Global Economic Growth

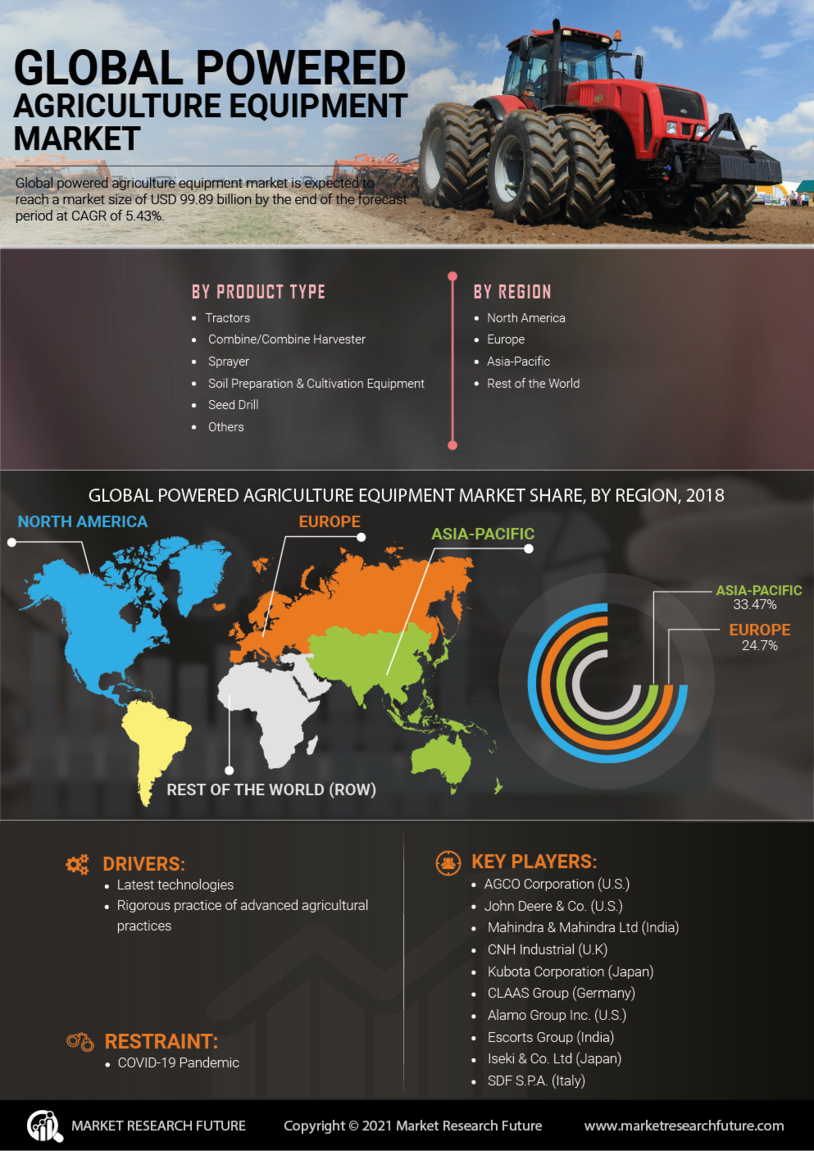

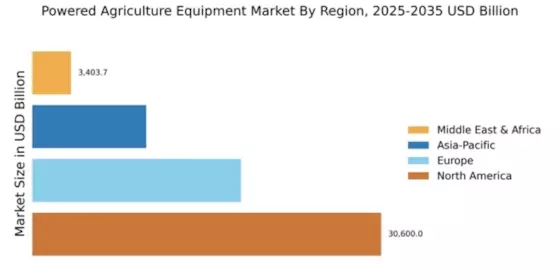

The Powered Agricultural Equipment Market is also influenced by overall economic growth, particularly in developing regions. As economies expand, there is a corresponding increase in agricultural investments, leading to higher demand for powered equipment. Countries experiencing economic development are modernizing their agricultural sectors, which includes the adoption of advanced machinery. This trend is evident in regions such as Asia-Pacific and Latin America, where investments in agricultural technology are surging. The anticipated growth in these markets is expected to further bolster the overall market, contributing to its projected value of 162.8 USD Billion in 2024.

Rising Global Population

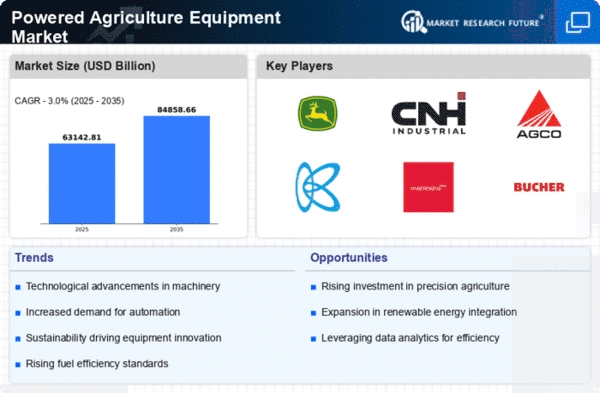

The Global Powered Agricultural Equipment Industry is significantly influenced by the rising global population, which is expected to reach approximately 9.7 billion by 2050. This demographic shift necessitates increased agricultural production to ensure food security. Consequently, farmers are increasingly turning to powered agricultural equipment to enhance productivity and meet the growing demand for food. The need for efficient farming practices is driving investments in modern equipment, leading to a projected market value of 252.0 USD Billion by 2035. This trend underscores the importance of powered agricultural equipment in addressing the challenges posed by population growth.

Technological Advancements

The Powered Agricultural Equipment Market is experiencing rapid technological advancements, which are enhancing the efficiency and productivity of agricultural operations. Innovations such as precision farming technologies, autonomous industrial machinery equipment, and advanced data analytics are becoming increasingly prevalent. For instance, the integration of GPS technology in tractors allows for more accurate planting and harvesting, reducing waste management and increasing yields. These advancements not only improve operational efficiency but also contribute to sustainable farming practices. As a result, the market is projected to reach 162.8 USD Billion in 2024, indicating a strong demand for technologically advanced equipment.

Government Initiatives and Support

Government initiatives aimed at promoting agricultural modernization are playing a crucial role in the Powered Agricultural Equipment Industry. Various countries are implementing policies that encourage the adoption of advanced agricultural technologies and equipment. For example, subsidies and financial assistance programs are being offered to farmers to facilitate the purchase of powered equipment. These initiatives not only enhance productivity but also contribute to sustainable agricultural practices. As a result, the market is expected to grow at a CAGR of 4.05% from 2025 to 2035, reflecting the positive impact of government support on the industry.

Increasing Focus on Sustainable Farming

The Powered Agricultural Equipment Industry is witnessing a growing emphasis on sustainable farming practices. Farmers are increasingly adopting equipment that minimizes environmental impact and promotes resource conservation. This shift is driven by consumer demand for sustainably produced food and the need to comply with environmental regulations. Equipment such as electric tractors and biofuel-powered machinery are gaining traction as they align with sustainability goals. This trend is likely to contribute to the market's growth, as more farmers seek to invest in powered agricultural equipment that supports eco-friendly practices.