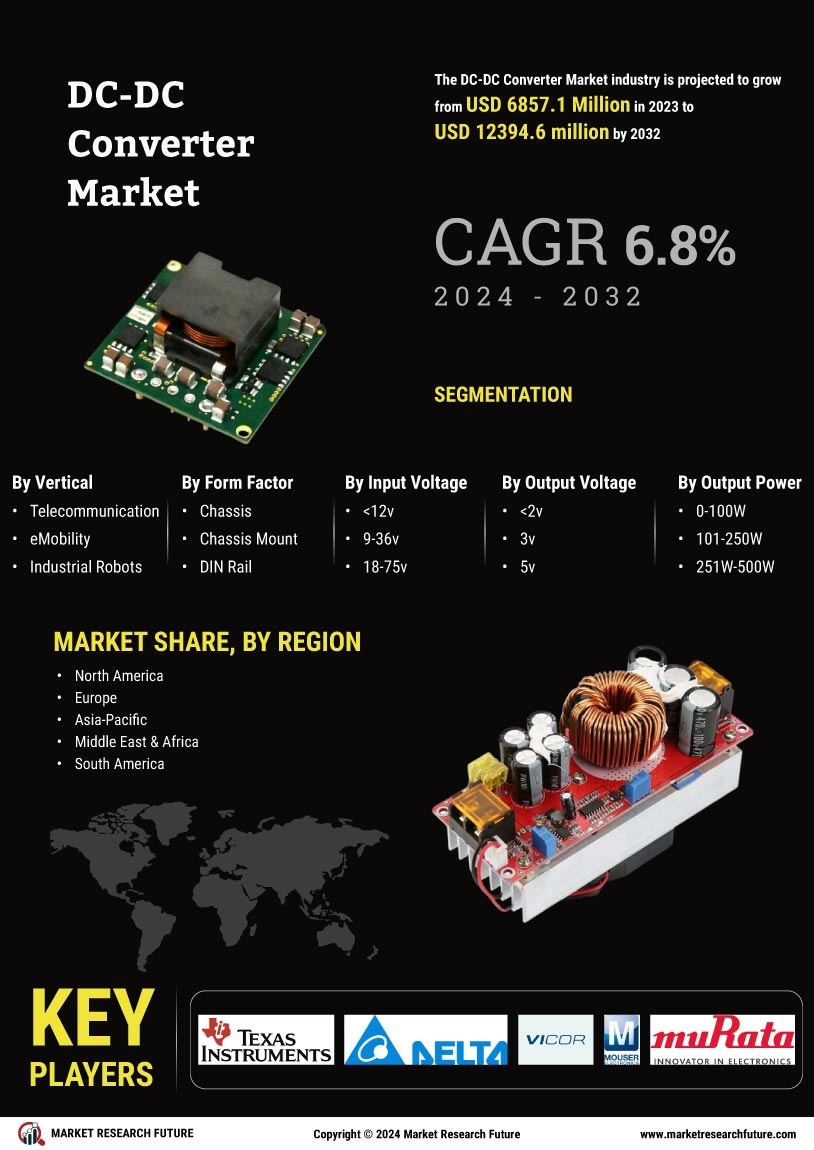

Market Growth Projections

The Global DC-DC Converter Market Industry is poised for substantial growth, with projections indicating a market size of 7.9 USD Billion in 2024 and an anticipated increase to 16.3 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 6.82% from 2025 to 2035, reflecting the increasing demand for efficient power management solutions across various sectors. The market's expansion is driven by factors such as the rise of renewable energy, advancements in electric vehicles, and the proliferation of consumer electronics, all of which underscore the critical role of DC-DC converters in modern energy systems.

Emergence of Smart Grid Technologies

The emergence of smart grid technologies is reshaping the Global DC-DC Converter Market Industry. Smart grids require sophisticated power management solutions to optimize energy distribution and consumption. DC-DC converters are essential for integrating renewable energy sources and managing energy flow within smart grids. As governments and utilities invest in smart grid infrastructure, the demand for efficient DC-DC converters is likely to increase. This trend indicates a growing recognition of the importance of energy efficiency and sustainability in power systems, potentially driving significant market growth in the coming years.

Rising Adoption of Consumer Electronics

The proliferation of consumer electronics is a key driver of the Global DC-DC Converter Market Industry. With the increasing demand for portable devices such as smartphones, tablets, and laptops, efficient power management solutions are essential. DC-DC converters facilitate the conversion of voltage levels, ensuring devices operate effectively and efficiently. As consumer electronics continue to evolve, the need for compact and efficient power solutions is expected to grow. This trend not only supports the market's expansion but also aligns with the global push for energy-efficient technologies, thereby enhancing the overall market landscape.

Advancements in Electric Vehicle Technology

The rapid evolution of electric vehicle technology significantly influences the Global DC-DC Converter Market Industry. As electric vehicles become more mainstream, the need for efficient power conversion systems increases. DC-DC converters are essential for managing power between the battery and various vehicle components, enhancing overall performance and efficiency. The automotive sector's shift towards electrification is likely to propel market growth, with projections indicating a compound annual growth rate of 6.82% from 2025 to 2035. This growth reflects the automotive industry's commitment to sustainability and innovation, further solidifying the role of DC-DC converters in modern electric vehicles.

Growing Demand for Renewable Energy Sources

The increasing global emphasis on renewable energy sources is driving the Global DC-DC Converter Market Industry. As nations strive to reduce carbon emissions and transition to sustainable energy, the demand for efficient power management solutions rises. DC-DC converters play a crucial role in optimizing energy conversion from renewable sources such as solar and wind. For instance, in 2024, the market is projected to reach 7.9 USD Billion, reflecting the growing integration of renewable energy systems. This trend is expected to continue as countries implement policies to enhance energy efficiency, potentially leading to a market size of 16.3 USD Billion by 2035.

Expansion of Telecommunications Infrastructure

The expansion of telecommunications infrastructure is significantly impacting the Global DC-DC Converter Market Industry. As the demand for reliable communication networks increases, the need for efficient power conversion solutions becomes paramount. DC-DC converters are integral in telecommunications equipment, providing stable power supply and enhancing system reliability. The ongoing development of 5G networks and the Internet of Things (IoT) further drive this demand, as these technologies require robust power management systems. This trend suggests a sustained growth trajectory for the market, as telecommunications companies invest in advanced infrastructure to meet global connectivity needs.