Market Share

Introduction: Harnessing Competitive Momentum in the Concentrated Photovoltaic Market

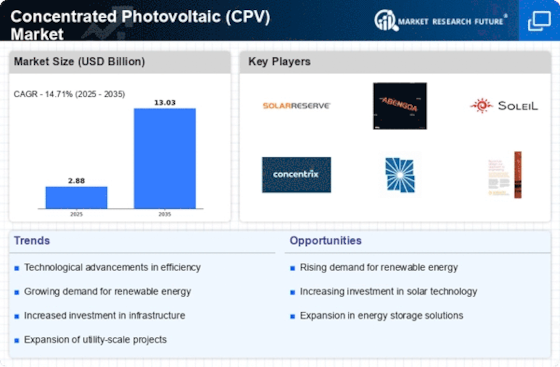

The Concentrated Photovoltaic (CPV) market is experiencing a transformation, driven by a combination of rapid technology uptake, evolving regulatory frameworks, and increasing demand for sustainable energy solutions. The resulting intense competition between the major players, including system integrators, equipment manufacturers, and operators, is facilitated by the emergence of advanced digital capabilities, such as machine learning-based data analytics, automation, and IoT integration. These digitally-enabled differentiators not only improve operational efficiency, but also enable companies to react to market conditions in real time. Also, new entrants, in the form of greentech start-ups, are reshaping the competitive landscape by introducing new business models that challenge the established order. The strategic deployment of CPV in emerging markets is a promising growth opportunity, particularly in the context of government incentives and increasing investment in the underlying energy infrastructure.

Competitive Positioning

Full-Suite Integrators

These vendors provide comprehensive solutions encompassing design, manufacturing, and installation of CPV systems.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Radical Sun Systems, Inc. (U.S.) | Innovative design and efficiency | CPV system integration | North America |

| SolAero Technologies Corp. (U.S.) | High-performance solar cells | Solar cell manufacturing | North America |

| Arzon Solar LLC. (U.S.) | Customizable solar solutions | CPV technology | North America |

Specialized Technology Vendors

These companies focus on specific technological advancements and innovations within the CPV sector.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Cool Earth Solar (U.S.) | Unique solar concentrator design | Solar concentrators | North America |

| Morgan Solar Inc. (Canada) | Cost-effective CPV solutions | CPV technology | North America |

| ARIMA Group (Taiwan) | Advanced optical technology | Optical systems for CPV | Asia-Pacific |

Infrastructure & Equipment Providers

These vendors supply essential components and infrastructure necessary for CPV system deployment.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Suncore Photovoltaic Technology Company Limited (China) | Robust manufacturing capabilities | Photovoltaic components | Asia-Pacific |

| Sumitomo Electric Industries, Ltd. (Japan) | Diverse energy solutions | Electrical equipment for CPV | Asia-Pacific |

| Saint-Augustin Canada Electric Inc. (STACE) (Canada) | Expertise in electrical systems | Electrical infrastructure | North America |

| Sanan Optoelectronics Technology Co., Ltd (China) | Leading in optoelectronic technology | Optoelectronic components | Asia-Pacific |

| Suntrix Company Ltd (China) | Innovative solar technology | Solar energy solutions | Asia-Pacific |

| Macsun Solar Energy Technology Co., Ltd. (China) | High-efficiency solar products | Solar energy technology | Asia-Pacific |

Emerging Players & Regional Champions

- SolarReserve (USA): Specializes in hybrid CPV systems that integrate thermal storage, recently secured a contract for a 100 MW project in Nevada, challenging traditional PV vendors by offering energy storage solutions that enhance reliability.

- HCPV Technologies (Spain): A specialist in high-concentration, high-tracking solar cells, this Spanish company has recently installed a pilot plant in Andalusia. Its high-efficiency products, designed for sunny regions, complement those offered by established manufacturers.

- Soleos Solar (Germany): The company offers a new concentrating photovoltaic module made of light materials and has recently teamed up with a German power company to install a 50-megawatt plant. Soleos is positioning itself as a challenger to traditional solar panel manufacturers by putting an emphasis on transport costs.

- Concentrix Solar (Germany): Develops CPV systems with a focus on cost reduction and efficiency, recently announced a contract for a 30 MW project in the Middle East, complementing established vendors by targeting regions with high solar insolation.

- CSP Technologies (Australia): Provides CPV solutions tailored for off-grid applications, recently launched a project in remote Australian communities, challenging established vendors by addressing niche markets that require energy independence.

Regional Trends: In 2024, the CPV market will be experiencing a growth in the regions of the world where the sun is very strong, such as the Middle East and southern Europe. Combined with energy storage, a trend is developing towards increasing the security of the grid. In terms of technology, the emphasis will be on lightweight materials and hybrid systems combining CPV with other forms of generation.

Collaborations & M&A Movements

- SolarTech Innovations and GreenEnergy Solutions entered a partnership to develop next-generation CPV systems aimed at increasing efficiency and reducing costs, positioning themselves as leaders in the sustainable energy sector.

- HelioPower acquired SunMax Technologies in early 2024 to enhance its technological capabilities in CPV systems, thereby strengthening its market share and competitive positioning in the renewable energy landscape.

- CPV Dynamics and EcoSolar formed a collaboration to jointly research and develop advanced materials for CPV modules, aiming to improve performance and durability in diverse environmental conditions.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| High Efficiency Solar Cells | SolarReserve, Concentrix Solar | SolarReserve has a special photovoltaic technology that reaches efficiencies of more than 40 per cent. Concentrix Solar has already successfully applied high-efficiency cells in its CPV systems. Its systems produce significant amounts of electricity in arid regions. |

| Tracking Systems | Soleil Energy, BrightSource Energy | The double-axis tracking system of Soleil Energy increases the energy production by up to thirty percent compared to the fixed system. The tracker of BrightSource Energy optimizes the exploitation of the sunlight throughout the day and thus increases the overall performance of the system. |

| Cost-Effective Manufacturing | CSP Technologies, Amonix | CSP Technologies has streamlined its manufacturing process, reducing costs while maintaining quality. Amonix has implemented automation in production, resulting in lower labor costs and increased scalability of CPV systems. |

| Sustainability Practices | Abengoa Solar, GreenBrilliance | Abengoa Solar focuses on sustainable materials and recycling processes in their CPV systems. GreenBrilliance has committed to using eco-friendly manufacturing practices, which has garnered positive attention in the market for sustainability. |

| Grid Integration Solutions | NEXTracker, First Solar | NEXTracker offers advanced grid integration solutions that facilitate seamless connection of CPV systems to existing grids. First Solar has developed proprietary software that enhances grid stability and energy management for CPV installations. |

| Energy Storage Integration | Tesla Energy, Fluence | Tesla Energy has pioneered energy storage solutions that complement CPV systems, allowing for energy dispatch during peak demand. Fluence provides integrated storage solutions that enhance the reliability of CPV-generated energy. |

Conclusion: Navigating the CPV Market Landscape

The Concentrated Photovoltaic (CPV) market in 2024 is characterized by an intense competition and marked fragmentation. The players are mainly the old and new players. In terms of regional trends, there is a growing emphasis on innovation and sustainability, especially in areas with high solar insolation where CPV technology can be used most effectively. Strategic positioning of the suppliers is based on the use of advanced capabilities such as artificial intelligence for predictive analysis, automation for operational efficiency and flexible solutions that meet the various energy needs. These capabilities are increasingly important for market leadership, because they help companies to meet not only current but also future needs and anticipate changes in the energy and regulatory environment. Strategic considerations are therefore essential for coping with the complexities of the CPV market.

Leave a Comment