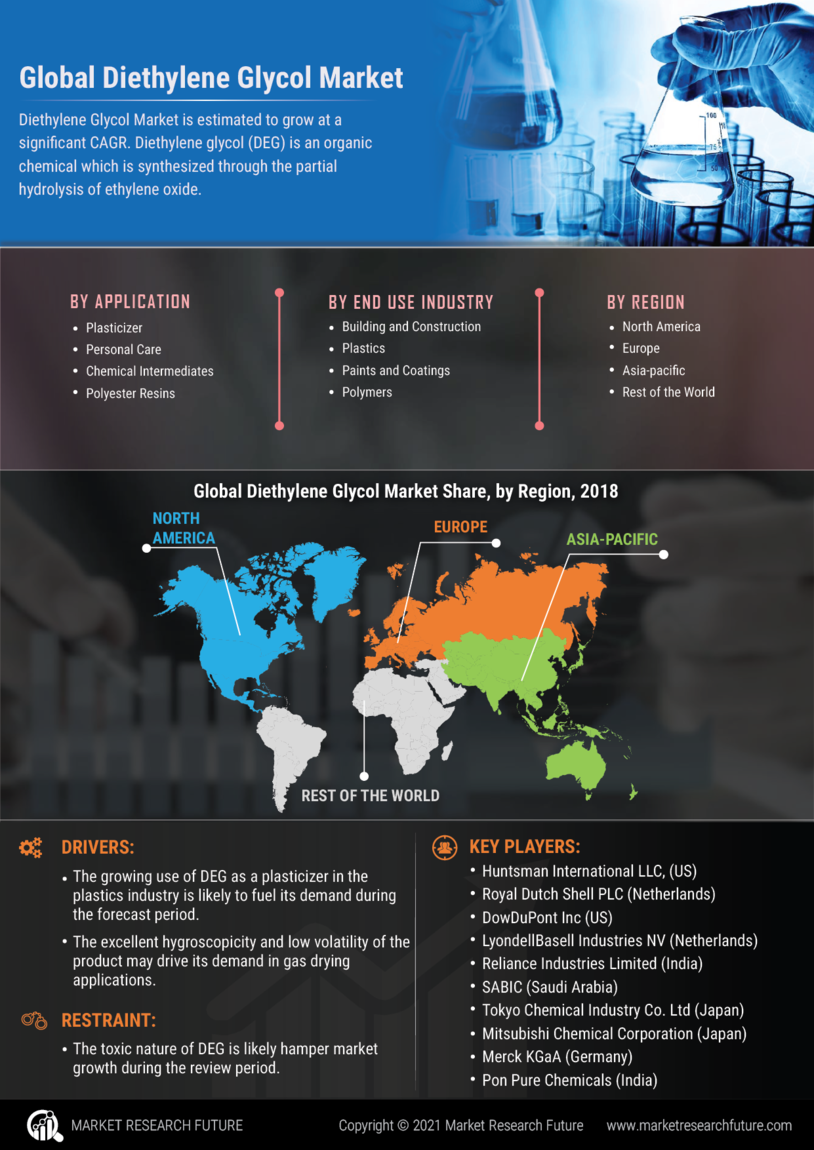

Growth in Textile Industry

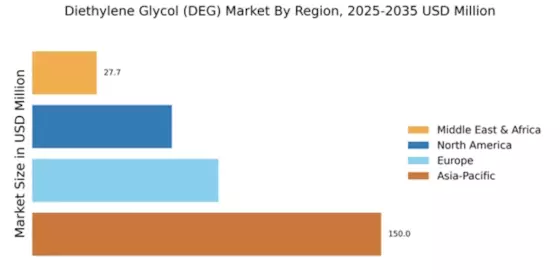

The textile industry plays a pivotal role in driving the Global Diethylene Glycol Market Industry. Diethylene glycol is extensively used as a solvent in the production of polyester fibers, which are integral to modern textiles. As global fashion trends evolve and the demand for synthetic fibers rises, the textile sector's consumption of diethylene glycol is likely to increase. This growth is further supported by the expanding middle class in developing regions, which fuels demand for apparel. The Global Diethylene Glycol Market is projected to witness a compound annual growth rate of 9.21% from 2025 to 2035, reflecting the textile industry's significant contribution to market dynamics.

Rising Demand from Automotive Sector

The Global Diethylene Glycol Market Industry experiences a notable surge in demand driven by the automotive sector. Diethylene glycol is utilized in the production of antifreeze and coolant formulations, which are essential for vehicle performance and longevity. As the automotive industry continues to expand, particularly in emerging markets, the need for high-quality cooling agents increases. This trend is expected to contribute significantly to the market's growth, with projections indicating that the Global Diethylene Glycol Market could reach 192.1 USD Billion in 2024. The automotive sector's reliance on diethylene glycol underscores its critical role in ensuring efficient vehicle operation.

Surge in Demand for Personal Care Products

The personal care industry significantly influences the Global Diethylene Glycol Market Industry. Diethylene glycol is utilized in various formulations, including skin care and hair care products, due to its properties as a humectant and solvent. As consumer preferences shift towards high-quality personal care products, the demand for diethylene glycol is likely to rise. The increasing awareness of personal grooming and hygiene, particularly in urban areas, further propels this trend. The market's expansion in this sector suggests a robust growth potential, contributing to the overall market dynamics of diethylene glycol.

Increasing Applications in Chemical Manufacturing

The Global Diethylene Glycol Market Industry benefits from its diverse applications in chemical manufacturing. Diethylene glycol serves as a key intermediate in the production of various chemicals, including plasticizers and resins. The ongoing expansion of the chemical manufacturing sector, particularly in Asia-Pacific, is likely to enhance the demand for diethylene glycol. As industries seek to optimize production processes and improve product quality, the reliance on diethylene glycol as a versatile chemical building block is expected to grow. This trend aligns with the market's projected growth trajectory, potentially reaching 506.2 USD Billion by 2035.

Environmental Regulations and Sustainability Initiatives

The Global Diethylene Glycol Market Industry is also shaped by the increasing emphasis on environmental regulations and sustainability initiatives. As industries strive to reduce their carbon footprint, there is a growing interest in bio-based alternatives to traditional petrochemical products. Diethylene glycol, being a versatile compound, is at the forefront of this transition. Companies are exploring sustainable production methods and eco-friendly applications, which may enhance the market's appeal. This shift towards sustainability is likely to influence consumer preferences and regulatory frameworks, potentially reshaping the landscape of the diethylene glycol market.