North America : Digital Delivery Dominance

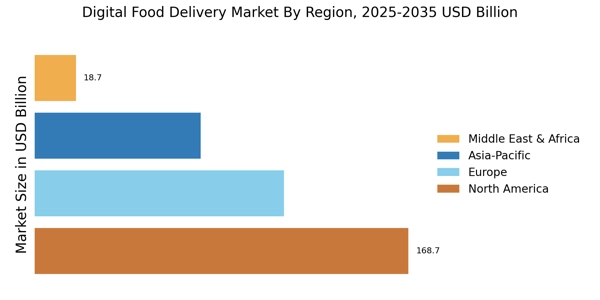

North America is the largest market for digital food delivery, accounting for approximately 45% of the global market share. The growth is driven by increasing consumer demand for convenience, the rise of mobile technology, and a robust logistics infrastructure. Regulatory support for food delivery services, including safety standards and labor regulations, further catalyzes market expansion. The U.S. is the primary contributor, followed by Canada, which holds around 10% of the market share.

The competitive landscape in North America is dominated by key players such as Uber Eats, DoorDash, and Grubhub. These companies leverage advanced technology and extensive delivery networks to enhance customer experience. The market is characterized by aggressive marketing strategies and partnerships with local restaurants, ensuring a diverse range of food options. The presence of established players and continuous innovation positions North America as a leader in the digital food delivery sector.

Europe : Emerging Market Trends

Europe is witnessing significant growth in the digital food delivery market, holding approximately 30% of the global share. The demand is fueled by changing consumer lifestyles, urbanization, and the increasing popularity of online ordering platforms. Countries like the UK and Germany are leading this trend, with the UK alone accounting for about 15% of the market. Regulatory frameworks are evolving to support food delivery services, focusing on consumer protection and food safety standards.

The competitive landscape in Europe features major players like Just Eat Takeaway and Deliveroo, alongside local startups. The market is characterized by a mix of established brands and emerging companies, fostering innovation and competition. The presence of diverse culinary options and a growing number of partnerships with restaurants enhance the consumer experience. As the market matures, companies are increasingly focusing on sustainability and delivery efficiency to meet consumer expectations.

Asia-Pacific : Rapid Growth and Innovation

Asia-Pacific is rapidly emerging as a powerhouse in the digital food delivery market, holding around 20% of the global share. The region's growth is driven by a large population, increasing smartphone penetration, and a shift towards online food ordering. Countries like India and China are at the forefront, with India holding approximately 8% of the market. Regulatory frameworks are adapting to support the burgeoning industry, focusing on safety and consumer rights.

The competitive landscape is vibrant, with key players like Zomato, Swiggy, and Foodpanda leading the charge. The market is characterized by intense competition and innovation, with companies continuously enhancing their platforms to improve user experience. The presence of diverse food cultures and a growing middle class further fuel demand, making Asia-Pacific a critical region for future growth in the digital food delivery sector.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region is an emerging market for digital food delivery, currently holding about 5% of the global market share. The growth is driven by urbanization, increasing internet penetration, and a young population eager for convenience. Countries like South Africa and the UAE are leading the charge, with the UAE accounting for approximately 3% of the market. Regulatory frameworks are evolving to support the industry, focusing on consumer protection and food safety standards.

The competitive landscape is characterized by a mix of local and international players, including Foodpanda and Uber Eats. The market is still in its infancy, presenting significant growth opportunities for new entrants. Companies are focusing on building partnerships with local restaurants and enhancing delivery logistics to capture the growing demand. As the region continues to develop, the digital food delivery market is expected to expand rapidly, driven by changing consumer preferences and technological advancements.