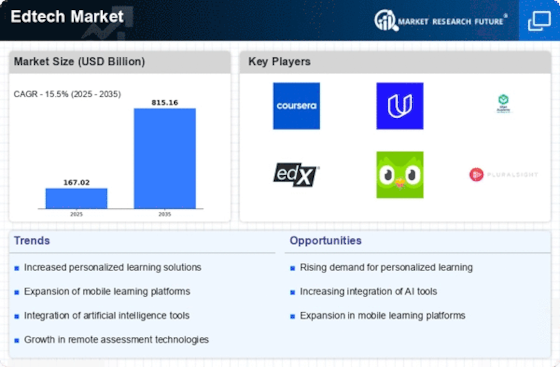

Leading market players often form strategic partnerships with educational institutions, government bodies, and other stakeholders. Collaborative ventures help in expanding reach, accessing new markets, and co-developing tailored solutions that address specific educational needs. Leading edu tech companies and education technology companies such as Coursera, Udacity, Khan Academy, and BYJU’S are driving innovation across the global Edtech market. Market participants are also Adopting a variety of strategic activities to expand their global footprint, with important market developments including new product launches, Product Diversification and Innovation, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Edtech industry must offer diversified solutions.

Acquiring innovative startups or merging with complementary companies is one of the key business tactics used by manufacturers in the global Edtech industry to benefit clients and increase the market sector. In recent years, the Edtech industry has offered some of the most significant advantages to Consumers. Major players in the Edtech Market, including 17zuoye, 2U, Age of Learning, Blackboard, BYJU'S, Chegg, Civitas Learning, Coursera, Dreambox Learning, Duolingo, Genshuixue, Guild Education, and others, are attempting to increase market demand by investing in product development to increase their product line and cater to diverse consumer needs.

Age of Learning is a leading education technology innovator, renowned for creating engaging and effective learning resources aimed at fostering a strong academic foundation and a lifelong passion for learning in children. The company's research-backed

digital education programs, exemplified by its flagship product ABCmouse.com Early Learning Academy and Adventure Academy, a massively multiplayer online game, have demonstrated efficacy in enhancing children's learning gains. Age of Learning's School Solutions Programs, including My Math Academy and My Reading Academy, provide adaptive and personalized learning experiences.

With over 10 billion completed learning activities by more than 50 million children globally, the Age of Learning is a key player in advancing equity, access, and educational opportunities. Through the Age of Learning Foundation, the company extends its commitment by offering research-proven educational products at no cost to millions of children in need worldwide.

In July Age of Learning entered into a strategic partnership with AASA, The School Superintendents Association. The collaboration aims to assist district superintendents in identifying and deploying evidence-based solutions that enable early childhood educators to personalize learning effectively within the classroom.

BYJU’S, a global ed-tech powerhouse founded in India in 2011, has emerged as a leader in providing adaptive and engaging learning solutions to over 150 million students worldwide. The company's extensive portfolio includes Disney-BYJU’S Early Learn, BYJU’S Future School, Epic!, Osmo, Tynker, Toppr, WhiteHat Jr, and the renowned flagship product BYJU’S – The Learning App. BYJU excels in Pre-K to 12 education and competitive exam preparations. With a unique blend of mobile technology, interactive content, and personalized learning, BYJU ensures a world-class educational experience. Their geography-agnostic solutions, supported by 12,000+ teachers, cater to individual learning styles.

Notable partnerships with global giants like Disney and Google enhance engagement. Backed by prominent investors, BYJU’S has executed over 15 strategic acquisitions, solidifying its global presence in the ed-tech landscape.

In June BYJU unveiled a collaboration with Google to facilitate the seamless continuation of online learning for educators and students alike. The incorporation of Google Workspace for Education into BYJU will provide a complimentary, collaborative, and personalized digital platform designed for efficient classroom organization. This offering will be made available free of charge to participating educational institutions.