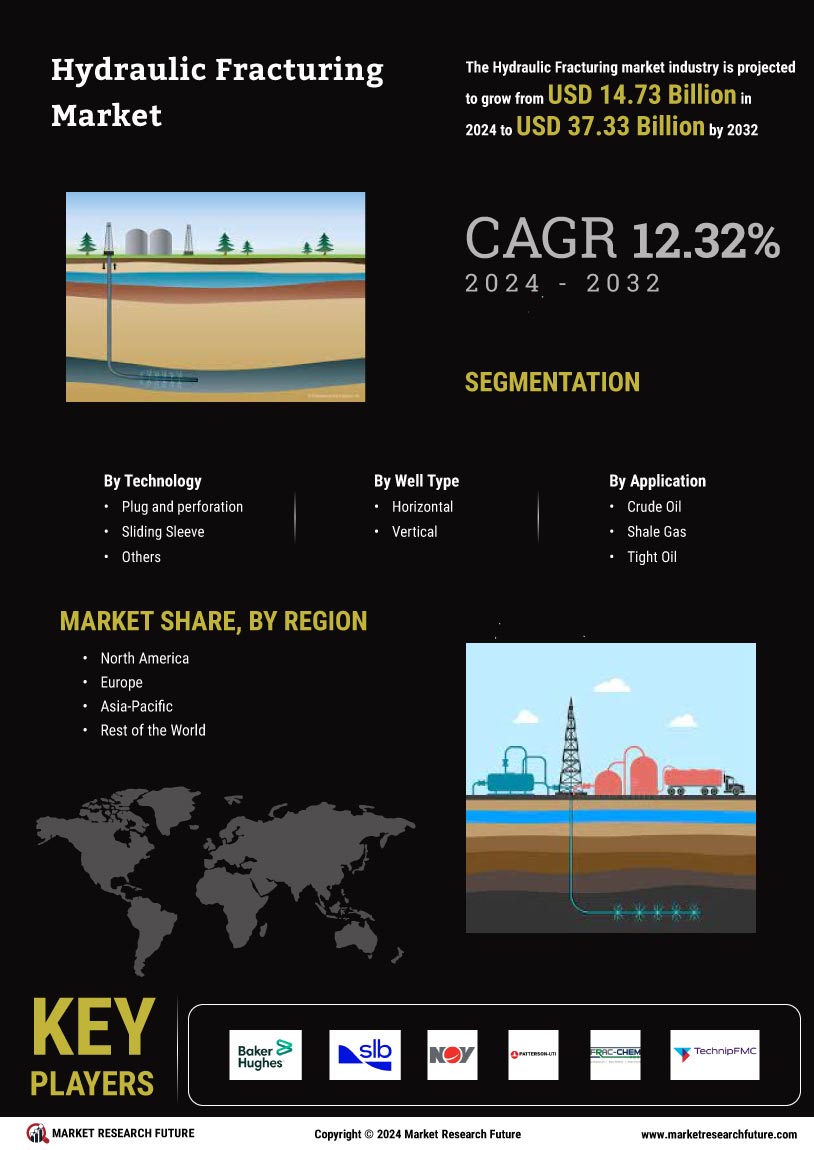

The Hydraulic Fracturing Market is currently characterized by a dynamic competitive landscape, driven by technological advancements, regulatory changes, and the increasing demand for energy. Baker Hughes Inc, headquartered in Houston, TX, is a major player in the North American hydraulic fracturing market, offering advanced fracturing solutions and equipment. The global hydraulic fracturing market is dominated by big fracking companies such as Halliburton, Schlumberger, and Baker Hughes, which lead in technological innovation and market share. Among the biggest fracking companies, Halliburton and Schlumberger have consistently invested in automation and digital fracturing technologies to improve efficiency and sustainability. Key players such as Halliburton (US), Schlumberger (US), and Baker Hughes (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. Halliburton (US) focuses on innovation through the development of advanced fracturing fluids and digital solutions, while Schlumberger (US) emphasizes its global reach and technological prowess, particularly in data analytics and automation. Baker Hughes (US) is increasingly investing in sustainable practices, aligning its operations with environmental regulations and market expectations. Collectively, these strategies not only enhance operational efficiency but also shape a competitive environment that is increasingly reliant on technological differentiation and sustainability initiatives. Baker Hughes business focuses on integrating digital solutions and eco-friendly technologies to enhance efficiency in hydraulic fracturing operations. Fracking equipment suppliers are innovating to provide advanced pumps, fluid systems, and automation solutions that enhance well productivity.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to reduce costs and improve service delivery. Leading fracking companies are investing in digitalization and automation to meet rising energy demands while adhering to environmental regulations. The market appears moderately fragmented, with several players vying for market share, yet dominated by a few key firms that exert considerable influence. This competitive structure allows for a diverse range of offerings, catering to various customer needs while fostering innovation and collaboration among industry participants. Frac service companies, including Halliburton and Schlumberger, provide comprehensive hydraulic fracturing solutions ranging from equipment to specialized fluids. Fracking statistics reveal a consistent increase in the number of horizontal wells and the volume of shale gas extracted globally.

In August 2025, Halliburton (US) announced a strategic partnership with a leading technology firm to enhance its digital fracking solutions. This collaboration aims to integrate artificial intelligence into their operations, potentially revolutionizing the efficiency and effectiveness of hydraulic fracturing processes. The strategic importance of this move lies in Halliburton's commitment to leveraging cutting-edge technology to maintain its competitive edge in a rapidly evolving market.

In September 2025, Schlumberger (US) unveiled a new suite of eco-friendly fracturing fluids designed to minimize environmental impact. This initiative not only aligns with global sustainability trends but also positions Schlumberger as a leader in environmentally responsible practices within the hydraulic fracturing sector. The strategic significance of this development is profound, as it addresses growing regulatory pressures and consumer demand for greener energy solutions.

In October 2025, Baker Hughes (US) launched a comprehensive digital platform aimed at optimizing hydraulic fracturing operations through real-time data analytics. This platform is expected to enhance decision-making processes and operational efficiency, reflecting Baker Hughes' focus on integrating technology into its service offerings. The strategic relevance of this initiative underscores the increasing importance of data-driven solutions in the hydraulic fracturing market.

As of October 2025, current competitive trends indicate a strong shift towards digitalization, sustainability, and the integration of artificial intelligence within the hydraulic fracturing sector. Strategic alliances are becoming increasingly pivotal, as companies seek to enhance their technological capabilities and market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability, thereby reshaping the landscape of the hydraulic fracturing market.