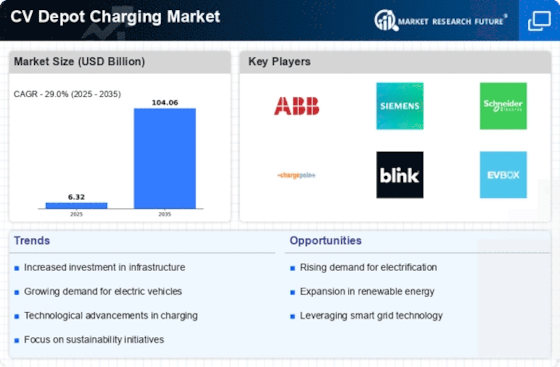

Corporate Sustainability Initiatives

Corporate sustainability initiatives are driving the CV Depot Charging Market as businesses strive to reduce their carbon footprints. Many companies are committing to sustainability goals, which often include transitioning their fleets to electric vehicles. In 2025, it is anticipated that over 70% of large corporations will have implemented sustainability strategies that encompass the adoption of electric fleets and the necessary charging infrastructure. This shift not only aligns with consumer preferences for environmentally responsible practices but also positions companies competitively in their respective markets. Consequently, the demand for depot charging solutions is expected to rise, further propelling the growth of the CV Depot Charging Market.

Growing Demand for Electric Vehicles

The rising demand for electric vehicles (EVs) is a primary driver of the CV Depot Charging Market. As consumers increasingly opt for EVs due to environmental concerns and cost savings, the need for efficient charging infrastructure becomes paramount. In 2025, it is estimated that the number of electric vehicles on the road will surpass 30 million, creating a substantial market for depot charging solutions. This surge in EV adoption necessitates the establishment of robust charging networks, particularly in commercial settings where fleet operations are prevalent. Consequently, the CV Depot Charging Market is likely to experience significant growth as businesses seek to accommodate their electric fleets with adequate charging facilities.

Government Incentives and Regulations

Government incentives and regulations play a crucial role in shaping the CV Depot Charging Market. Many governments are implementing policies aimed at reducing carbon emissions and promoting the use of electric vehicles. For instance, tax credits, grants, and subsidies for the installation of charging infrastructure are becoming increasingly common. In 2025, it is projected that over 50 countries will have established regulations mandating the installation of charging stations in commercial depots. These initiatives not only encourage businesses to invest in depot charging solutions but also enhance the overall market landscape, driving innovation and competition within the CV Depot Charging Market.

Increased Focus on Fleet Electrification

The increased focus on fleet electrification is a significant driver of the CV Depot Charging Market. As logistics and transportation companies recognize the benefits of electric fleets, including lower operating costs and reduced emissions, the demand for depot charging infrastructure is surging. In 2025, it is projected that the electrification of commercial fleets will account for a substantial portion of new vehicle sales. This trend is prompting businesses to invest in dedicated charging facilities to support their electric vehicles. As a result, the CV Depot Charging Market is likely to expand rapidly, driven by the need for efficient and reliable charging solutions tailored to fleet operations.

Technological Innovations in Charging Solutions

Technological innovations are transforming the CV Depot Charging Market, leading to more efficient and faster charging solutions. Developments such as ultra-fast charging technology and smart charging systems are becoming increasingly prevalent. In 2025, the market is expected to witness a rise in the adoption of wireless charging and vehicle-to-grid technologies, which allow for bidirectional energy flow. These advancements not only improve the user experience but also optimize energy consumption and reduce operational costs for fleet operators. As a result, the CV Depot Charging Market is likely to benefit from enhanced charging capabilities that meet the evolving needs of electric vehicle fleets.