Market Growth Projections

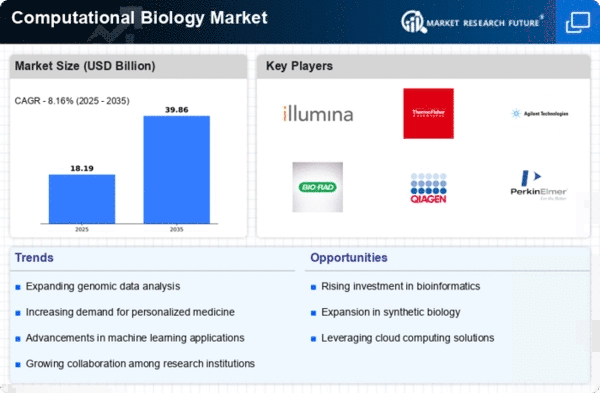

The Global Computational Biology Market Industry is poised for substantial growth, with projections indicating a market size of 16.8 USD Billion in 2024 and an anticipated increase to 39.9 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 8.16% from 2025 to 2035, driven by factors such as technological advancements, increased demand for personalized medicine, and the integration of AI in research. The market's expansion underscores the critical role of computational biology in addressing complex biological challenges and advancing healthcare solutions.

Advancements in Genomic Research

Advancements in genomic research are propelling the Global Computational Biology Market Industry forward. The ability to sequence genomes rapidly and cost-effectively has opened new avenues for understanding complex biological systems. Technologies such as CRISPR and next-generation sequencing are at the forefront of this evolution, facilitating large-scale data analysis. This growth is evidenced by the projected market size of 39.9 USD Billion by 2035, indicating a robust interest in leveraging computational biology for innovative research and applications in various fields, including agriculture and medicine.

Collaborative Research Initiatives

Collaborative research initiatives are fostering innovation within the Global Computational Biology Market Industry. Partnerships between academic institutions, government agencies, and private companies are becoming more prevalent, facilitating knowledge exchange and resource sharing. These collaborations often focus on large-scale projects that require extensive computational resources and expertise, such as the Human Genome Project. Such initiatives not only accelerate research timelines but also enhance the quality of outcomes, positioning computational biology as a cornerstone of modern scientific inquiry.

Growing Investment in Biotechnology

Growing investment in biotechnology is a key driver of the Global Computational Biology Market Industry. Governments and private sectors are increasingly funding research initiatives that utilize computational biology to address pressing health challenges. For instance, initiatives aimed at developing novel therapeutics and vaccines are receiving substantial financial backing. This influx of capital is likely to enhance the capabilities of computational biology tools and platforms, further expanding their applications in drug discovery and development. The anticipated market growth underscores the importance of sustained investment in this dynamic field.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into computational biology is transforming the Global Computational Biology Market Industry. AI algorithms enhance data analysis, enabling researchers to uncover patterns and insights from vast biological datasets. For example, machine learning models are increasingly used to predict protein structures and interactions, significantly accelerating drug discovery processes. This trend is expected to contribute to a compound annual growth rate (CAGR) of 8.16% from 2025 to 2035, as organizations seek to harness AI's potential to drive efficiencies and innovation in biological research.

Rising Demand for Personalized Medicine

The Global Computational Biology Market Industry is experiencing a surge in demand for personalized medicine, which tailors treatment to individual genetic profiles. This trend is driven by advancements in genomics and bioinformatics, enabling healthcare providers to offer more effective therapies. For instance, the integration of computational biology in drug development has led to the identification of biomarkers that predict patient responses. As a result, the market is projected to reach 16.8 USD Billion in 2024, reflecting the increasing reliance on computational tools to enhance therapeutic outcomes.