Rising Energy Security Concerns

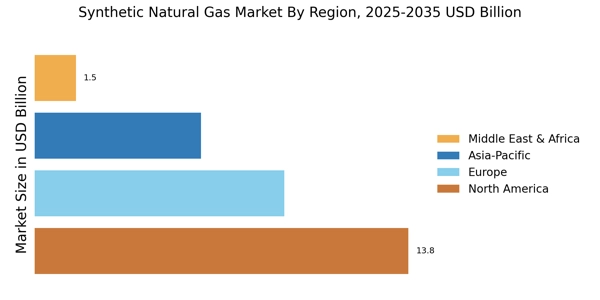

Rising energy security concerns are driving interest in the Synthetic Natural Gas Market. As geopolitical tensions and supply chain vulnerabilities become more pronounced, countries are seeking to diversify their energy sources. Synthetic natural gas, produced from domestic resources, offers a strategic advantage by reducing reliance on imported fossil fuels. This shift is particularly relevant in regions where energy independence is a priority. The Synthetic Natural Gas Market stands to gain from this trend, as it provides a stable and secure energy supply. Furthermore, the ability to produce synthetic natural gas from renewable sources enhances its appeal, aligning with national energy security goals while addressing environmental concerns.

Growing Industrial Applications and Demand

The growing industrial applications and demand for synthetic natural gas are significant drivers for the Synthetic Natural Gas Market. Industries such as chemicals, fertilizers, and power generation are increasingly adopting synthetic natural gas due to its versatility and lower emissions profile. The market for synthetic natural gas in industrial applications is expected to grow at a rate of 7% annually, reflecting the increasing recognition of its benefits. As industries seek to enhance their sustainability practices, the demand for synthetic natural gas is likely to rise. This trend not only supports the growth of the Synthetic Natural Gas Market but also contributes to broader efforts aimed at reducing the carbon footprint of industrial processes.

Technological Innovations in Gas Production

Technological innovations in gas production are significantly influencing the Synthetic Natural Gas Market. Advances in gasification and methanation technologies have enhanced the efficiency and cost-effectiveness of synthetic natural gas production. For instance, the integration of carbon capture and storage technologies has the potential to reduce production costs by up to 30%, making synthetic natural gas more competitive with traditional natural gas. Furthermore, the development of modular production units allows for decentralized production, which can cater to local energy demands more effectively. As these technologies continue to evolve, they are likely to drive further investment and interest in the Synthetic Natural Gas Market, fostering a more robust and resilient energy landscape.

Government Incentives and Support Mechanisms

Government incentives and support mechanisms play a crucial role in shaping the Synthetic Natural Gas Market. Many governments are implementing policies that promote the use of synthetic natural gas as part of their energy transition strategies. For example, tax credits, subsidies, and grants for research and development are becoming increasingly common. These initiatives not only lower the financial barriers for companies entering the market but also stimulate innovation and competition. As a result, the Synthetic Natural Gas Market is expected to expand, with more players entering the field and contributing to a diverse energy portfolio. The alignment of government policies with market needs is likely to create a favorable environment for growth.

Increasing Demand for Clean Energy Solutions

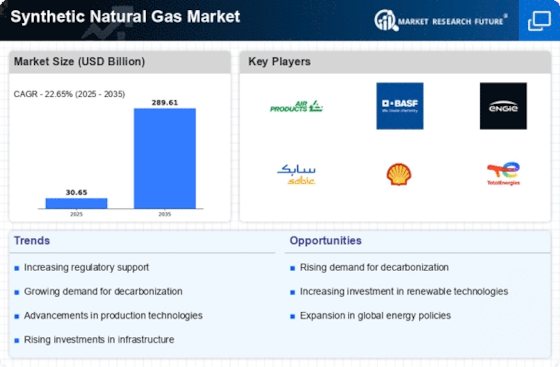

The rising demand for clean energy solutions is a pivotal driver for the Synthetic Natural Gas Market. As nations strive to meet stringent environmental regulations and reduce greenhouse gas emissions, synthetic natural gas emerges as a viable alternative to traditional fossil fuels. The market is projected to witness a compound annual growth rate of approximately 8% over the next five years, driven by the need for cleaner energy sources. This shift is not merely a trend but a fundamental change in energy consumption patterns, as industries and consumers alike seek sustainable options. The Synthetic Natural Gas Market is positioned to benefit from this transition, as it offers a cleaner combustion profile compared to conventional natural gas, thereby appealing to environmentally conscious stakeholders.