Aging Population

The aging population is a crucial factor impacting the Diabetic Macular Edema Market. As individuals age, the risk of developing diabetes and its associated complications, including diabetic macular edema, increases. The demographic shift towards an older population is expected to result in a higher incidence of diabetes-related eye diseases. This trend indicates a growing need for specialized treatments and management strategies tailored to older patients. Consequently, pharmaceutical companies and healthcare providers may focus on developing age-appropriate therapies, which could further stimulate market growth as they cater to the unique needs of this demographic.

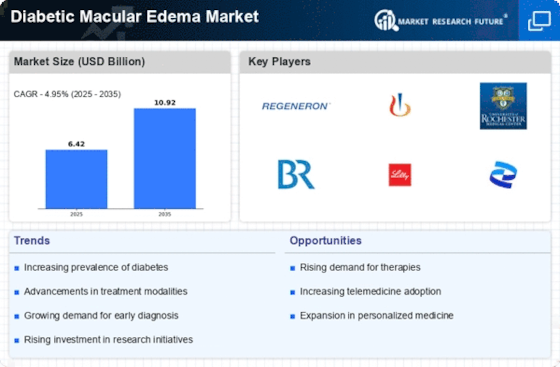

Rising Prevalence of Diabetes

The increasing prevalence of diabetes worldwide is a primary driver for the Diabetic Macular Edema Market. According to the World Health Organization, the number of individuals diagnosed with diabetes has surged significantly over the past few decades. This rise correlates with an uptick in diabetic complications, including diabetic macular edema, which affects a substantial portion of the diabetic population. As diabetes becomes more prevalent, the demand for effective treatment options for diabetic macular edema is likely to grow. This trend suggests that healthcare providers and pharmaceutical companies may need to focus on developing innovative therapies to address the needs of this expanding patient demographic, thereby propelling the market forward.

Technological Advancements in Treatment

Technological advancements in treatment modalities are reshaping the Diabetic Macular Edema Market. Recent innovations, such as the development of anti-VEGF therapies and corticosteroids, have shown promising results in managing diabetic macular edema. These treatments not only improve visual acuity but also reduce the risk of vision loss, which is a critical concern for patients. Furthermore, the introduction of sustained-release drug delivery systems is enhancing treatment adherence and efficacy. As these technologies continue to evolve, they are expected to drive market growth by providing more effective and convenient treatment options for patients suffering from diabetic macular edema.

Increased Awareness and Screening Programs

Increased awareness about diabetic macular edema and the importance of early detection is significantly influencing the Diabetic Macular Edema Market. Public health initiatives and educational campaigns are encouraging individuals with diabetes to undergo regular eye examinations. This heightened awareness is leading to earlier diagnosis and treatment of diabetic macular edema, which can prevent severe vision impairment. Moreover, screening programs implemented by healthcare organizations are facilitating access to necessary diagnostic tools, thereby expanding the patient base. As more individuals are diagnosed and treated, the market is likely to experience substantial growth, driven by the demand for effective therapies.

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is playing a pivotal role in shaping the Diabetic Macular Edema Market. Regulatory agencies are increasingly recognizing the need for expedited approval processes for new treatments that address unmet medical needs in diabetic macular edema. This supportive environment encourages pharmaceutical companies to invest in research and development, leading to the introduction of novel therapies. As these innovative treatments receive regulatory approval, they are likely to enhance patient outcomes and drive market expansion. The collaboration between regulatory bodies and industry stakeholders is essential for fostering an ecosystem that promotes the development of effective solutions for diabetic macular edema.