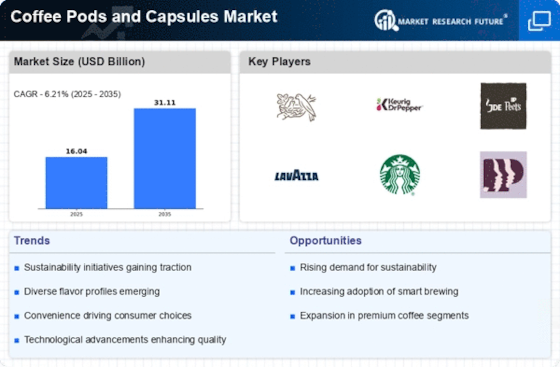

Major market players are spending a lot of money on R&D to increase their product lines, which will help the coffee pods and capsules market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the coffee pods and capsules industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

One of the primary business strategies adopted by manufacturers in the coffee pods and capsules industry to benefit clients and expand the market sector is to manufacture locally to reduce operating costs. In recent years, coffee pods and capsules industry has provided medicine with some of the most significant benefits. The coffee pods and capsules market major player such as Illycaffè S.p.A.(Italy), Keurig Dr Pepper, Inc.(US), Melitta (Germany), The Kraft Heinz Company (US), and others are working to expand the market demand by investing in research and development activities.

The J.M. Smucker Corporation, popularly known as Smuckers, is an American food and beverage business. The company, headquartered in Orrville, Ohio, was formed in 1897 as a producer of apple butter. M. Smucker's current business units are consumer goods, pet foods, and coffee. Smucker's, the company's flagship brand, makes fruit preserves, peanut butter, syrups, frozen crustless sandwiches, and ice cream toppings. Jerome Monroe Smucker created the J.M. Smucker Company in 1897. Smucker spent a large portion of his life as a farmer in Orrville, Ohio, where he was born on December 5, 1858.

Smucker constructed a cider mill in Orrville in 1897.

In February The J.M. Smucker Corporation released the 1850 coffee product line. This has aided the corporation in broadening its product offering.

Nestlé produces the coffee brand Nescafé. It comes in a variety of forms. The name is a combination of the terms "Nestlé" and "café". Nestlé launched their main coffee brand in Switzerland on April 1, 1938. Nestlé began establishing a coffee brand in 1930, at the request of the Brazilian government, to assist in the preservation of the significant surplus of the yearly Brazilian coffee harvest. The development effort was led by Max Morgenthaler. Nestlé launched the new beverage under the brand name "Nescafé" on April 1, 1938.

Nescafé is a soluble powdered coffee that acquired a household name in the United States during World War II. October 2022 - Nestlé's most recognisable coffee brand and one of the most well-known coffees in the world, Nescafé, today unveiled The Nescafé Plan 2030, the company's comprehensive plan to support more sustainable coffee cultivation. The organisation is accelerating its ten-year-old Nescafé-related initiatives. Work together with coffee growers to help them transition to regenerative agriculture.