Market Trends

Key Emerging Trends in the Elastography Imaging Market

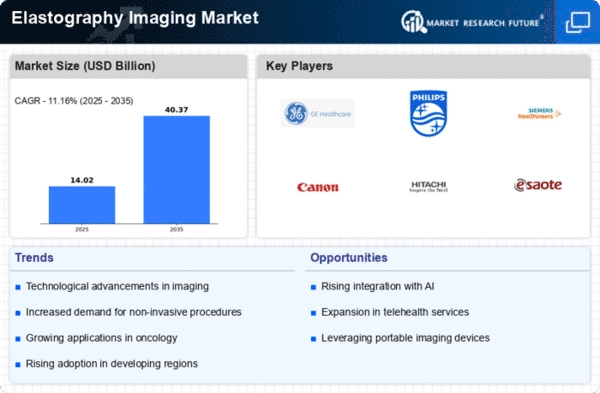

Recently improved medical imaging technologies have boosted the elastography imaging industry. Elastography evaluates tissue stiffness and flexibility non-invasively. The information helps physicians diagnose and monitor several medical diseases. The growth in chronic illnesses including breast cancer, liver fibrosis, and cirrhosis drives the elastography imaging industry. Demand for elastography is rising since it detects and monitors these issues early. Increasing technology has boosted the elastography imaging industry. Doctors like elastography because it improves picture quality, scan speed, and diagnosis accuracy. The usage has extended across numerous medical sectors. Use elastography photos for more than simply the usual. Elastography, originally used to examine the liver, now images the breast, musculoskeletal system, and heart. In several medical disciplines, supplying additional items has increased market importance. More healthcare staff and consumers are learning about elastography, improving the market. This screening procedure is used as a medical tool since it's painless and provides real-time information. New medical imaging technologies like elastography are simpler to employ due to rising healthcare prices worldwide. Public and commercial organizations are investing in cutting-edge medical equipment, driving the elastography imaging device market. Medical device manufacturers, research institutions, and healthcare personnel have collaborated to improve elastography imaging. These collaborations have streamlined R&D, resulting in new products and technology. Elastography is easier to reimburse, thus physicians utilize it more in their medical plans. Compensation helps patients and encourages healthcare providers to acquire elastography gear. Elastography image market has some encouraging signals, but pricey equipment is hard to procure in certain regions. For the market to flourish and elastography imaging to be utilized worldwide, these issues must be resolved. New technology, continuous research, and increased awareness of elastography imaging are projected to drive the market. Demand for elastography is projected to rise as new applications and advantages are discovered. This will improve medical diagnosis and treatment.

Leave a Comment