Research Methodology on Remote Sensing Satellite Market

Introduction

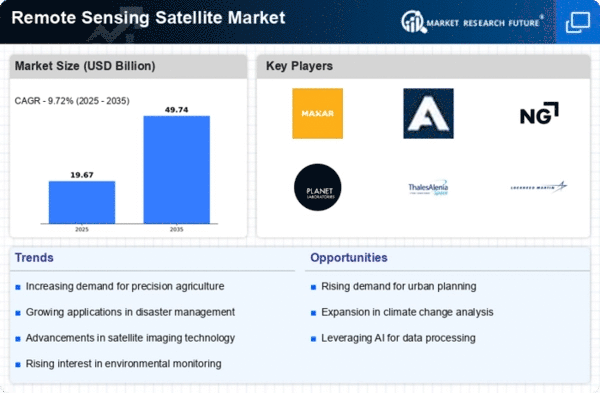

The Remote Sensing Satellite Market report provides an in-depth analysis of the market size, competitive scenario, and geographical scenario of the global Remote Sensing Satellite market for the forecast period of 2023-2030. The report includes a detailed analysis of market dynamics, market forecasts, Porter’s five forces, Value Chain Analysis, and industry-intensive SWOT analysis. The market report also includes an extensive market overview of the competitive landscape of the market along with the market share assessment of key players and major players in the remote sensing satellite market.

The study defines Remote Sensing Satellites as spacecraft that are launched from the Earth’s surface to gather information about certain objects or components present on the surface of the Earth or in its atmosphere from a distance. These kinds of satellites are mainly used to capture information regarding climate, land utilization, weather and more. Moreover, the research also provides an exhaustive analysis of the market trends and provides market estimations to gauge the investment feasibility and potential returns in the Remote Sensing Satellite Market.

Research Objective

The primary objective of this study is to identify and gauge the value and volume of the Remote Sensing Satellite market for an observed forecast period of 2023-2030.

- To understand the dynamics of the Remote Sensing Satellite market across different regions.

- To determine the market positioning of the key players in the Global Remote Sensing Satellite market.

- To identify the market share of the major players in the Remote Sensing Satellite market

- To identify and analyze the Macro and Micro drivers and restraints impacting the growth of the Global Remote Sensing Satellite market

- To analyze the competition structures in the Remote Sensing Satellite market

- To conduct extensive research to analyze consumer behaviour along with demographic trends

- To gain insights into the strategic developments in terms of new product launches, mergers, and acquisitions in the Remote Sensing Satellite market

- To identify and analyze the global trends affecting the Global Remote Sensing Satellite market

Research Questions

- What are the major factors driving the Remote Sensing Satellite market?

- What is the major challenge impeding the growth of the Remote Sensing Satellite market?

- What is the degree of competition in the Remote Sensing Satellite market?

- What strategy should the players adopt to increase the market share?

- What is the expected market size for the forecast period 2023-2030?

Company Background

The Remote Sensing Satellite Market is mainly dependent on the demand drivers of the global commercial space industry. The satellite industry continues to expand its market by launching remote-sensing satellites into space. Companies like Lockheed Martin, Raytheon, Thales Alenia Space, Airbus Group, Telespazio and Mitsubishi Electric are some of the leading players in the Remote Sensing Satellite market.

The players in the Remote Sensing Satellite market are actively involved in developing new products for better service. Many of the competitors focus on developing the most advanced payloads and platforms in the satellite industry. This includes satellites and their related component. The competitive landscape portrays the intensity of the competition between the players in the global Remote Sensing Satellite market.

Research Methodology

Research Design

The research was carried out using both primary and secondary research methods. The secondary research included extensive research of the published data and reports from various industries and organizations to gain a comprehensive understanding of the outlook and the Remote Sensing Satellite Market. The primary research included interviews with leading industry executives to learn more about their current strategies and their prospects for the future.

Scope of the Study

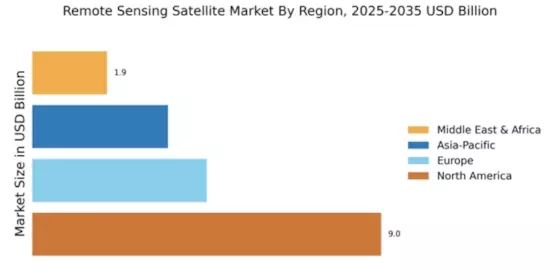

The scope of the research study includes current and historical market trends of the global Remote Sensing Satellite market along with the regional level analysis such as North America, Europe, Asia Pacific and Rest of the world. It also covers the market growth drivers, regional market analysis, trends and outlook, pricing analysis, competitive landscape, value chain analysis and market size with forecast from 2023 to 2030.

Source of Data

Research on this Remote Sensing Satellite market was conducted through both primary and secondary sources. The secondary source of research includes analyses of the financial reports, annual reports, and press releases of the key market players along with their websites. The primary source of research includes interviews with the leading industry professionals, domain experts and technical experts.

Research Approach

The research process was initiated with a detailed understanding of the product, product type, product end-user and brand. This was followed by understanding of the current trends, outlook and market dynamics in the Remote Sensing Satellite market. This helped in identifying the segments of the remote sensing satellite market which could be further segmented into various sub-segments. After this, the research focused on understanding the consumer behaviour towards the product and the value chain analysis of the Remote Sensing Satellite market.

Bottom-up Approach

In this approach, the data collected from secondary sources like journals, company websites, datasheets, press releases etc. was further analyzed to deduce the market estimations of the segments of the Remote Sensing Satellite market. The final market size was then validated with the top-down approach.

Top Down Approach

In the top-down approach, the consumption data collected from the interviews of leading industry professionals, domain experts and technical experts was analyzed to deduce the absolute market size of the remote sensing satellite market.

Factor Analysis

The factor analysis was done to understand the impact of the various factors such as market drivers, restraints, and opportunities on the growth of the Remote Sensing Satellite market. These factors were analyzed at length to obtain their magnitudes and the effect of each on the growth of the market.

Time-Series Analysis

The time-series analysis was performed to gain insights into fluctuations in the demand for the remote sensing satellite market for the forecast period 2023-2030. This helped in understanding the patterns of market growth of the remote sensing satellite market.

Data Triangulation

The data triangulation method was used to further analyze and validate the market size of the Remote Sensing Satellite Market. This involves confirming the market estimations with the help of demand-side and supply-side data generated through primary and secondary research.

Conclusion

The research study provides an extensive understanding of the growth trajectory of the existing Remote Sensing Satellite market based on factors affecting its performance. The study also provides the market size and market outlook for the forecast period 2023-2030. The key players in the Remote Sensing Satellite market were identified and their strategies were analyzed to determine the overall competition in the global Remote Sensing Satellite market. The research study also provides a detailed analysis of the factors acting as market drivers and market restraints. In addition, the data triangulation process was used to validate the market size of the Remote Sensing Satellite market. A detailed analysis of the factors affecting the market and the strategic developments by the leading players was discussed in the research study.