Cost Efficiency

Cost efficiency is emerging as a significant driver within the Global Drone Data Service Market Industry. Drones offer a more economical alternative to traditional data collection methods, such as manned aircraft or ground surveys. For example, using drones for infrastructure inspections can reduce costs associated with labor and equipment. This financial advantage is particularly appealing to small and medium-sized enterprises, which may have limited budgets for data collection. As organizations increasingly recognize the cost benefits of drone services, the market is likely to see sustained growth, reinforcing the importance of drones in various operational contexts.

Regulatory Support

Regulatory frameworks are evolving to support the growth of the Global Drone Data Service Market Industry. Governments worldwide are establishing guidelines that facilitate the safe integration of drones into airspace. For example, the Federal Aviation Administration in the United States has implemented regulations that allow for commercial drone operations under specific conditions. This regulatory support not only enhances safety but also encourages investment in drone technologies. As the market matures, it is anticipated that these regulations will continue to adapt, further promoting the use of drones for various applications, thereby sustaining the market's growth trajectory.

Environmental Monitoring

The Global Drone Data Service Market Industry is also being propelled by the growing emphasis on environmental monitoring and conservation efforts. Drones are increasingly employed for tasks such as wildlife tracking, forest management, and pollution assessment. Their ability to cover large areas quickly and gather high-resolution data makes them invaluable for environmental studies. For instance, drones are utilized to monitor deforestation rates and assess the health of ecosystems. This trend not only highlights the versatility of drone applications but also aligns with global sustainability goals, potentially expanding the market as more organizations prioritize environmental responsibility.

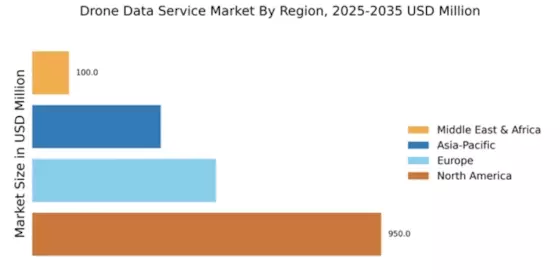

Market Growth Projections

The Global Drone Data Service Market Industry is projected to maintain a steady trajectory, with a market value of 8.15 USD Billion anticipated in 2035. The expected CAGR of 0.0% for the period from 2025 to 2035 suggests a stabilization in market dynamics, where growth may be influenced by the maturation of technology and market saturation. This projection indicates that while the market may not experience rapid expansion, it will likely sustain its current value as industries continue to integrate drone data services into their operations. The focus will shift towards optimizing existing technologies and enhancing service offerings.

Technological Advancements

The Global Drone Data Service Market Industry is experiencing a surge in technological advancements, particularly in drone capabilities and data analytics. Innovations in artificial intelligence and machine learning are enhancing the efficiency of data processing and analysis. For instance, drones equipped with high-resolution cameras and LiDAR technology are increasingly utilized for surveying and mapping applications. This trend is expected to drive the market as businesses seek to leverage these advanced capabilities for improved decision-making. As of 2024, the market is valued at 8.15 USD Billion, indicating a robust demand for innovative drone data solutions.

Increased Demand for Aerial Data

The demand for aerial data across various sectors is a key driver of the Global Drone Data Service Market Industry. Industries such as agriculture, construction, and real estate are increasingly relying on drone data for precision farming, site inspections, and property assessments. For instance, agricultural businesses utilize drones to monitor crop health and optimize yields, while construction firms employ aerial imagery for project management. This growing reliance on aerial data is expected to sustain the market's value, projected to remain at 8.15 USD Billion from 2024 to 2035, with a CAGR of 0.0% for the period from 2025 to 2035.