Rising Fuel Prices

The volatility of fuel prices is a notable driver of the Global Electric Two-Wheeler Market Industry. As gasoline prices fluctuate, consumers are increasingly looking for cost-effective alternatives to traditional vehicles. Electric two-wheelers present a viable solution, offering lower operating costs and reduced dependence on fossil fuels. The long-term savings associated with electric vehicles, combined with the rising cost of gasoline, are likely to encourage more consumers to transition to electric two-wheelers. This shift is expected to contribute to the market's expansion, aligning with the broader trend towards sustainable transportation.

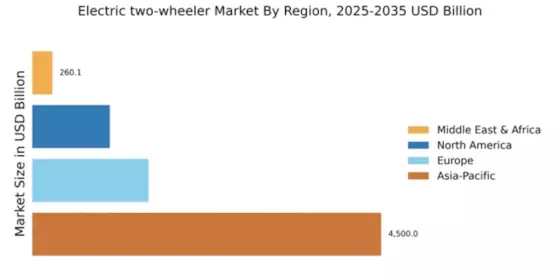

Market Growth Projections

The Global Electric Two-Wheeler Market Industry is poised for substantial growth, with projections indicating a market value of 30.1 USD Billion in 2024 and an anticipated increase to 100 USD Billion by 2035. The compound annual growth rate of 11.55% from 2025 to 2035 underscores the robust demand for electric two-wheelers. This growth trajectory reflects the convergence of various factors, including technological advancements, government support, and changing consumer preferences. As the market evolves, it is likely to attract new entrants and foster innovation, further enhancing the competitive landscape.

Technological Advancements

Technological innovations play a pivotal role in shaping the Global Electric Two-Wheeler Market Industry. Advances in battery technology, such as lithium-ion batteries, have significantly improved the range and efficiency of electric two-wheelers. Enhanced charging infrastructure, including fast-charging stations, is also emerging, making electric two-wheelers more convenient for consumers. Furthermore, the integration of smart technologies, such as connectivity features and advanced safety systems, is likely to attract a broader customer base. These developments not only enhance user experience but also contribute to the overall growth of the market, which is anticipated to reach 100 USD Billion by 2035.

Growing Environmental Concerns

The increasing awareness of environmental issues drives the Global Electric Two-Wheeler Market Industry. As urban areas grapple with pollution and climate change, consumers are more inclined to adopt electric two-wheelers as a sustainable alternative to traditional gasoline-powered vehicles. Governments worldwide are implementing stricter emissions regulations, which further incentivizes the shift towards electric mobility. For instance, many countries are setting ambitious targets for reducing carbon emissions, thereby creating a favorable environment for electric two-wheelers. This trend is expected to contribute to the market's growth, with projections indicating a market value of 30.1 USD Billion in 2024.

Government Incentives and Policies

Government incentives and supportive policies are crucial drivers of the Global Electric Two-Wheeler Market Industry. Many governments are offering subsidies, tax rebates, and grants to encourage the adoption of electric vehicles. These financial incentives reduce the initial purchase cost for consumers, making electric two-wheelers more accessible. Additionally, various countries are investing in charging infrastructure to alleviate range anxiety among potential buyers. As a result, the market is likely to witness a surge in demand, with a projected compound annual growth rate of 11.55% from 2025 to 2035, reflecting the positive impact of these initiatives.

Urbanization and Traffic Congestion

Rapid urbanization and increasing traffic congestion are significant factors influencing the Global Electric Two-Wheeler Market Industry. As cities expand and populations grow, the demand for efficient and sustainable transportation solutions rises. Electric two-wheelers offer a practical alternative for navigating congested urban environments, providing flexibility and ease of use. Their compact size allows for maneuverability in heavy traffic, making them an attractive option for commuters. This trend is expected to drive market growth, as more individuals seek eco-friendly transportation methods to address urban mobility challenges.