Growing Investment in Smart Infrastructure

The Distributed Temperature Sensing Market is benefiting from the growing investment in smart infrastructure initiatives. Governments and private entities are increasingly focusing on developing smart cities and enhancing infrastructure resilience. Distributed temperature sensing technologies play a crucial role in these initiatives by providing real-time data that supports decision-making and resource allocation. For example, smart grids utilize temperature sensing to optimize energy distribution and reduce losses. The market for smart infrastructure is projected to grow substantially, with investments expected to exceed USD 1 trillion by 2025. This trend indicates a robust opportunity for distributed temperature sensing systems, as they are integral to the functionality and efficiency of smart infrastructure projects.

Rising Awareness of Predictive Maintenance

The Distributed Temperature Sensing Market is experiencing a rise in awareness regarding predictive maintenance strategies among various sectors. Organizations are increasingly recognizing the value of utilizing temperature data to predict equipment failures before they occur. This proactive approach not only minimizes downtime but also extends the lifespan of critical assets. Industries such as manufacturing and energy are particularly focused on implementing predictive maintenance solutions, which are expected to drive the demand for distributed temperature sensing technologies. Market Research Future indicates that the predictive maintenance market is anticipated to grow at a compound annual growth rate of 25% over the next five years. This growth suggests a strong correlation between the adoption of predictive maintenance practices and the increasing utilization of distributed temperature sensing systems.

Focus on Environmental Monitoring and Safety

The Distributed Temperature Sensing Market is increasingly focused on environmental monitoring and safety, driven by regulatory pressures and public awareness of environmental issues. Industries are adopting distributed temperature sensing systems to monitor temperature changes in ecosystems, ensuring compliance with environmental regulations. This is particularly relevant in sectors such as agriculture, where temperature monitoring can help optimize crop yields and resource management. Additionally, the need for safety in industrial applications is propelling the adoption of these technologies. For instance, temperature monitoring in hazardous environments can prevent accidents and ensure worker safety. Market analysts indicate that the environmental monitoring segment of the distributed temperature sensing market is expected to grow significantly, potentially reaching USD 500 million by 2025, as organizations invest in technologies that promote sustainability and safety.

Technological Advancements in Sensing Technologies

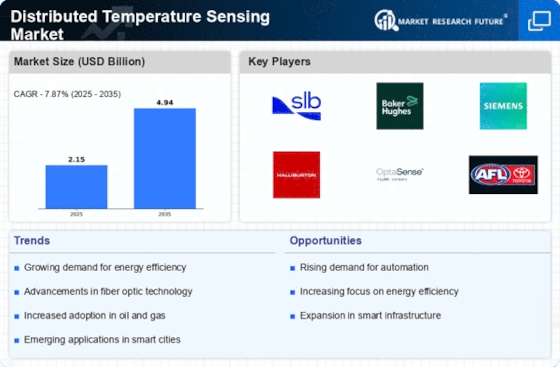

The Distributed Temperature Sensing Market is experiencing a surge in technological advancements that enhance the capabilities of temperature sensing systems. Innovations such as fiber optic sensors and wireless communication technologies are becoming increasingly prevalent. These advancements allow for more accurate and real-time temperature monitoring across various applications, including oil and gas, power generation, and environmental monitoring. The integration of advanced data analytics with these technologies is expected to drive market growth, as organizations seek to optimize operations and reduce costs. According to recent estimates, the market for distributed temperature sensing systems is projected to reach USD 1.5 billion by 2026, reflecting a compound annual growth rate of approximately 8% from 2021 to 2026. This growth is indicative of the increasing reliance on sophisticated sensing technologies in various industries.

Increased Demand for Real-Time Monitoring Solutions

The Distributed Temperature Sensing Market is witnessing a heightened demand for real-time monitoring solutions across multiple sectors. Industries such as oil and gas, utilities, and manufacturing are increasingly adopting distributed temperature sensing systems to ensure operational efficiency and safety. The ability to monitor temperature variations in real-time allows for proactive maintenance and reduces the risk of equipment failure. This trend is particularly evident in the oil and gas sector, where temperature monitoring is critical for pipeline integrity and safety. Market data suggests that the demand for real-time monitoring solutions is expected to grow at a rate of 10% annually, driven by the need for enhanced operational oversight and risk management. As organizations prioritize safety and efficiency, the adoption of distributed temperature sensing technologies is likely to expand.