Advancements in Biotechnology

The rapid advancements in biotechnology and genetic engineering are expected to propel the DNA Data Storage Market forward. Innovations in DNA synthesis and sequencing technologies have made it feasible to encode and retrieve data from DNA with greater efficiency and accuracy. These advancements not only enhance the reliability of DNA storage but also expand its applicability across various fields, including medicine, research, and information technology. As the capabilities of biotechnology continue to evolve, the DNA Data Storage Market may experience increased interest and investment, as organizations recognize the potential of DNA as a transformative data storage solution. This trend could lead to collaborative efforts between tech companies and biotech firms, further driving innovation in the market.

Regulatory Support and Funding

Government initiatives and funding aimed at promoting innovative technologies are likely to bolster the DNA Data Storage Market. Various countries are increasingly recognizing the importance of advanced data storage solutions and are providing financial support for research and development in this area. Such regulatory backing can facilitate the growth of the DNA Data Storage Market by encouraging startups and established companies to invest in DNA storage technologies. Additionally, favorable policies may help streamline the commercialization of DNA storage solutions, making them more accessible to a broader range of industries. As public and private sectors collaborate to advance this technology, the DNA Data Storage Market could witness accelerated growth and adoption.

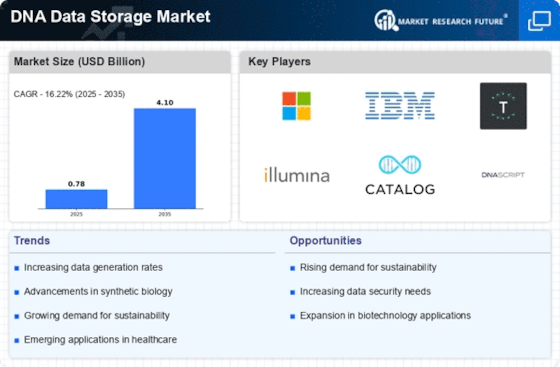

Data Explosion and Storage Needs

The exponential growth of data generated across various sectors appears to be a primary driver for the DNA Data Storage Market. With estimates suggesting that global data creation will reach 175 zettabytes by 2025, traditional storage solutions are increasingly inadequate. This surge in data necessitates innovative storage methods, and DNA data storage, with its potential to store vast amounts of information in a compact form, emerges as a viable alternative. The DNA Data Storage Market is likely to benefit from this trend, as organizations seek efficient, long-term solutions to manage their data. Furthermore, the durability and stability of DNA as a storage medium could appeal to industries that require reliable data preservation over extended periods.

Cost-Effectiveness of DNA Storage

As research and development in the DNA Data Storage Market progresses, the cost of synthesizing and reading DNA is expected to decline. Current estimates indicate that the cost of DNA data storage could drop significantly, potentially reaching as low as $0.01 per megabyte in the coming years. This reduction in cost may encourage more organizations to adopt DNA storage solutions, particularly as the volume of data they manage continues to grow. The economic feasibility of DNA storage could thus drive its adoption across various sectors, including healthcare, finance, and entertainment, where data integrity and longevity are paramount. Consequently, the DNA Data Storage Market may witness increased investment and innovation as companies seek to capitalize on these cost advantages.

Environmental Sustainability Initiatives

The increasing emphasis on sustainability and environmental responsibility is likely to influence the DNA Data Storage Market positively. Traditional data storage methods, such as hard drives and data centers, consume significant energy and resources, contributing to environmental degradation. In contrast, DNA data storage offers a more sustainable alternative, as it requires less physical space and energy for data preservation. Organizations are increasingly seeking eco-friendly solutions, and the DNA Data Storage Market may capitalize on this trend by promoting the environmental benefits of DNA storage. As companies strive to meet sustainability goals, the adoption of DNA storage could become a strategic advantage, positioning them as leaders in responsible data management.