Growing Focus on Customer Experience

The Digital Twin In Finance Market is witnessing a growing focus on enhancing customer experience. Financial institutions are utilizing digital twin technology to create personalized services and products tailored to individual client needs. By simulating customer interactions and preferences, firms can optimize their offerings and improve satisfaction levels. This trend is particularly relevant as competition intensifies in the finance sector, with companies striving to differentiate themselves through superior customer engagement. Research indicates that organizations prioritizing customer experience are 60% more profitable than those that do not. As a result, the adoption of digital twins is likely to become a key strategy for financial institutions aiming to enhance their customer-centric approaches.

Integration of Internet of Things (IoT)

The Digital Twin In Finance Market is increasingly integrating Internet of Things (IoT) technologies. This integration allows financial institutions to gather real-time data from various sources, enhancing the accuracy and relevance of digital twin models. By connecting physical assets to digital representations, firms can monitor performance and make data-driven decisions. The IoT market in finance is projected to grow significantly, with estimates suggesting it could reach USD 10 billion by 2025. This growth indicates a shift towards more connected financial ecosystems, where digital twins play a crucial role in optimizing operations and improving risk management. The synergy between IoT and digital twins is likely to redefine how financial institutions operate in the coming years.

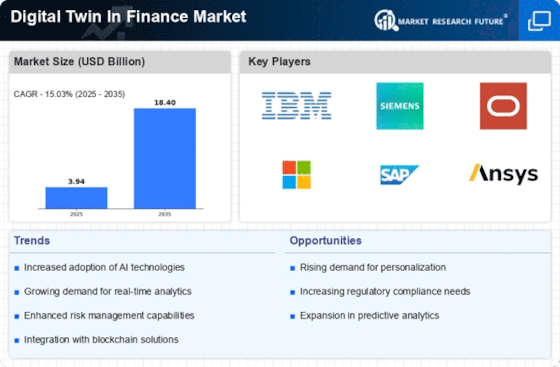

Regulatory Pressure and Compliance Needs

The Digital Twin In Finance Market is heavily influenced by regulatory pressure and compliance needs. Financial institutions are required to adhere to stringent regulations, necessitating the implementation of advanced technologies for reporting and compliance. Digital twins can streamline these processes by providing accurate and real-time data, thereby reducing the risk of non-compliance. As regulatory frameworks evolve, the demand for solutions that can ensure adherence to these standards is expected to rise. The compliance technology market is anticipated to grow at a rate of 15% annually, reflecting the increasing importance of regulatory compliance in finance. Consequently, the adoption of digital twin technology is likely to become a vital component in meeting these compliance challenges.

Increased Demand for Predictive Analytics

The Digital Twin In Finance Market is experiencing a surge in demand for predictive analytics. Financial institutions are increasingly leveraging digital twin technology to create virtual replicas of their assets and operations. This allows for enhanced forecasting and risk assessment, enabling firms to make informed decisions. According to recent estimates, the predictive analytics market is projected to reach USD 20 billion by 2026, indicating a robust growth trajectory. As organizations seek to optimize their financial strategies, the integration of digital twins facilitates real-time simulations and scenario analysis, thereby improving overall operational efficiency. This trend underscores the importance of data-driven decision-making in the finance sector, as firms strive to remain competitive in a rapidly evolving landscape.

Advancements in Artificial Intelligence and Machine Learning

The Digital Twin In Finance Market is significantly influenced by advancements in artificial intelligence (AI) and machine learning (ML). These technologies enhance the capabilities of digital twins, allowing for more sophisticated modeling and analysis of financial data. AI algorithms can process vast amounts of information, identifying patterns and trends that may not be immediately apparent. This capability is crucial for risk management and investment strategies, as it enables financial institutions to respond proactively to market changes. The AI market in finance is expected to grow at a compound annual growth rate of 23% through 2027, reflecting the increasing reliance on intelligent systems. Consequently, the integration of AI and ML into digital twin applications is likely to drive innovation and efficiency within the finance sector.