Cost Efficiency in Operations

Cost efficiency remains a pivotal driver in the Drone Logistics and Transportation Market. Drones can potentially reduce operational costs associated with traditional delivery methods, such as fuel and labor expenses. By automating deliveries, companies can minimize human error and optimize resource allocation. Reports indicate that drone deliveries can lower costs by up to 30% compared to conventional delivery systems. This financial incentive encourages businesses to adopt drone technology, particularly in sectors where margins are tight. As companies strive to enhance profitability while maintaining service quality, the integration of drones into logistics operations appears to be a viable solution.

Growing Focus on Sustainability

The growing focus on sustainability is significantly influencing the Drone Logistics and Transportation Market. Drones are often viewed as a more environmentally friendly alternative to traditional delivery vehicles, as they typically produce lower emissions and consume less energy. This aligns with the increasing consumer demand for sustainable practices in logistics. Companies are leveraging drones to reduce their carbon footprints and enhance their corporate social responsibility profiles. As sustainability becomes a central tenet of business strategy, the adoption of drone technology is expected to rise, driven by both regulatory pressures and consumer preferences for greener solutions.

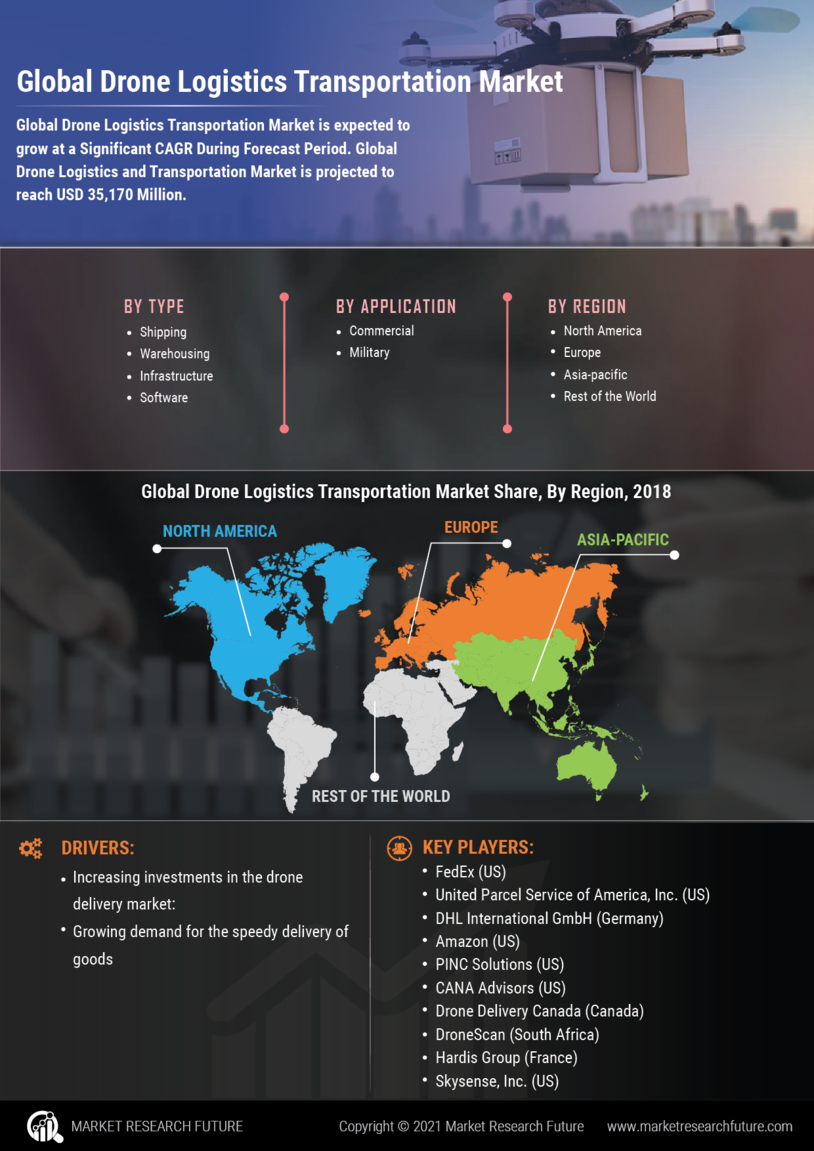

Regulatory Support and Frameworks

Regulatory support is a crucial driver for the Drone Logistics and Transportation Market. Governments are increasingly recognizing the potential of drones in enhancing logistics efficiency and are establishing frameworks to facilitate their integration into airspace. Recent regulatory developments have streamlined the approval processes for drone operations, allowing companies to deploy drones for commercial purposes more readily. This supportive environment is essential for fostering innovation and encouraging investment in drone technology. As regulations become more favorable, businesses are likely to accelerate their adoption of drones, thereby expanding the market and creating new opportunities for growth.

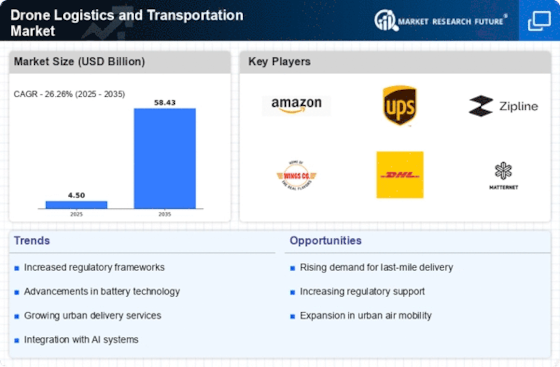

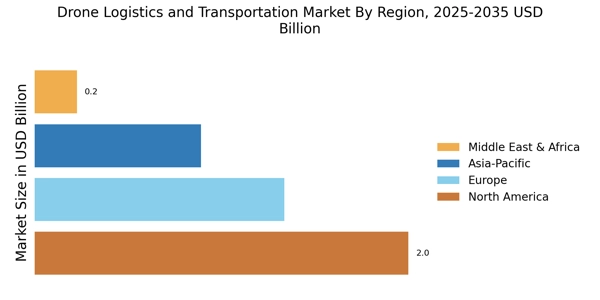

Increased Demand for Last-Mile Delivery

The Drone Logistics and Transportation Market is experiencing a surge in demand for last-mile delivery solutions. As e-commerce continues to expand, companies are seeking efficient methods to deliver goods directly to consumers. Drones offer a promising solution, capable of bypassing traffic and reducing delivery times significantly. According to recent estimates, the last-mile delivery segment is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth is driven by consumer expectations for faster delivery services, which are increasingly becoming a standard in the retail sector. Consequently, businesses are investing in drone technology to enhance their logistics capabilities, thereby positioning themselves competitively in the market.

Technological Innovations in Drone Capabilities

Technological innovations are transforming the Drone Logistics and Transportation Market. Advances in battery life, payload capacity, and navigation systems are enhancing the operational capabilities of drones. For instance, the development of hybrid drones that combine electric and fuel-based power sources is extending flight durations and increasing delivery ranges. Furthermore, the integration of artificial intelligence and machine learning is enabling drones to navigate complex environments autonomously. These innovations not only improve efficiency but also expand the potential applications of drones in logistics, from medical supply deliveries to urban freight transport. As technology continues to evolve, the market is likely to witness an influx of new players and solutions.