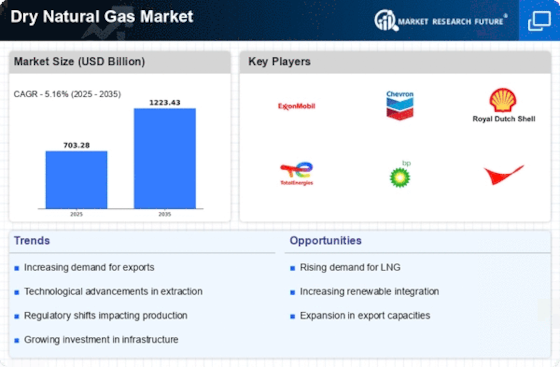

Increasing Demand for Clean Energy

The Dry Natural Gas Market is experiencing a notable surge in demand due to the global shift towards cleaner energy sources. Governments and organizations are increasingly prioritizing sustainability, leading to a rise in natural gas consumption as a transitional fuel. In 2025, natural gas is projected to account for approximately 25% of the energy mix, reflecting its role in reducing carbon emissions compared to coal and oil. This trend is further supported by the growing adoption of natural gas in power generation and transportation sectors, which are actively seeking to lower their environmental impact. As a result, the Dry Natural Gas Market is likely to benefit from this heightened demand, positioning itself as a key player in the energy transition.

Regulatory Support and Policy Frameworks

The Dry Natural Gas Market is significantly influenced by favorable regulatory frameworks and government policies aimed at promoting natural gas usage. Many countries are implementing policies that incentivize the development of natural gas infrastructure and production. For instance, tax incentives and subsidies for natural gas projects are becoming more common, encouraging investment in this sector. Additionally, international agreements focused on reducing greenhouse gas emissions are likely to bolster the market, as natural gas is often viewed as a cleaner alternative to other fossil fuels. This supportive regulatory environment may enhance the growth prospects of the Dry Natural Gas Market, attracting both domestic and foreign investments.

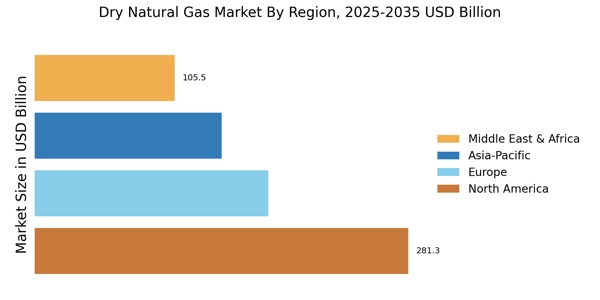

Infrastructure Development and Investment

The Dry Natural Gas Market is poised for growth due to ongoing infrastructure development and investment. The construction of pipelines, storage facilities, and liquefied natural gas (LNG) terminals is essential for facilitating the transportation and distribution of natural gas. In recent years, investments in infrastructure have surged, with billions allocated to enhance connectivity and ensure reliable supply chains. This expansion is critical for meeting the rising demand for natural gas, particularly in emerging markets where energy access is a priority. As infrastructure continues to develop, the Dry Natural Gas Market is likely to see increased efficiency and reduced costs, further solidifying its position in the energy landscape.

Rising Industrial and Residential Consumption

The Dry Natural Gas Market is benefiting from a marked increase in both industrial and residential consumption. Industries such as manufacturing, chemicals, and food processing are increasingly turning to natural gas as a primary energy source due to its cost-effectiveness and lower emissions. In residential sectors, the adoption of natural gas for heating and cooking is on the rise, driven by its affordability and efficiency. As of 2025, residential consumption of natural gas is expected to grow by approximately 15%, reflecting changing consumer preferences. This rising demand from both sectors is likely to bolster the Dry Natural Gas Market, contributing to its overall growth and stability.

Technological Innovations in Extraction and Processing

Technological advancements are playing a crucial role in shaping the Dry Natural Gas Market. Innovations in extraction techniques, such as hydraulic fracturing and horizontal drilling, have significantly increased the efficiency and output of natural gas production. These technologies have enabled access to previously untapped reserves, thereby expanding the supply base. Furthermore, improvements in processing technologies are enhancing the quality and safety of natural gas, making it a more attractive option for consumers. As these technologies continue to evolve, they are expected to drive down production costs and increase the competitiveness of the Dry Natural Gas Market, potentially leading to greater market penetration.