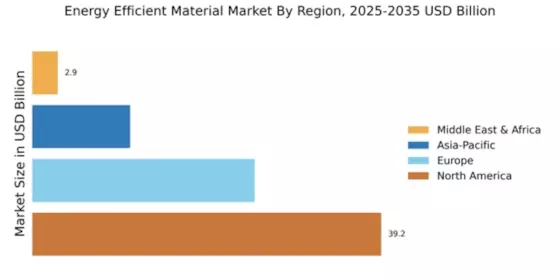

North America : Market Leader in Efficiency

North America is poised to maintain its leadership in the Energy Efficient Material Market, holding a significant market share of 39.24% as of 2024. The region's growth is driven by stringent regulations aimed at reducing carbon emissions and enhancing energy efficiency in buildings. Government incentives and funding for sustainable construction practices further bolster demand for energy-efficient materials, making it a key player in the global market.

The competitive landscape in North America is characterized by the presence of major players such as Owens Corning, 3M, and DuPont. These companies are investing heavily in R&D to innovate and improve their product offerings. The U.S. and Canada are leading countries in this sector, with a growing focus on sustainable building practices and energy-efficient technologies. This trend is expected to continue, further solidifying North America's position in the market.

Europe : Sustainable Innovation Hub

Europe is emerging as a significant player in the Energy Efficient Material Market, with a market share of 25.0% as of 2024. The region's growth is fueled by ambitious climate goals and regulations aimed at achieving net-zero emissions. The European Union's Green Deal and various national policies are driving demand for energy-efficient materials, making sustainability a core focus for construction and manufacturing sectors.

Leading countries in Europe include Germany, France, and the UK, where companies like Saint-Gobain and BASF are at the forefront of innovation. The competitive landscape is marked by a strong emphasis on research and development, with firms investing in new technologies to enhance energy efficiency. As Europe continues to prioritize sustainability, the demand for energy-efficient materials is expected to rise significantly, positioning the region as a leader in this market.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing a gradual rise in the Energy Efficient Material Market, holding an 11.0% market share as of 2024. The region's growth is driven by rapid urbanization, increasing energy consumption, and government initiatives promoting sustainable building practices. Countries like China and India are implementing regulations to enhance energy efficiency in construction, which is expected to boost demand for energy-efficient materials in the coming years.

China is the leading country in this region, with significant investments in green building technologies. The competitive landscape includes key players such as Nippon Steel Corporation and Kingspan Group, who are focusing on innovative solutions to meet the growing demand. As awareness of energy efficiency increases, the Asia-Pacific market is set to expand, driven by both regulatory support and market demand.

Middle East and Africa : Resource-Rich Frontier

The Middle East and Africa region is in the nascent stages of developing its Energy Efficient Material Market, currently holding a market share of 2.87% as of 2024. The growth in this region is primarily driven by increasing energy costs and a growing awareness of sustainability. Governments are beginning to implement regulations aimed at promoting energy efficiency, which is expected to catalyze market growth in the coming years.

Leading countries in this region include South Africa and the UAE, where there is a rising interest in sustainable construction practices. The competitive landscape is still developing, with opportunities for both local and international players to enter the market. As the region continues to invest in energy-efficient technologies, the potential for growth in this sector is significant, paving the way for future advancements.