Rising Global Population

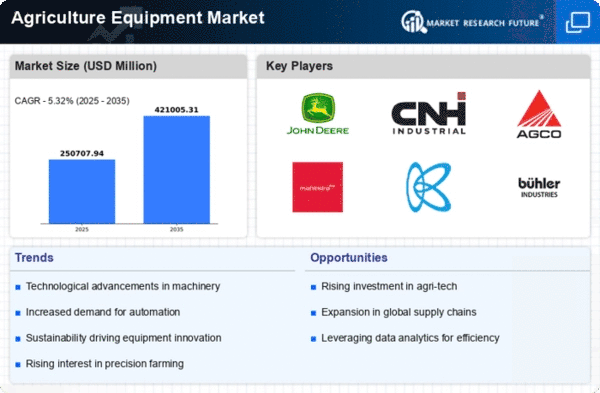

The Global Agriculture Equipment Industry is influenced by the rising global population, which necessitates increased food production. With the world population expected to reach approximately 9.7 billion by 2050, the demand for efficient agricultural practices is paramount. This demographic shift compels farmers to invest in modern equipment that can enhance yield and reduce labor costs. Consequently, the market is likely to expand as agricultural stakeholders seek to meet the food demands of a growing populace. The anticipated growth trajectory indicates a market value of 423.8 USD Billion by 2035, underscoring the urgency for innovative agricultural solutions.

Technological Advancements

The Agriculture Equipment Industry is experiencing a surge in technological advancements, which significantly enhances productivity and efficiency. Innovations such as precision agriculture, automation, and smart farming technologies are becoming increasingly prevalent. For instance, the integration of GPS and IoT in farming equipment allows for real-time monitoring and data analysis, leading to optimized resource utilization. This trend is likely to contribute to the market's growth, as farmers seek to adopt these technologies to remain competitive. As a result, the market is projected to reach 238.0 USD Billion in 2024, reflecting the growing demand for advanced agricultural solutions.

Government Initiatives and Support

Government initiatives and support play a crucial role in shaping the Agriculture Equipment Industry. Various countries are implementing policies aimed at promoting agricultural modernization and sustainability. For example, subsidies for purchasing advanced machinery and grants for research in agricultural technologies are becoming more common. These initiatives not only encourage farmers to adopt new equipment but also stimulate market growth by creating a favorable investment climate. As governments recognize the importance of food security and sustainable practices, the market is expected to flourish, driven by these supportive measures.

Market Diversification and Global Trade

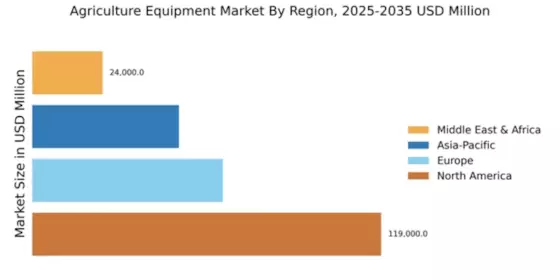

Market diversification and global trade are pivotal factors impacting the Agriculture Equipment Market. As emerging economies expand their agricultural sectors, there is an increasing demand for diverse agricultural machinery. Countries in Asia and Africa are particularly notable, as they seek to modernize their farming practices. This trend is likely to foster international trade in agricultural equipment, as manufacturers aim to penetrate new markets. The anticipated compound annual growth rate of 5.38% from 2025 to 2035 suggests a robust expansion in the industry, driven by the need for varied and advanced agricultural solutions.

Sustainability and Environmental Concerns

The Agriculture Equipment Market is increasingly influenced by sustainability and environmental concerns. As awareness of climate change and resource depletion grows, there is a pressing need for equipment that minimizes environmental impact. Farmers are now more inclined to invest in machinery that promotes sustainable practices, such as reduced emissions and efficient water usage. This shift towards eco-friendly equipment is likely to drive market growth, as consumers and regulatory bodies demand greener solutions. The industry's response to these concerns may lead to innovative products that align with sustainability goals, further enhancing market dynamics.