Labor Shortages

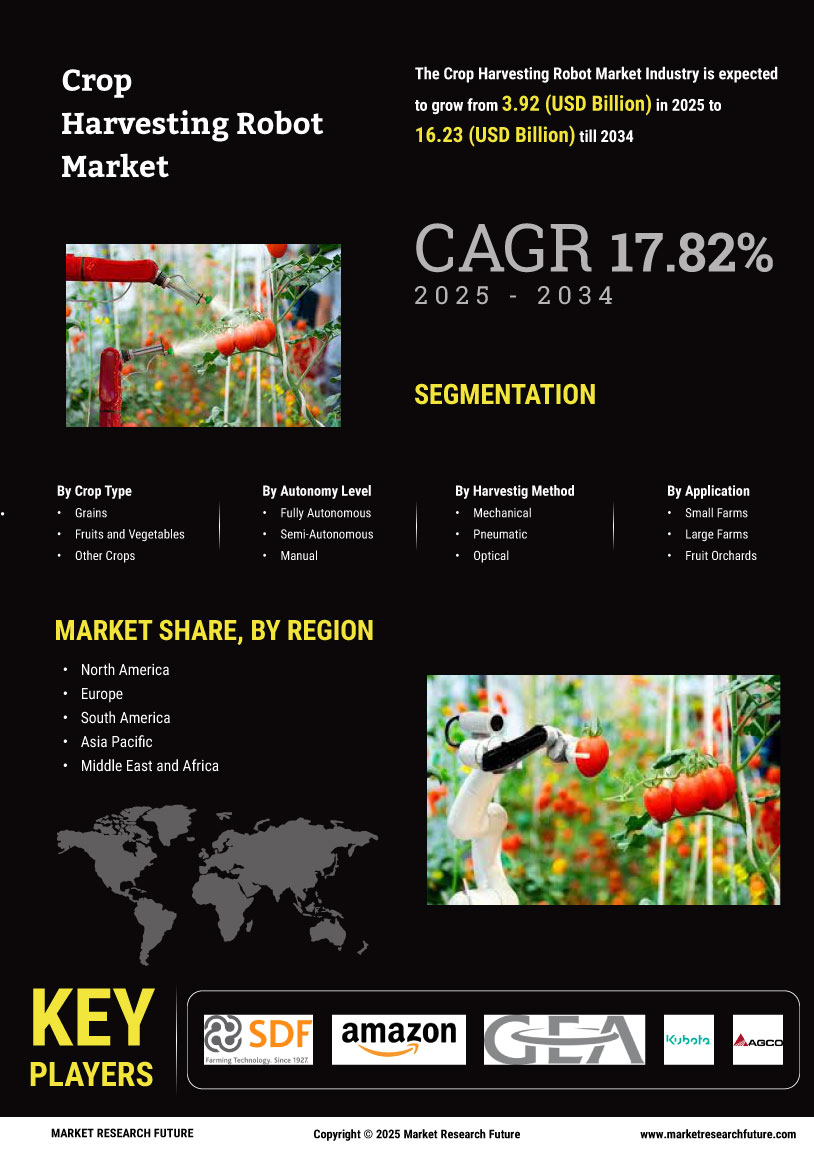

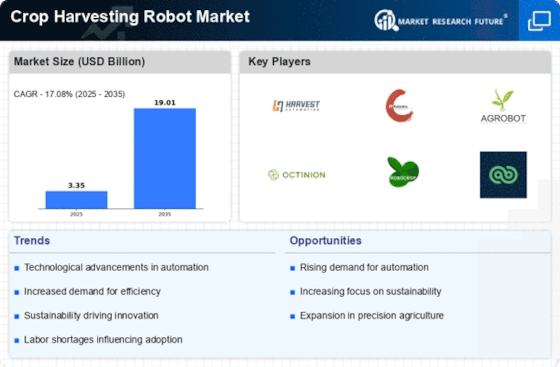

The Crop Harvesting Robot Market is significantly influenced by the ongoing labor shortages in the agricultural sector. Many regions are facing challenges in finding sufficient labor to meet the demands of harvesting, particularly during peak seasons. This shortage has prompted farmers to seek alternative solutions, leading to an increased interest in robotic harvesting technologies. The market data suggests that the demand for crop harvesting robots is expected to grow by over 20% annually as farmers look to automate their operations. By alleviating the reliance on human labor, these robots not only ensure timely harvesting but also enhance overall productivity, making them an attractive option for farmers facing labor constraints.

Rising Food Demand

The Crop Harvesting Robot Market is poised for growth due to the rising global food demand driven by population growth and changing dietary preferences. As the world population is projected to reach nearly 9 billion by 2050, the pressure on agricultural production intensifies. Harvesting robots offer a viable solution to meet this demand by increasing efficiency and yield. Market analysis indicates that the integration of robotics in harvesting can potentially boost crop yields by 15 to 20%, thereby contributing to food security. This trend underscores the importance of the Crop Harvesting Robot Market in addressing the challenges of food production in an increasingly demanding environment.

Sustainability Focus

The Crop Harvesting Robot Market is increasingly aligned with sustainability initiatives, as the demand for environmentally friendly agricultural practices grows. Harvesting robots are designed to minimize waste and reduce the carbon footprint associated with traditional harvesting methods. By employing precision agriculture techniques, these robots can optimize resource use, such as water and fertilizers, leading to more sustainable farming practices. Data indicates that the implementation of robotic harvesting can reduce pesticide usage by up to 50%, contributing to healthier ecosystems. As consumers become more environmentally conscious, the Crop Harvesting Robot Market is likely to benefit from this shift towards sustainable agriculture, positioning itself as a leader in eco-friendly farming solutions.

Technological Advancements

The Crop Harvesting Robot Market is experiencing a surge in technological advancements that enhance the efficiency and effectiveness of harvesting processes. Innovations such as artificial intelligence, machine learning, and advanced sensors are being integrated into harvesting robots, allowing for improved decision-making and precision in crop collection. According to recent data, the adoption of these technologies is projected to increase productivity by up to 30%, thereby reducing operational costs. Furthermore, the development of autonomous systems enables robots to operate with minimal human intervention, which is particularly beneficial in remote or large-scale agricultural settings. This trend not only streamlines harvesting operations but also positions the Crop Harvesting Robot Market as a pivotal player in modern agriculture.

Government Support and Funding

The Crop Harvesting Robot Market is benefiting from increased government support and funding aimed at promoting agricultural innovation. Various governments are recognizing the potential of robotics in enhancing agricultural productivity and sustainability. Initiatives such as grants, subsidies, and research funding are being directed towards the development and deployment of harvesting robots. Recent statistics reveal that government investments in agricultural technology have surged, with funding for robotics projects increasing by over 25% in the past year. This support not only accelerates technological advancements but also encourages collaboration between research institutions and industry players, further propelling the growth of the Crop Harvesting Robot Market.