Market Trends

Key Emerging Trends in the Cosmetic Pigments Market

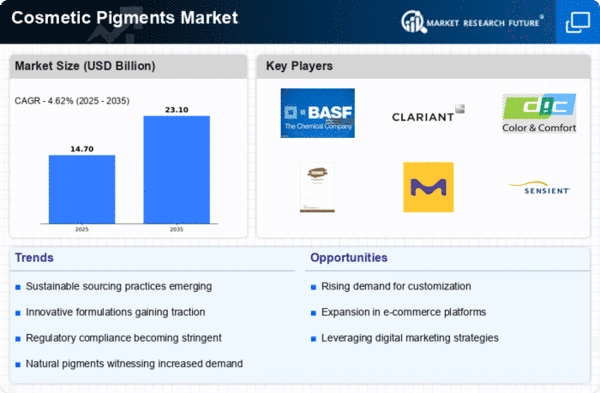

The cosmetic pigments market is experiencing significant trends that are shaping the industry and driving its growth. One prominent trend is the increasing demand for cosmetic pigments due to the rising popularity of beauty and personal care products worldwide. With changing consumer preferences and evolving beauty trends, there is a growing demand for innovative and high-quality cosmetic formulations that offer vibrant colors, long-lasting effects, and diverse finishes. Cosmetic pigments play a crucial role in enhancing the visual appeal and performance of cosmetics such as lipsticks, eyeshadows, blushes, and nail polishes, driving their usage across various segments of the beauty industry.

Moreover, there is a growing emphasis on natural and sustainable cosmetic pigments derived from mineral sources, plant extracts, and other natural ingredients. With increasing awareness of environmental sustainability and health-consciousness among consumers, there is a rising demand for cosmetics formulated with natural and eco-friendly ingredients. Natural cosmetic pigments offer advantages such as biodegradability, non-toxicity, and reduced environmental impact compared to synthetic pigments, making them an attractive option for beauty brands seeking to align with consumer preferences and sustainability goals.

Furthermore, the market is witnessing increasing demand for specialty cosmetic pigments with unique properties such as color-shifting, pearlescent, and iridescent effects. Specialty pigments enable cosmetic manufacturers to create distinctive and trend-setting formulations that stand out in the competitive beauty market. These pigments are used to create eye-catching makeup looks, innovative nail art designs, and captivating skincare products that appeal to consumers' desire for self-expression and individuality. As beauty trends continue to evolve, the demand for specialty cosmetic pigments is expected to grow, driving market expansion and fostering innovation in cosmetic formulations.

Additionally, the cosmetic pigments market is experiencing a shift towards digitalization and customization, driven by technological advancements and changing consumer behaviors. With the rise of social media and digital platforms, consumers are increasingly seeking personalized beauty experiences and products that cater to their unique preferences and skin tones. Cosmetic companies are leveraging digital tools such as augmented reality (AR), artificial intelligence (AI), and color-matching algorithms to develop customized makeup solutions and offer personalized recommendations to consumers. This trend towards customization and digitalization is driving investment in research and development, product innovation, and customer engagement strategies in the cosmetic pigments market.

Leave a Comment