Rising Data Traffic

The Network Packet Broker Market is experiencing a surge in data traffic due to the proliferation of connected devices and the increasing reliance on cloud services. As organizations generate and consume vast amounts of data, the need for efficient data management and monitoring becomes paramount. This trend is reflected in the projected growth of data traffic, which is expected to reach 175 zettabytes by 2025. Consequently, network packet brokers play a crucial role in ensuring that data flows seamlessly across networks, enabling organizations to maintain performance and reliability. The demand for solutions that can handle this escalating data volume is likely to drive the Network Packet Broker Market forward, as businesses seek to optimize their network infrastructure.

Adoption of IoT Solutions

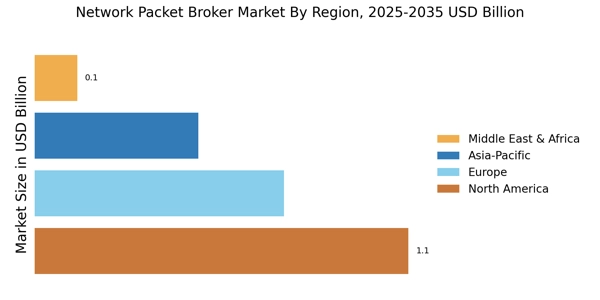

The integration of Internet of Things (IoT) solutions is significantly influencing the Network Packet Broker Market. As more devices become interconnected, the complexity of managing network traffic increases. IoT applications generate substantial amounts of data that require real-time analysis and monitoring. The Network Packet Broker Market is poised to benefit from this trend, as organizations look for ways to efficiently manage the data generated by IoT devices. The market for IoT is projected to grow to 1.1 trillion dollars by 2025, indicating a robust demand for network packet brokers that can facilitate the seamless flow of data across diverse IoT ecosystems. This adoption is likely to enhance the capabilities of network packet brokers, making them indispensable in modern network architectures.

Emergence of 5G Technology

The rollout of 5G technology is set to revolutionize the Network Packet Broker Market by enabling faster data transmission and lower latency. As 5G networks become more prevalent, the volume of data traffic is expected to increase exponentially, necessitating advanced solutions for data management and analysis. Network packet brokers are essential in this context, as they can efficiently handle the high-speed data flows characteristic of 5G networks. The 5G market is anticipated to reach 667 billion dollars by 2026, highlighting the potential for growth in the Network Packet Broker Market. This technological advancement may lead to the development of innovative features within network packet brokers, further enhancing their value proposition in modern network environments.

Growing Cybersecurity Threats

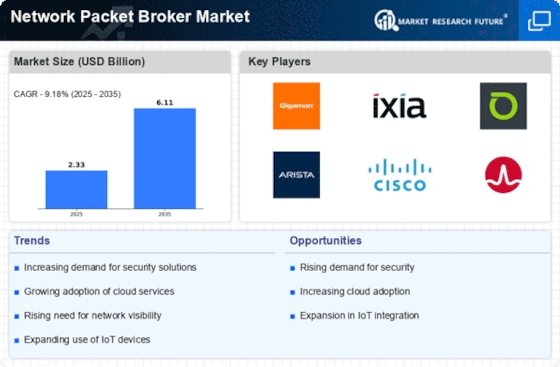

The escalating frequency and sophistication of cybersecurity threats are compelling organizations to invest in robust network security solutions, thereby impacting the Network Packet Broker Market. Cyberattacks, such as DDoS and ransomware, have become increasingly prevalent, prompting businesses to seek comprehensive monitoring and analysis tools. Network packet brokers facilitate enhanced visibility into network traffic, allowing organizations to detect and respond to threats in real-time. The Network Packet Broker Market is projected to reach 345 billion dollars by 2026, indicating a strong correlation between cybersecurity investments and the demand for network packet brokers. This growing awareness of cybersecurity risks is likely to propel the Network Packet Broker Market as organizations prioritize the protection of their network infrastructure.

Regulatory Compliance Requirements

The Network Packet Broker Market is increasingly shaped by stringent regulatory compliance requirements. Organizations are mandated to adhere to various data protection and privacy regulations, such as GDPR and HIPAA, which necessitate enhanced network monitoring and data management capabilities. Network packet brokers provide the necessary tools to ensure compliance by enabling organizations to capture, analyze, and secure data traffic effectively. As regulatory scrutiny intensifies, the demand for solutions that can assist in meeting these compliance standards is expected to rise. This trend may lead to a greater emphasis on the development of advanced features within network packet brokers, thereby driving growth in the Network Packet Broker Market.