in e-commerce activities. As online shopping becomes more prevalent, businesses are compelled to adopt EDI solutions to manage the increased volume of transactions efficiently. EDI software enables seamless communication between trading partners, ensuring that orders, invoices, and shipping notices are exchanged promptly. Recent statistics indicate that e-commerce sales have seen a substantial increase, with projections suggesting continued growth in the coming years. This trend necessitates robust EDI systems that can handle the complexities of e-commerce transactions, thereby driving the demand for EDI software in various sectors, including retail and logistics.

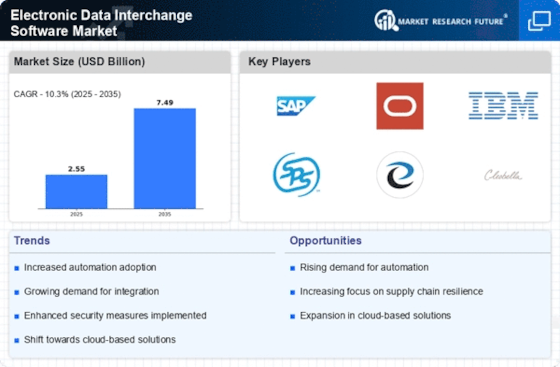

Increased Demand for Automation

The Electronic Data Interchange Software Market is experiencing a surge in demand for automation solutions. Businesses are increasingly recognizing the need to streamline operations and reduce manual errors. Automation through EDI software facilitates faster processing of transactions, which can lead to improved efficiency and cost savings. According to recent data, companies that implement EDI solutions can reduce order processing time by up to 80%. This trend is particularly evident in sectors such as retail and manufacturing, where timely data exchange is critical. As organizations strive for operational excellence, the adoption of EDI software is likely to continue growing, driven by the need for enhanced productivity and reduced operational costs.

Enhanced Supply Chain Management

The Electronic Data Interchange Software Market is benefiting from the growing emphasis on enhanced supply chain management. Companies are increasingly adopting EDI solutions to improve visibility and coordination across their supply chains. EDI software facilitates real-time data exchange, allowing businesses to respond swiftly to market changes and customer demands. This capability is particularly crucial in industries such as automotive and pharmaceuticals, where supply chain efficiency can significantly impact profitability. Data suggests that organizations utilizing EDI can achieve a reduction in supply chain costs by up to 30%. As businesses seek to optimize their supply chains, the demand for EDI software is expected to rise, reflecting a broader trend towards integrated supply chain solutions.

Focus on Data Security and Compliance

The Electronic Data Interchange Software Market is increasingly shaped by the focus on data security and compliance. With the rise in cyber threats and stringent regulatory requirements, businesses are prioritizing secure data exchange methods. EDI software provides robust security features, including encryption and authentication, which are essential for protecting sensitive information. Moreover, compliance with regulations such as GDPR and HIPAA is becoming a critical concern for organizations. As companies strive to meet these compliance standards, the demand for secure EDI solutions is likely to grow. This trend underscores the importance of integrating security measures within EDI software, ensuring that businesses can operate confidently in a complex regulatory landscape.

Integration with Advanced Technologies

The Electronic Data Interchange Software Market is witnessing a trend towards integration with advanced technologies such as artificial intelligence and blockchain. These technologies enhance the capabilities of EDI software, enabling smarter data processing and improved transaction transparency. For instance, AI can analyze transaction patterns to optimize supply chain decisions, while blockchain can provide an immutable record of transactions, enhancing trust among trading partners. As businesses seek to leverage these technologies for competitive advantage, the demand for EDI solutions that incorporate such innovations is likely to increase. This integration not only streamlines operations but also positions companies to adapt to future technological advancements.