Wider Availability

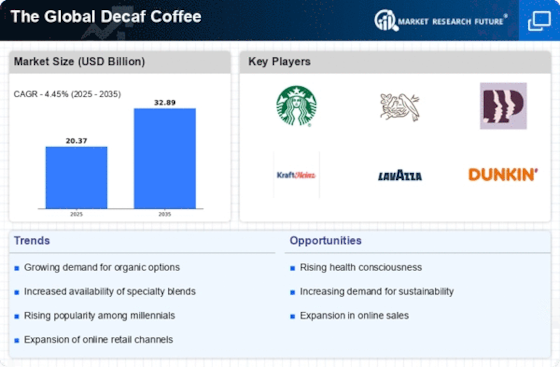

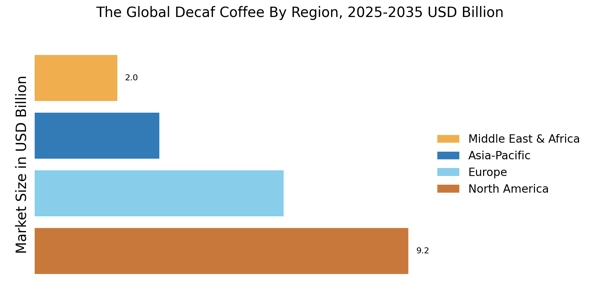

The expansion of distribution channels for decaf coffee products is a crucial factor propelling The Global Decaf Coffee Industry. Retailers, both online and brick-and-mortar, are increasingly stocking a diverse range of decaffeinated coffee options to meet growing consumer demand. This trend is evident in supermarkets, specialty stores, and e-commerce platforms, where decaf coffee is becoming more accessible. Market data suggests that the availability of decaf products has increased by over 30% in recent years, indicating a shift in retail strategies to cater to health-conscious consumers. As accessibility improves, The Global Decaf Coffee Industry is likely to benefit from heightened consumer interest and increased sales.

Specialty Offerings

The rise of specialty coffee shops and artisanal brands has significantly influenced The Global Decaf Coffee Industry. Consumers are increasingly drawn to unique and high-quality coffee experiences, which include a variety of decaffeinated options. Specialty roasters are now offering decaf blends that highlight distinct flavor profiles, appealing to discerning coffee drinkers. This trend is supported by market data indicating that specialty coffee sales, including decaf varieties, have been on the rise, reflecting a shift in consumer preferences. As more coffee enthusiasts seek out premium decaf options, The Global Decaf Coffee Industry is poised for expansion, driven by innovation and a focus on quality.

Health Consciousness

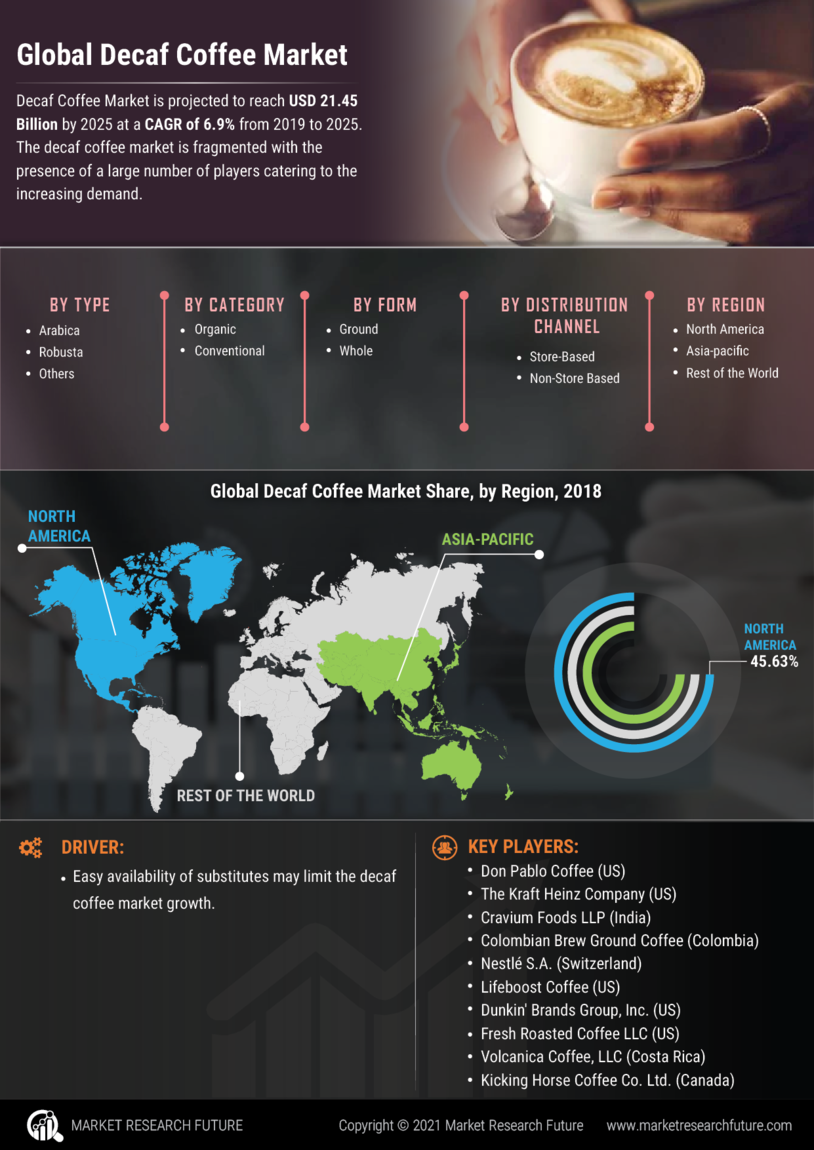

The increasing awareness of health and wellness among consumers appears to be a primary driver for The Global Decaf Coffee Industry. As individuals become more health-conscious, they seek alternatives to traditional caffeinated beverages. Decaf coffee, which retains the rich flavor of coffee without the stimulating effects of caffeine, is gaining traction. According to recent data, the demand for decaffeinated options has surged, with a notable increase in sales reported in various regions. This trend is particularly evident among demographics such as pregnant women and those with certain health conditions, who are advised to limit caffeine intake. Consequently, The Global Decaf Coffee Industry is likely to experience sustained growth as more consumers prioritize their health and opt for decaffeinated products.

Sustainability Trends

Sustainability has emerged as a significant driver in The Global Decaf Coffee Industry. Consumers are becoming more environmentally conscious, seeking products that align with their values. This trend has led to a growing demand for decaf coffee sourced from sustainable and ethical practices. Brands that emphasize organic and fair-trade certifications are particularly appealing to consumers who prioritize sustainability. Market data indicates that sales of sustainably sourced decaf coffee have increased, reflecting a broader shift towards eco-friendly consumption. As sustainability continues to shape consumer choices, The Global Decaf Coffee Industry is expected to adapt and thrive, offering products that resonate with environmentally aware consumers.

Innovative Brewing Methods

The advent of innovative brewing methods is reshaping The Global Decaf Coffee Industry. As consumers seek convenience and quality, new brewing technologies are emerging, allowing for enhanced flavor extraction in decaffeinated coffee. Methods such as cold brew and nitro coffee are gaining popularity, even among decaf options. This innovation is supported by market data showing a rise in sales of ready-to-drink decaf beverages, which cater to on-the-go consumers. As these brewing techniques become more mainstream, they are likely to attract a broader audience to the decaf segment. Consequently, The Global Decaf Coffee Industry may witness growth driven by the appeal of modern brewing solutions.