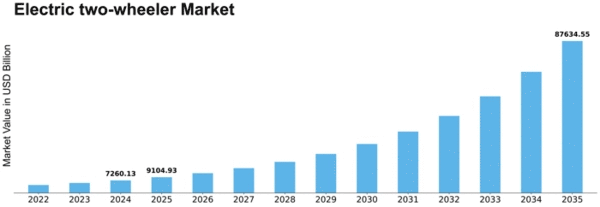

Electric Two Wheeler Size

Electric two-wheeler Market Growth Projections and Opportunities

The Network Engineering Services market is impacted by a group of variables that on the whole shape its development and direction. One of the essential drivers is the rising interest for powerful and adaptable network foundation to help the computerized change of organizations. As associations embrace distributed computing, IoT, and other trend setting innovations, the requirement for effective network engineering services becomes basic. Network engineers assume an essential part in planning, executing, and keeping up with the foundation that empowers consistent correspondence and information trade inside and between associations. State run administrations overall perceive the significance of vigorous and secure network foundation for financial development and public seriousness. Arrangements connected with information security, online protection, and the advancement of computerized foundation influence the necessities and principles that network engineering services should adhere to, affecting market elements. The market for network engineering services is additionally molded by the rising significance of online protection. With the rising recurrence and refinement of digital dangers, associations focus on getting their networks. Network engineers are essential in carrying out online protection measures, like firewalls, interruption discovery frameworks, and encryption conventions, to defend sensitive information and guarantee the uprightness of network correspondences. Worldwide and provincial patterns likewise assume a part in forming the Network Engineering Services market. The rising reception of remote work, the increase of cell phones, and the development of information concentrated applications add to the interest for network engineering services that can uphold these patterns. Furthermore, territorial varieties in innovation reception and framework improvement impact the prerequisites and difficulties looked by network engineering specialist collectives in various geological areas. Security contemplations likewise essentially influence the market elements of network engineering services. With the heightening recurrence and complexity of digital threats, organizations are focusing on vigorous network security arrangements. Network engineers are entrusted with executing and keeping up with security conventions, firewalls, and interruption recognition frameworks to defend delicate information and guarantee the propriety of correspondence networks. The accentuation on network protection is reshaping the scene of network engineering services, with a rising spotlight on active hazard detection and reaction.

Leave a Comment