Research Methodology on Dry Age-Related Macular Degeneration AMD Market

Introduction

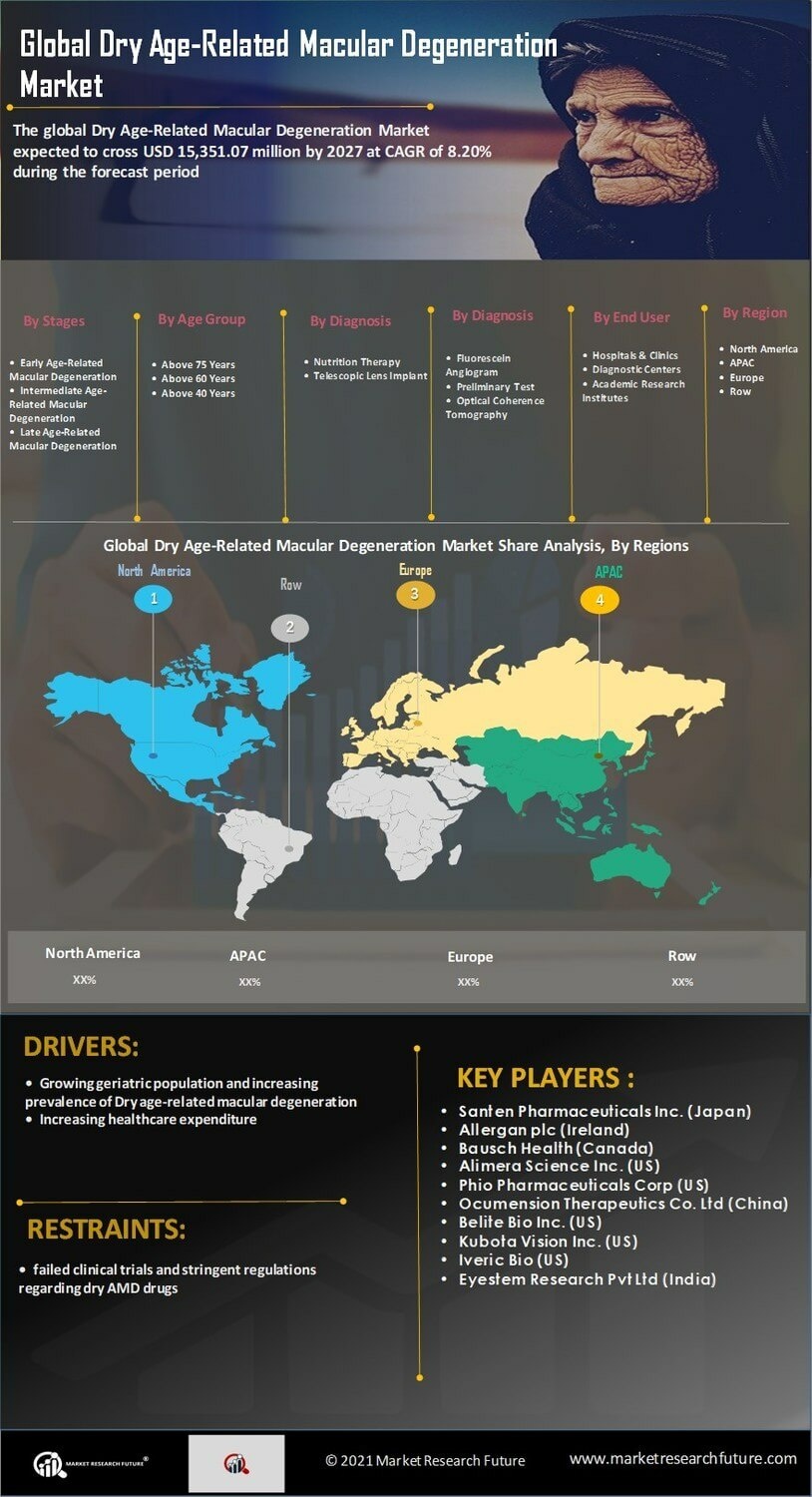

Dry Age-Related Macular Degeneration (AMD) is one of the leading causes of severe vision loss and blindness among seniors in developed countries. Market Research Future (MRFR) estimates that the Dry AMD market will grow at a rapid pace by the year 2030. This research report examines the factors impacting the increasing prevalence of AMD and provides a comprehensive assessment of the Dry AMD market.

The primary objectives of this research report are to assess the current and historical status of the Dry AMD market, create a current market projection of Dry AMD for the forecast period 2023 to 2030, identify the current and potential drivers of growth for the Dry AMD market, and explore the potential market opportunities for manufacturers of treatments for Dry AMD.

Research Objectives

The primary objective of this research is to determine the current and historical status of the Dry AMD market. The secondary research objective of this study is to create a market projection for the Dry AMD market.

Research Methodology

The overall research methodology employed in this report involves both primary and secondary research. The primary research component consists of interviews with industry experts as well as surveys of patients, doctors, and manufacturers of Dry AMD treatments. The secondary research component involves using a wide variety of sources, including published materials, medical journals, and reports from patient advocacy groups.

Definition of the Population

The population of the Dry AMD market includes all people who have been diagnosed with Dry AMD and who are currently in the treatment market. The population of this report also includes all medical professionals and companies manufacturing/distributing treatments for Dry AMD.

Sampling and Data Collection

To collect data for this report, a multilayered sampling process is employed. For primary data collection, a convenience sample of patients with Dry AMD is used, whereby patients are asked to participate in one-on-one interviews. Patients are also asked to complete an online survey to provide further insight into their experiences with Dry AMD. For secondary data collection, an exhaustive review of medical journals, patient advocacy reports, and other published materials is conducted.

Outcomes and Data Analysis

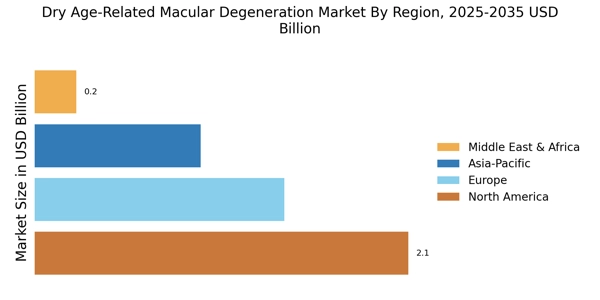

The data collected from both primary and secondary sources is then analyzed for patterns and trends. The data is grouped by region, market size, treatment type, and current and potential market drivers. An analysis of the data is then conducted to determine the overall current and projected market size for Dry AMD treatments. The analysis is then used to form the basis of the conclusions of this report.

Conclusion

This research report provides a comprehensive assessment of the current and projected Dry AMD market. By utilizing a multi-layered sampling and data collection process, the current and potential drivers of the Dry AMD market are identified. The data collected is then analyzed to determine the overall market size for Dry AMD treatments for the period 2023 to 2030.