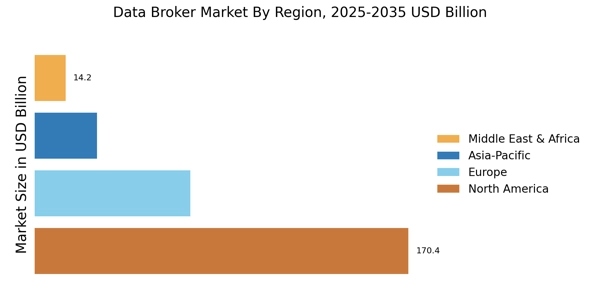

North America : Data Hub of Innovation

North America dominates the data broker market, accounting for approximately 60% of the global share. The region's growth is driven by increasing demand for data analytics, regulatory frameworks supporting data privacy, and advancements in technology. The U.S. leads this market, followed closely by Canada, which holds about 15% of the market share. Regulatory catalysts, such as the California Consumer Privacy Act, are shaping the landscape, ensuring consumer data protection while fostering innovation. The competitive landscape in North America is robust, featuring key players like Acxiom, Experian, and TransUnion. These companies leverage advanced analytics and machine learning to provide tailored solutions across various sectors, including finance, healthcare, and marketing. The presence of major tech firms further enhances the region's capabilities, making it a fertile ground for data-driven strategies and innovations. North America accounted for the largest broker market share, driven by strong regulatory frameworks and advanced analytics adoption.

Europe : Emerging Regulatory Landscape

Europe is witnessing significant growth in the data broker market, driven by stringent data protection regulations like the General Data Protection Regulation (GDPR). This region holds approximately 25% of the global market share, with the UK and Germany being the largest contributors. The demand for data-driven insights is increasing, particularly in sectors such as finance and retail, as businesses seek to comply with regulations while optimizing their operations. Leading countries in Europe include the UK, Germany, and France, where companies are adapting to the evolving regulatory landscape. The competitive environment features both established players and emerging startups, focusing on ethical data usage and transparency. The presence of organizations like the European Data Protection Board ensures that data brokers operate within a framework that prioritizes consumer rights and data security.

Asia-Pacific : Rapidly Growing Data Market

Asia-Pacific is rapidly emerging as a significant player in the data broker market, currently holding about 10% of the global share. The region's growth is fueled by increasing digitalization, a burgeoning e-commerce sector, and a rising demand for data analytics across various industries. Countries like China and India are at the forefront, with China leading the market due to its vast consumer base and technological advancements, while India follows closely with a growing startup ecosystem. The competitive landscape in Asia-Pacific is diverse, featuring both local and international players. Companies are increasingly focusing on compliance with local regulations, such as the Personal Data Protection Bill in India, which aims to enhance data privacy. The presence of key players like Oracle and local firms is driving innovation, making the region a hotspot for data-driven solutions and services.

Middle East and Africa : Emerging Data Opportunities

The Middle East and Africa (MEA) region is gradually recognizing the potential of the data broker market, currently holding around 5% of the global share. The growth is driven by increasing internet penetration, mobile usage, and a rising interest in data analytics among businesses. Countries like South Africa and the UAE are leading the charge, with the UAE focusing on becoming a data-driven economy as part of its Vision 2021 initiative, which aims to enhance digital transformation across sectors. In the MEA region, the competitive landscape is still developing, with a mix of local and international players entering the market. The focus is on building infrastructure and regulatory frameworks to support data privacy and security. As businesses increasingly recognize the value of data, the region is poised for growth, with opportunities for innovation and collaboration in data-driven strategies.