Health and Wellness Trends

The coffee Market is significantly influenced by the rising health and wellness trends among consumers. Research indicates that coffee is perceived as a functional beverage, offering various health benefits such as improved cognitive function and antioxidant properties. As consumers become more health-conscious, they are gravitating towards coffee products that align with their wellness goals. This shift is reflected in the growing popularity of organic and low-calorie coffee options, which are increasingly available in the market. Furthermore, the Coffee Market is responding to this trend by emphasizing the health benefits of coffee in marketing campaigns, thereby attracting a broader audience. The integration of health-oriented messaging is likely to bolster sales and expand the consumer base, ultimately contributing to the sustained growth of the Coffee Market.

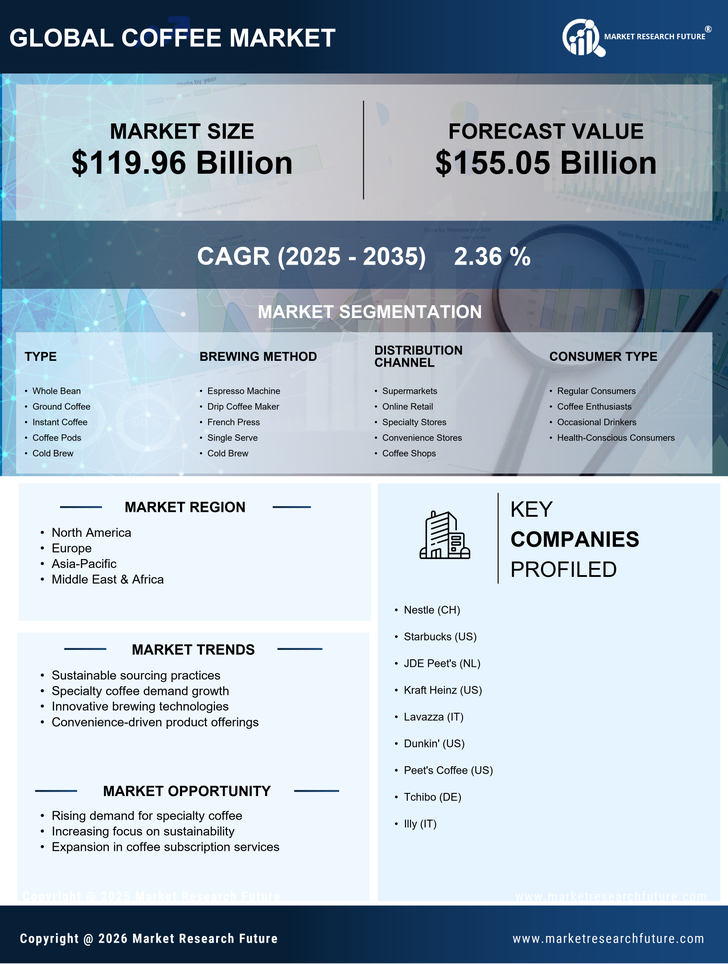

Emergence of Coffee Subscriptions

The Coffee Market is witnessing a transformative shift with the emergence of coffee subscription services. These services offer consumers the convenience of receiving curated coffee selections delivered directly to their homes, catering to the growing demand for personalized experiences. Recent statistics suggest that subscription services in the Coffee Market have seen a growth rate of over 20% annually, reflecting a significant change in consumer purchasing behavior. This model not only enhances customer loyalty but also allows brands to establish direct relationships with consumers, fostering a deeper connection. As the Coffee Market continues to evolve, the subscription model is likely to play a pivotal role in shaping future consumption patterns, providing both convenience and variety to coffee enthusiasts.

Sustainability and Ethical Sourcing

Sustainability has emerged as a critical driver within the Coffee Market, as consumers increasingly prioritize ethically sourced products. The demand for sustainable coffee is on the rise, with a growing number of consumers willing to pay a premium for products that adhere to ethical sourcing practices. This trend is supported by data indicating that sales of certified organic and fair-trade coffee have increased by approximately 15% over the past year. The Coffee Market is responding by implementing sustainable practices throughout the supply chain, from cultivation to distribution. Companies are investing in transparency and traceability, ensuring that consumers are informed about the origins of their coffee. This commitment to sustainability not only enhances brand reputation but also aligns with the values of a socially conscious consumer base, thereby driving growth within the Coffee Market.

Increasing Demand for Coffee Products

The Coffee Market is currently experiencing a notable surge in demand for coffee products, driven by changing consumer preferences. As more individuals seek out premium and specialty coffee options, the market is witnessing a shift towards higher-quality offerings. According to recent data, the consumption of coffee has increased by approximately 2.5% annually, indicating a robust growth trajectory. This trend is particularly evident among younger demographics, who are increasingly inclined to explore diverse coffee flavors and brewing methods. The Coffee Market is thus adapting to these evolving tastes, with companies innovating their product lines to cater to this growing consumer base. This increasing demand not only enhances market competition but also encourages the introduction of new brands and products, further enriching the Coffee Market landscape.

Technological Innovations in Coffee Production

Technological advancements are playing a pivotal role in shaping the Coffee Market, particularly in the areas of production and processing. Innovations such as precision agriculture and automated brewing systems are enhancing efficiency and quality in coffee production. Recent data indicates that the adoption of technology in coffee farming has led to a 10% increase in yield for many producers, thereby improving profitability. Additionally, advancements in brewing technology are allowing consumers to replicate café-quality coffee at home, further driving interest in the Coffee Market. As technology continues to evolve, it is likely to introduce new methods and products that will redefine consumer experiences and expectations. The integration of technology into the Coffee Market not only streamlines operations but also enhances the overall quality of coffee, appealing to discerning consumers.