Rising Awareness of Skin Health

There is a growing awareness regarding skin health and the importance of using quality skincare products, which is positively impacting the Cosmetic Oil Market. Consumers are increasingly seeking products that offer multiple benefits, such as hydration, anti-aging properties, and protection against environmental stressors. This trend is supported by a surge in educational content available through various platforms, including social media and beauty blogs. Market data indicates that the skincare segment, which includes cosmetic oils, is expected to reach a valuation of over 150 billion in the next few years. This heightened awareness is driving consumers to invest in premium cosmetic oils that promise enhanced skin health, thereby expanding the market.

Expansion of E-commerce Platforms

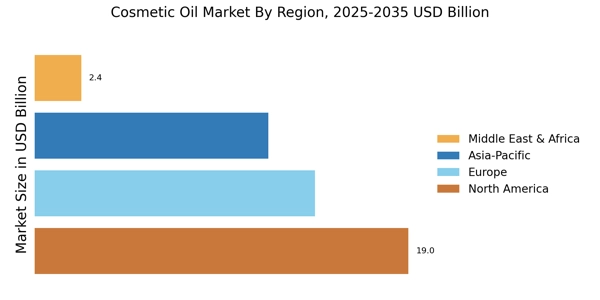

The expansion of e-commerce platforms is transforming the Cosmetic Oil Market by providing consumers with greater access to a diverse range of products. Online shopping has become a preferred method for many consumers, particularly in the beauty sector, due to its convenience and the ability to compare products easily. Data indicates that e-commerce sales in the beauty industry are expected to account for over 25% of total sales in the coming years. This shift is prompting brands to enhance their online presence and invest in digital marketing strategies. As a result, the Cosmetic Oil Market is likely to see increased competition and innovation as brands strive to capture the attention of online shoppers.

Growing Demand for Organic Products

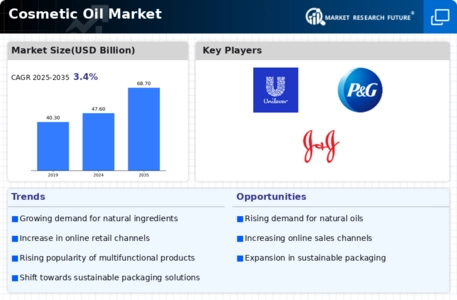

The Cosmetic Oil Market is experiencing a notable increase in demand for organic and natural products. Consumers are becoming increasingly aware of the potential harmful effects of synthetic ingredients, leading to a shift towards products that are perceived as safer and more environmentally friendly. According to recent data, the organic cosmetic segment is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend is particularly evident among millennials and Gen Z consumers, who prioritize sustainability and ethical sourcing in their purchasing decisions. As a result, brands within the Cosmetic Oil Market are reformulating their products to include organic oils, which not only cater to consumer preferences but also enhance brand loyalty and market share.

Influence of Celebrity Endorsements

The influence of celebrity endorsements is significantly shaping consumer preferences within the Cosmetic Oil Market. High-profile endorsements and collaborations with beauty influencers are driving brand visibility and consumer trust. As celebrities often have a substantial following, their recommendations can lead to increased sales and brand loyalty. Market analysis suggests that products endorsed by celebrities tend to experience a sales boost of up to 30% shortly after the endorsement. This trend highlights the importance of strategic marketing in the Cosmetic Oil Market, where brands are increasingly leveraging celebrity partnerships to enhance their market presence and attract a wider audience.

Technological Advancements in Formulation

Technological advancements in formulation are playing a crucial role in the evolution of the Cosmetic Oil Market. Innovations such as microencapsulation and advanced extraction techniques are enabling manufacturers to enhance the efficacy and stability of cosmetic oils. These technologies allow for the incorporation of active ingredients that can penetrate deeper into the skin, providing better results. Furthermore, the development of multifunctional oils that combine various benefits into a single product is gaining traction. As a result, the Cosmetic Oil Market is witnessing an influx of innovative products that appeal to consumers looking for convenience and effectiveness. This trend is likely to continue as brands invest in research and development to stay competitive.