Rising Demand for Natural Ingredients

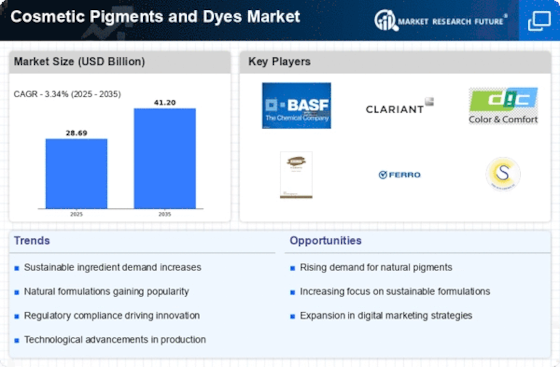

The cosmetic pigments and dyes Market is witnessing a notable shift towards natural and organic ingredients. Consumers increasingly prefer products that are free from synthetic chemicals, prompting manufacturers to innovate with plant-based pigments and dyes. This trend is supported by a growing awareness of the potential health risks associated with synthetic alternatives. According to recent data, the market for natural cosmetic ingredients is projected to grow at a compound annual growth rate of over 8% in the coming years. This demand for natural formulations is likely to drive the Cosmetic Pigments and Dyes Market, as brands strive to meet consumer expectations for safety and sustainability.

Expansion of E-commerce in Beauty Products

The rise of e-commerce has transformed the Cosmetic Pigments and Dyes Market, providing consumers with unprecedented access to a wide array of products. Online platforms enable brands to reach a broader audience, facilitating the introduction of niche and artisanal cosmetic lines. This shift is particularly beneficial for smaller brands that may lack the resources for traditional retail distribution. Recent statistics suggest that online beauty sales are expected to account for a significant portion of the overall market, further driving the demand for diverse cosmetic pigments and dyes. As a result, the Cosmetic Pigments and Dyes Market is likely to see continued growth fueled by e-commerce.

Technological Advancements in Pigment Production

Technological innovations in the production of cosmetic pigments and dyes are significantly influencing the Cosmetic Pigments and Dyes Market. Advances in manufacturing processes, such as nanotechnology and bioengineering, enable the creation of more vibrant and long-lasting colors. These technologies not only enhance the aesthetic appeal of cosmetic products but also improve their performance and stability. For instance, the introduction of encapsulated pigments allows for controlled release and better color retention. As a result, the Cosmetic Pigments and Dyes Market is likely to benefit from these advancements, attracting both manufacturers and consumers seeking high-quality products.

Growing Influence of Social Media and Beauty Trends

The Cosmetic Pigments and Dyes Market is increasingly shaped by the influence of social media and evolving beauty trends. Platforms like Instagram and TikTok have become pivotal in promoting new cosmetic products and color trends, leading to rapid shifts in consumer preferences. Influencers and beauty gurus often showcase vibrant makeup looks, driving demand for specific shades and formulations. This trend is reflected in market data, which indicates a surge in sales of bold and unconventional colors. Consequently, the Cosmetic Pigments and Dyes Market must adapt to these dynamic trends to remain competitive and relevant.

Increased Focus on Personalization and Customization

The demand for personalized beauty products is reshaping the Cosmetic Pigments and Dyes Market. Consumers are increasingly seeking products tailored to their individual preferences, including specific colors and formulations. This trend is prompting brands to offer customizable options, allowing consumers to create their unique cosmetic products. Market Research Future indicates that personalized beauty products are gaining traction, with a notable percentage of consumers expressing interest in bespoke formulations. This shift towards personalization is likely to drive innovation within the Cosmetic Pigments and Dyes Market, as companies strive to meet the diverse needs of their clientele.