Integration with Smart Technologies

The Digital Light Processing Chipset Market is increasingly integrating with smart technologies, which is reshaping the landscape of display solutions. The rise of smart homes and IoT devices has created a demand for DLP chipsets that can seamlessly connect with various smart systems. This integration allows for enhanced user experiences, such as voice control and automated settings, which are becoming essential features in modern projection systems. As consumers prioritize convenience and connectivity, manufacturers are focusing on developing DLP chipsets that support these smart functionalities. Market analysis indicates that the integration of DLP chipsets with smart technologies could lead to a market expansion of approximately 15% over the next few years, as more consumers adopt smart home solutions.

Growth in Education and Corporate Sectors

The Digital Light Processing Chipset Market is benefiting from the growth in the education and corporate sectors, where the demand for effective presentation tools is increasing. Educational institutions and businesses are increasingly adopting advanced projection systems for classrooms and conference rooms, respectively. DLP chipsets are favored for their reliability and superior image quality, making them ideal for professional settings. The market data reveals that the education sector alone is projected to contribute significantly to the DLP chipset market, with an expected growth rate of around 9% annually. This trend highlights the importance of DLP technology in facilitating effective communication and learning, further driving the demand for these chipsets.

Rising Demand for Home Entertainment Systems

The Digital Light Processing Chipset Market is witnessing a notable increase in demand for home entertainment systems. As consumers seek to enhance their viewing experiences, the popularity of home theaters and high-quality projection systems is on the rise. This trend is fueled by the growing availability of streaming services and high-definition content, which require advanced projection technologies. DLP chipsets play a crucial role in delivering superior image quality and performance, making them a preferred choice for home entertainment setups. Market data suggests that the home entertainment segment is expected to account for a significant share of the DLP chipset market, with projections indicating a growth rate of around 12% annually. This shift towards home-based entertainment solutions is likely to bolster the demand for DLP chipsets in the coming years.

Technological Advancements in Display Technology

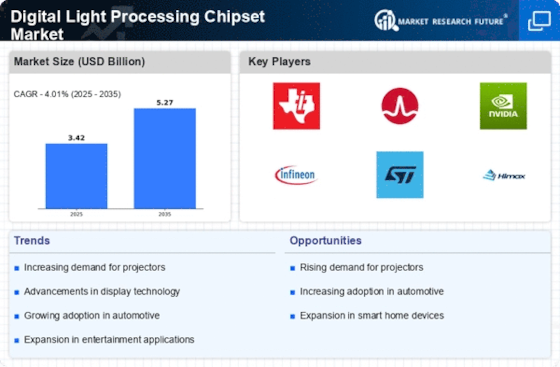

The Digital Light Processing Chipset Market is experiencing a surge in technological advancements, particularly in display technology. Innovations such as higher resolution displays, enhanced color accuracy, and improved brightness levels are driving the demand for DLP chipsets. For instance, the introduction of 4K and 8K resolution projectors has necessitated the development of more sophisticated chipsets to support these high-definition formats. As a result, manufacturers are investing heavily in research and development to create next-generation DLP chipsets that can meet the evolving needs of consumers and businesses alike. This trend is expected to continue, with the market projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years, indicating a robust demand for advanced display solutions.

Emerging Applications in Automotive and Healthcare

The Digital Light Processing Chipset Market is expanding into emerging applications within the automotive and healthcare sectors. In automotive, DLP technology is being utilized for advanced head-up displays and infotainment systems, enhancing the driving experience with high-quality visuals. Similarly, in healthcare, DLP chipsets are being integrated into medical imaging systems, providing clearer and more accurate representations of diagnostic images. This diversification into new applications is expected to propel the DLP chipset market forward, with estimates suggesting a growth rate of approximately 11% in these sectors. As industries continue to explore innovative uses for DLP technology, the market is likely to see a significant increase in demand for specialized chipsets.