Regulatory Support and Frameworks

The Drone Technology Market benefits from evolving regulatory frameworks that support the safe integration of drones into various sectors. Governments are establishing guidelines that facilitate commercial drone operations while ensuring safety and privacy. For instance, regulations that allow beyond visual line of sight (BVLOS) operations are expected to expand the operational scope of drones significantly. This regulatory support is crucial for industries like delivery services and agriculture, where drones can enhance efficiency and reduce costs. The establishment of clear regulations is likely to attract investments, further stimulating the growth of the Drone Technology Market.

Increased Investment in Drone Startups

Investment in drone startups is on the rise, indicating a robust interest in the Drone Technology Market. Venture capitalists and private equity firms are increasingly funding innovative drone companies that focus on niche applications such as drone delivery, agricultural monitoring, and emergency response. This influx of capital is fostering innovation and accelerating the development of new technologies. Recent reports suggest that investment in drone technology startups reached unprecedented levels, with funding exceeding several billion dollars in the last year alone. This trend is likely to enhance competition and drive advancements within the Drone Technology Market.

Growing Demand for Aerial Data Collection

The demand for aerial data collection is surging, significantly impacting the Drone Technology Market. Industries such as construction, mining, and environmental monitoring are increasingly utilizing drones for data acquisition and analysis. Drones equipped with high-resolution cameras and sensors can capture detailed aerial imagery and collect data more efficiently than traditional methods. Market data indicates that the aerial data collection segment is expected to grow at a compound annual growth rate of over 15% in the coming years. This growing demand for precise and timely data is likely to drive further innovation and investment in the Drone Technology Market.

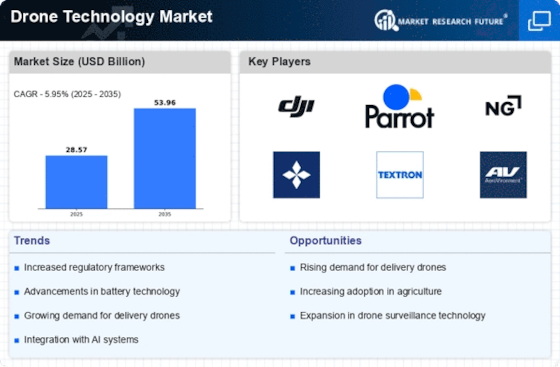

Technological Advancements in Drone Technology

The Drone Technology Market is experiencing rapid technological advancements that enhance the capabilities of drones. Innovations in artificial intelligence, machine learning, and sensor technology are driving the development of more sophisticated drones. These advancements enable drones to perform complex tasks such as autonomous navigation, obstacle avoidance, and real-time data processing. According to recent data, the integration of AI in drones is projected to increase operational efficiency by up to 30%. As a result, industries such as agriculture, logistics, and surveillance are increasingly adopting these advanced drones, thereby propelling the growth of the Drone Technology Market.

Rising Awareness of Environmental Sustainability

The growing awareness of environmental sustainability is influencing the Drone Technology Market positively. Drones are being recognized for their potential to reduce carbon footprints in various applications, such as precision agriculture and infrastructure inspection. By utilizing drones, companies can minimize the need for heavy machinery and reduce emissions associated with traditional methods. Furthermore, drones can assist in environmental monitoring and conservation efforts, providing valuable data for research and policy-making. As sustainability becomes a priority for businesses and governments alike, the adoption of drones is likely to increase, further propelling the growth of the Drone Technology Market.

.png)