Growing Focus on Personalized Medicine

The shift towards personalized medicine is reshaping the Cell Harvesting Market. As healthcare moves away from one-size-fits-all approaches, the need for tailored therapies that cater to individual patient profiles becomes paramount. This trend necessitates the efficient harvesting of specific cell types, which can be utilized in personalized treatment plans. The market for personalized medicine is projected to grow significantly, with estimates suggesting it could reach USD 2 trillion by 2030. This growth is likely to drive demand for specialized cell harvesting techniques that can accommodate the unique requirements of personalized therapies. Thus, the Cell Harvesting Market is expected to expand in response to this evolving healthcare paradigm.

Rising Demand for Cell-Based Therapies

The Cell Harvesting Market is experiencing a notable surge in demand for cell-based therapies, driven by advancements in regenerative medicine and personalized healthcare. As the prevalence of chronic diseases continues to rise, the need for effective treatment options becomes increasingly critical. According to recent data, the cell therapy market is projected to reach USD 20 billion by 2026, indicating a robust growth trajectory. This demand is further fueled by the increasing number of clinical trials focusing on cell therapies, which require efficient cell harvesting techniques. Consequently, the Cell Harvesting Market is poised to benefit from this trend, as healthcare providers seek innovative solutions to meet the growing therapeutic needs of patients.

Increasing Investment in Stem Cell Research

Investment in stem cell research is a key driver for the Cell Harvesting Market. As researchers and institutions allocate more resources towards understanding stem cell biology and its applications, the demand for effective cell harvesting techniques intensifies. Recent reports indicate that funding for stem cell research has increased significantly, with government and private sectors investing billions annually. This influx of capital supports the development of advanced cell harvesting technologies, which are essential for isolating and purifying stem cells for therapeutic use. Consequently, the Cell Harvesting Market stands to gain from this trend, as enhanced research capabilities lead to more innovative applications and therapies in regenerative medicine.

Technological Innovations in Cell Harvesting

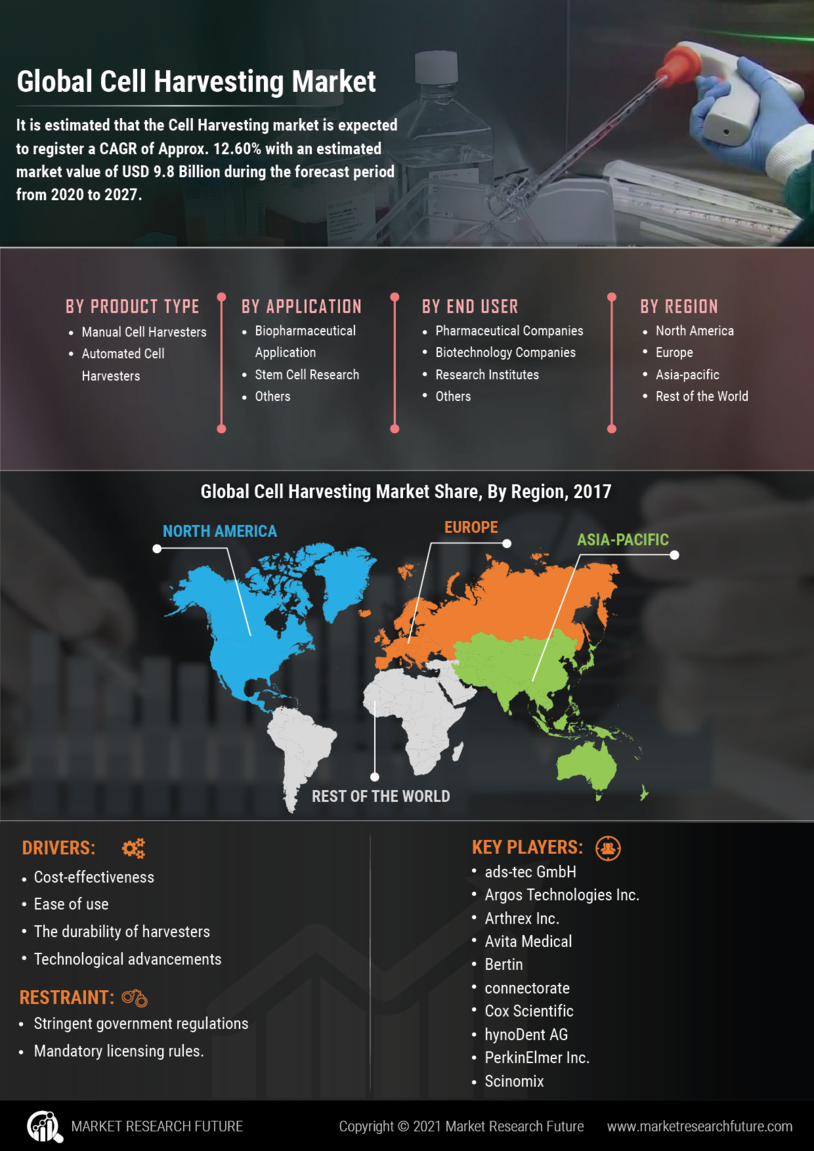

Technological innovations play a pivotal role in shaping the Cell Harvesting Market. The introduction of automated cell harvesting systems and advanced bioprocessing technologies has significantly enhanced the efficiency and yield of cell recovery processes. For instance, the integration of microfluidics and automation in cell harvesting has streamlined workflows, reducing processing times and minimizing contamination risks. As a result, the market for automated cell harvesting solutions is expected to witness substantial growth, with estimates suggesting a compound annual growth rate of over 15% in the coming years. These innovations not only improve operational efficiency but also contribute to the overall quality of cell-based products, thereby driving the Cell Harvesting Market forward.

Regulatory Support for Cell Therapy Development

Regulatory support is a crucial factor influencing the Cell Harvesting Market. Governments and regulatory bodies are increasingly recognizing the potential of cell therapies and are streamlining approval processes to facilitate their development. Initiatives aimed at expediting the review of cell-based products are becoming more common, which encourages investment and innovation within the sector. For instance, the introduction of fast-track designations for promising cell therapies has led to a more favorable environment for research and commercialization. This regulatory landscape not only enhances the viability of cell harvesting technologies but also fosters growth within the Cell Harvesting Market, as companies seek to align their products with evolving regulatory standards.