Increased Focus on Supply Chain Resilience

The UK Electronic Data Interchange Edi Software Market is witnessing a heightened focus on supply chain resilience. Recent disruptions in global supply chains have prompted UK businesses to reevaluate their operational strategies. EDI software plays a crucial role in enhancing supply chain visibility and agility, allowing organizations to respond swiftly to changes in demand and supply. Market analysis suggests that companies investing in EDI solutions are better positioned to mitigate risks associated with supply chain disruptions. As businesses prioritize resilience, the adoption of EDI systems is expected to increase, fostering a more robust and adaptable supply chain framework across various industries in the UK.

Expansion of E-Commerce and Digital Transactions

The rapid expansion of e-commerce in the UK is significantly influencing the Electronic Data Interchange Edi Software Market. With online retail sales projected to reach over 200 billion GBP by 2026, businesses are increasingly adopting EDI solutions to facilitate seamless digital transactions. EDI software enables efficient order processing, invoicing, and inventory management, which are essential for e-commerce operations. As more companies transition to online platforms, the demand for EDI systems that can integrate with e-commerce solutions is likely to grow. This trend not only enhances operational efficiency but also improves customer satisfaction by ensuring timely and accurate order fulfillment.

Regulatory Compliance and Data Protection Initiatives

In the UK Electronic Data Interchange Edi Software Market, regulatory compliance and data protection initiatives are becoming increasingly critical. The implementation of the General Data Protection Regulation (GDPR) has heightened the focus on data security, compelling organizations to adopt EDI solutions that ensure compliance. Companies are now prioritizing EDI software that incorporates robust security features to protect sensitive information during data exchanges. This shift is reflected in market data, indicating that over 60% of UK businesses consider compliance a primary factor when selecting EDI solutions. As regulatory frameworks evolve, the demand for compliant EDI software is expected to rise, driving innovation and investment in the UK market.

Technological Advancements and Integration Capabilities

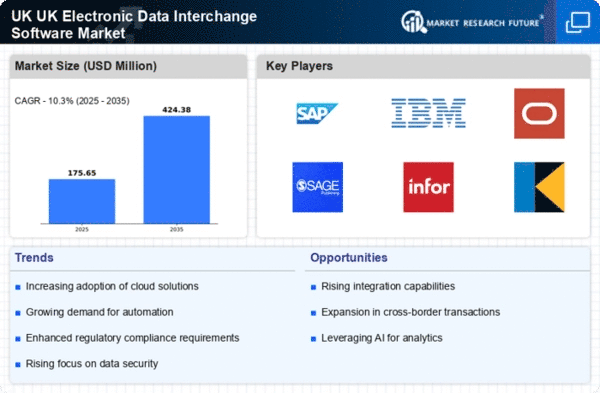

Technological advancements are significantly shaping the UK Electronic Data Interchange Edi Software Market. The integration of advanced technologies such as artificial intelligence and machine learning into EDI solutions is enhancing their capabilities. These innovations enable businesses to automate data processing, improve accuracy, and reduce manual intervention. Market data indicates that approximately 40% of UK companies are exploring AI-driven EDI solutions to optimize their operations. As organizations seek to leverage technology for competitive advantage, the demand for sophisticated EDI software that offers seamless integration with existing systems is likely to grow. This trend underscores the importance of technological evolution in driving the future of the EDI market in the UK.

Growing Demand for Automation in Supply Chain Management

The UK Electronic Data Interchange Edi Software Market is experiencing a notable surge in demand for automation within supply chain management. Businesses are increasingly recognizing the efficiency gains associated with automating data exchange processes. According to recent statistics, approximately 70% of UK companies are now utilizing EDI solutions to streamline their operations. This trend is driven by the need for real-time data sharing, which enhances decision-making and reduces operational costs. As organizations strive to remain competitive, the adoption of EDI software is likely to continue growing, facilitating smoother transactions and improved inventory management. The integration of automated EDI systems is expected to be a key driver in the evolution of supply chain practices across various sectors in the UK.