Emergence of 5G Technology

The emergence of 5G technology is poised to have a profound impact on the Displayport IP Market. With its promise of ultra-fast data transmission and low latency, 5G is expected to facilitate new applications that require high-quality video streaming and real-time data processing. This technological advancement may lead to an increased demand for Displayport IP solutions that can leverage the capabilities of 5G networks. As industries such as entertainment, automotive, and telecommunications explore the potential of 5G, the need for advanced display interfaces that can handle high-resolution content seamlessly is likely to grow. Market projections indicate that the 5G technology market could surpass 700 billion USD by 2025, suggesting a fertile ground for the Displayport IP Market to thrive as it aligns with the needs of 5G-enabled applications.

Expansion of Gaming and E-Sports

The Displayport IP Market is poised for growth due to the rapid expansion of the gaming and e-sports sectors. As gaming technology evolves, there is an increasing need for high-performance display interfaces that can support high refresh rates and low latency. Displayport IP solutions are becoming essential for delivering the immersive experiences that gamers demand. Recent statistics indicate that the e-sports market alone is expected to reach a valuation of over 1 billion USD by 2025, highlighting the lucrative opportunities for Displayport IP providers. This growth is likely to drive innovation in display technologies, as manufacturers strive to meet the needs of competitive gaming environments. Consequently, the Displayport IP Market may witness a surge in demand for advanced features that enhance gaming performance, thereby solidifying its position in this dynamic market.

Focus on Enhanced User Experience

The Displayport IP Market is increasingly driven by a focus on enhancing user experience across various devices. As consumers demand more intuitive and visually appealing interfaces, manufacturers are compelled to adopt advanced display technologies that provide superior image quality and responsiveness. This trend is particularly evident in sectors such as consumer electronics, where the integration of Displayport IP solutions can significantly improve the overall user experience. Recent surveys indicate that over 70% of consumers prioritize display quality when purchasing new devices, underscoring the importance of high-performance display interfaces. As a result, the Displayport IP Market is likely to see a surge in demand for innovative solutions that cater to these consumer preferences, fostering a competitive landscape where quality and performance are paramount.

Increasing Adoption of 8K Displays

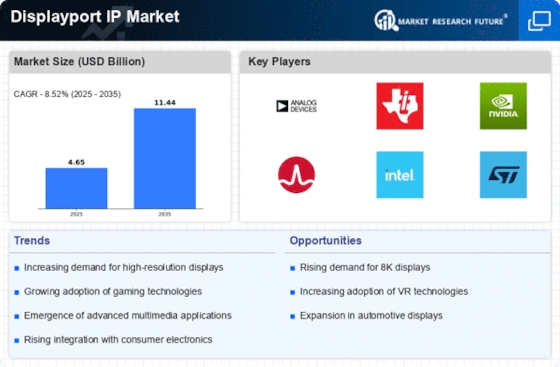

The Displayport IP Market is experiencing a notable surge in the adoption of 8K displays, driven by advancements in display technology. As consumers and businesses alike seek higher resolutions for enhanced visual experiences, the demand for Displayport IP solutions that support 8K resolution is likely to grow. According to recent data, the market for 8K displays is projected to expand significantly, with a compound annual growth rate (CAGR) of over 30% in the coming years. This trend indicates a robust opportunity for manufacturers and developers within the Displayport IP Market to innovate and provide solutions that cater to this high-resolution demand. Furthermore, the integration of 8K displays in sectors such as gaming, entertainment, and professional visualization is expected to further propel the market, creating a favorable environment for Displayport IP technologies.

Rise of Virtual and Augmented Reality

The Displayport IP Market is significantly influenced by the rise of virtual reality (VR) and augmented reality (AR) technologies. As these immersive technologies gain traction across various applications, including gaming, training, and remote collaboration, the demand for high-bandwidth display interfaces is expected to increase. Displayport IP solutions are well-suited to support the high data rates required for VR and AR applications, which often necessitate low latency and high refresh rates. Market analysis suggests that the VR and AR market could reach a valuation of over 200 billion USD by 2025, indicating a substantial opportunity for Displayport IP technologies. This growth may encourage manufacturers to innovate and enhance their offerings, ensuring compatibility with the evolving demands of the VR and AR landscape, thereby reinforcing the relevance of the Displayport IP Market.