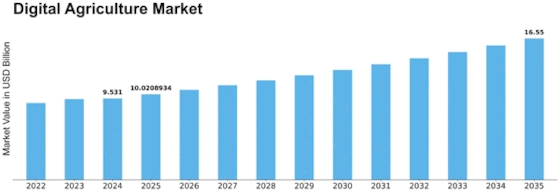

Digital Agriculture Size

Digital Agriculture Market Growth Projections and Opportunities

The digital agriculture market is considerably stimulated by using a myriad of market elements that collectively shape its trajectory and increase. One of the primary driving forces is the growing international populace, which has created an urgent need for more desirable agricultural productivity. With conventional farming practices attaining their limits, the integration of digital technology becomes important to satisfy the growing demand for food. Digital agriculture gives innovative solutions to optimize crop yields, reduce aid inefficiencies, and ensure sustainable farming practices. The creation of superior technology, which includes precision farming, sensors, and drones, has revolutionized the agricultural landscape. These technologies enable farmers to accumulate and examine real-time data on soil conditions, climate patterns, and crop fitness, allowing for specific choice-making and useful resource allocation. The demand for that virtual equipment is fueled by the growing cognizance of their capacity to improve typical performance, lessen environmental effects, and increase profitability in the long run. Government guidelines and tasks play a pivotal function in shaping the digital agriculture market. Many governments globally are recognizing the ability of virtual technology to address meal safety, environmental sustainability, and rural improvement. Subsidies, offers, and incentives for adopting virtual farming practices inspire farmers to put money into generation and contribute to the general increase of the digital agriculture market. The increasing connectivity in rural areas is a key enabler of digital agriculture. The availability of excessive-velocity net and cell networks allows the seamless transfer of facts between farmers, agricultural equipment, and virtual structures. This connectivity is essential to the functioning of smart farming systems, enabling real-time verbal exchange and coordination. As infrastructure improves, extra farmers gain access to digital equipment, unlocking the full capability of precision farming and information-driven choice-making. The function of agribusinesses and generation companies is instrumental in shaping the digital agriculture market. Agtech companies are continuously innovating and growing new answers to deal with the evolving needs of farmers. Collaborations among generation carriers and traditional agricultural stakeholders create synergies that pressure the adoption of virtual practices. Investments in research and improvement make contributions to the evolution of present-day technology, making sure that the digital agriculture market remains dynamic and aware of rising challenges. Consumer recognition and demand for sustainably produced meals are influencing market dynamics. As clients grow to be more aware of the environmental and social impact of meal manufacturing, there is a growing preference for products that adhere to sustainable and moral farming practices. Digital agriculture, with its emphasis on resource efficiency and environmental sustainability, aligns with these customer options, developing market opportunities for farmers who embrace virtual technology.

Leave a Comment