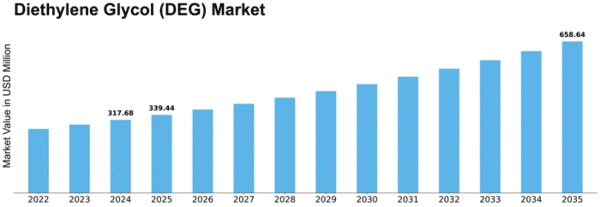

Diethylene Glycol Deg Size

Diethylene Glycol (DEG) Market Growth Projections and Opportunities

The Diethylene Glycol (DEG) market is subject to a variety of factors that collectively shape its dynamics. Understanding these elements is crucial for industry participants to make informed decisions and navigate the market effectively.

End-Use Industries:

Diethylene Glycol serves as a versatile chemical with applications in various industries, including textiles, plastics, and pharmaceuticals. The health and growth of these end-use industries significantly influence the demand for DEG, making it essential for manufacturers to monitor industry trends. Polyester Fiber and Resin Production:

A significant portion of Diethylene Glycol is used in the production of polyester fibers and resins. Market dynamics are closely tied to the demand for polyester-based products, such as textiles and packaging materials, with fluctuations in this sector affecting DEG consumption. Plasticizers and Solvents:

DEG is utilized as a plasticizer in the manufacturing of plastics and as a solvent in various applications. Trends in the plastics and solvents industries directly impact DEG demand, with changes in manufacturing practices influencing market dynamics. Pharmaceuticals and Personal Care Products:

Diethylene Glycol is employed in the pharmaceutical and personal care industries for applications such as antifreeze solutions and humectants. The demand for pharmaceutical and personal care products contributes to the overall market for DEG, with growth in these sectors positively impacting market dynamics. Global Economic Conditions:

Economic stability and growth rates in major economies influence industrial activities and consumer spending, directly impacting the demand for DEG. Economic downturns may lead to reduced production and consumption of DEG-related products, affecting the overall market. Raw Material Prices:

DEG production relies on raw materials such as ethylene oxide, and fluctuations in the prices of these raw materials impact production costs. Changes in global ethylene oxide prices, influenced by factors such as supply and demand dynamics, geopolitical events, and trade policies, contribute to DEG market volatility. Environmental and Regulatory Considerations:

Stringent environmental regulations impact the DEG industry, particularly in terms of emissions control and waste management. Compliance with environmental standards is crucial for DEG manufacturers to ensure sustainable operations and meet regulatory requirements. Emerging Applications:

Ongoing research and development lead to emerging applications for DEG, such as in the production of fuel cells and energy storage devices. Companies that invest in exploring and capitalizing on new applications contribute to the evolution of the DEG market. Technological Advances:

Advancements in DEG production technologies can enhance efficiency, reduce costs, and improve the quality of the final product. Companies investing in innovative production processes and technologies gain a competitive edge in the market by offering superior products and cost-effective solutions. Global Trade Dynamics:

DEG is a globally traded commodity, and changes in trade policies, tariffs, and geopolitical tensions can impact international trade and pricing. Market participants need to stay informed about global trade dynamics to anticipate potential disruptions and adapt their strategies accordingly. Consumer Preferences for Sustainable Products:

Growing consumer awareness of sustainability influences the choice of raw materials and production processes in various industries. DEG manufacturers incorporating sustainable practices and promoting eco-friendly applications of their products can gain a competitive advantage. Supply Chain Resilience:

The resilience of the DEG supply chain is crucial for market stability, considering potential disruptions due to events such as natural disasters or geopolitical issues. Diversifying supply chain sources and implementing robust risk management strategies become essential for market participants.

Leave a Comment