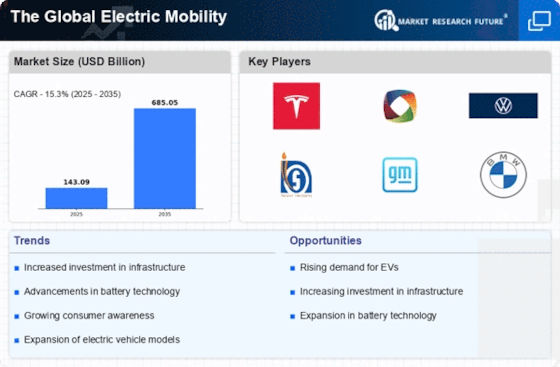

Rising Environmental Concerns

The increasing awareness of environmental issues is a pivotal driver for the Electric Mobility Market. As climate change and air pollution become more pressing global challenges, consumers and governments alike are seeking sustainable alternatives to traditional fossil fuel vehicles. This shift is reflected in the growing demand for electric vehicles (EVs), which are perceived as a cleaner option. In 2025, it is estimated that the market for electric vehicles will reach approximately 30 million units sold annually, indicating a robust growth trajectory. The E-Mobility Market is thus positioned to benefit from this heightened focus on sustainability, as more individuals and organizations prioritize eco-friendly transportation solutions.

Economic Incentives and Subsidies

Economic incentives and subsidies provided by governments are instrumental in propelling the Electric Mobility Sector. Many countries have implemented financial incentives to encourage the adoption of electric vehicles, such as tax credits, rebates, and grants. These measures significantly lower the upfront costs associated with purchasing EVs, making them more accessible to a broader audience. For instance, in 2025, it is anticipated that government incentives will account for nearly 20% of the total electric vehicle sales. This financial support not only stimulates consumer interest but also fosters a favorable environment for manufacturers, thereby driving the growth of the E-Mobility Market.

Advancements in Charging Infrastructure

The development of comprehensive charging infrastructure is crucial for the Electric Mobility Landscape. As the number of electric vehicles on the road increases, the need for accessible and efficient charging stations becomes paramount. Investments in charging networks are expanding, with projections suggesting that the number of public charging points could exceed 3 million by 2025. This expansion not only alleviates range anxiety among potential EV buyers but also enhances the overall appeal of electric mobility. Consequently, the E-Mobility Market is likely to experience accelerated growth as consumers gain confidence in the availability of charging solutions.

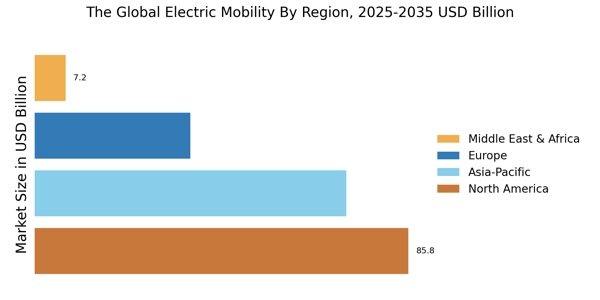

Growing Urbanization and Population Density

The trend of urbanization and increasing population density in metropolitan areas is reshaping transportation needs, thereby influencing the Electric Mobility Landscape. As cities become more congested, the demand for efficient and sustainable transportation solutions rises. Electric vehicles, with their lower operational costs and reduced emissions, are becoming an attractive option for urban dwellers. By 2025, it is projected that urban areas will account for over 70% of global electric vehicle sales, highlighting the critical role of urbanization in driving market growth. This demographic shift presents a unique opportunity for the Electric Transportation Market to cater to the evolving transportation landscape.

Technological Innovations in Electric Vehicles

Technological innovations in electric vehicles are a key driver for the Electric Mobility Sector. Advances in battery technology, such as increased energy density and faster charging capabilities, are enhancing the performance and appeal of electric vehicles. Furthermore, the integration of smart technologies, including autonomous driving features and connectivity, is transforming the driving experience. As of 2025, it is expected that electric vehicles will comprise over 25% of new car sales, driven by these technological advancements. This trend indicates a strong potential for growth within the Electric Transportation Market, as consumers increasingly seek vehicles that offer both sustainability and cutting-edge technology.