Research Methodology on Social and Emotional Learning (SEL) Market

1. Introduction

Social and emotional learning (SEL) refers to an approach to developing an individual's skills in recognizing and managing emotions, creating meaningful relationships, making responsible decisions and solving conflicts. It involves efficient learning about one’s self, other people, and the world around them. There is immense potential in this field, especially in the educational sector which is the main driver of the SEL market.

Today, the growing need to develop the social and emotional development of students is leading to the increasing demand for SEL. This has resulted in increased investments by the government and private sector, thus further driving the growth of the Social and Emotional Learning (SEL) Market.

2. Research Objectives

The primary objective of this research is to understand the current market scenario of Social and Emotional Learning (SEL). These objectives are:

- To study the growth rate of the market for Social and Emotional Learning (SEL)

- To identify the drivers, restraints and other factors impacting the Social and Emotional Learning (SEL) Market

- To assess the positioning of SEL technology

- To analyse the challenges and opportunities in the Social and Emotional Learning (SEL) Market

- To study the competitive landscape and identify the key players

- To sense the demand-supply gap of the Social and Emotional Learning (SEL) Market

- To identify and analyse emerging trends in the Social and Emotional Learning (SEL) Market

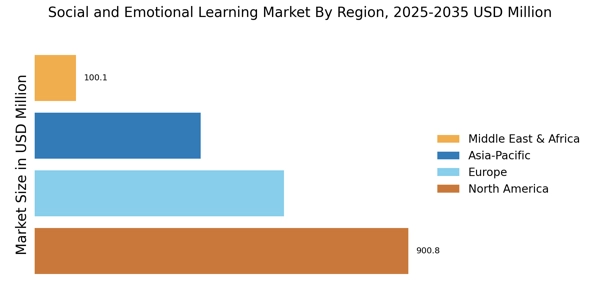

- To analyse and forecast the market size for Social and Emotional Learning (SEL), with respect to five regions: North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America

3. Research Methodology

The research methodology adopted for this research is a combination of primary and secondary research. A comprehensive study of the Social and Emotional Learning (SEL) Market is provided which includes the definition, scope, market analysis, regional analysis, competitive landscape, different segmentation and trends.

For this study, both primary and secondary research was conducted. Primary sources were industry professionals, industry experts and product owners. Several surveys were conducted to gain insight into the usage of Social and Emotional Learning (SEL). The commercial data provided by industry players and stakeholders were also used.

The primary research includes one-on-one interviews with senior-level executives and industry thought leaders and surveys of product owners. In addition to interviewing industry professionals, the secondary research included an in-depth study of published literature such as industry and trade journals, company financials and reports, government databases and other industry reports. The data gathered from the research is analysed and an in-depth market analysis was performed.

For the purpose of this study, a detailed market analysis was undertaken to identify the various segments and sub-segments of the Social and Emotional Learning (SEL) market. The key participants were identified, and their offerings were evaluated to understand their strategies as well as the competitive landscape in the Social and Emotional Learning (SEL) market.

The social and emotional learning (SEL) market is divided into 5 key regions: North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America. The analysis is conducted both at a regional and global level. Each region was further segmented into countries where a detailed analysis of the market drivers, restraints, trends and opportunities is conducted. The market estimates in terms of revenue and market share were obtained from primary and secondary research.

Further, the research methodology also includes data triangulation and market breakdown to determine the overall impact and accuracy of the data. Additionally, the forecast is based on constant fluctuations in the market, factors and trends in the market.

The findings discussed in the research report are the outcome of the detailed secondary, primary and in-depth analysis of the Social and Emotional Learning (SEL) market. The report contains the current market scenario. The base year considered for forecasting the market is 2022 and the size of the market is estimated from 2023 to 2030.