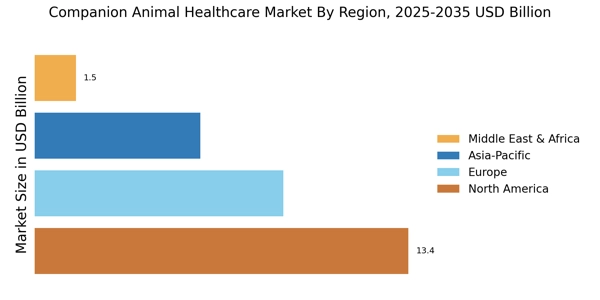

North America : Market Leader in Pet Care

Companion Animal Healthcare Market has shown strong influence in all the major regions. North America is the largest market for companion animal healthcare, accounting for approximately 45% of the global market share. The region's growth is driven by increasing pet ownership, rising disposable incomes, and a growing focus on pet health and wellness. Regulatory support for veterinary practices and pet medications further catalyzes market expansion. The U.S. and Canada are the primary contributors to this growth, with a strong emphasis on preventive care and advanced veterinary services. The competitive landscape in North America is characterized by the presence of major players such as Zoetis, Merck Animal Health, and Elanco Animal Health. Recent launches of companion animal health products emphasize ease of administration, such as long-acting injectables and palatable oral formulations, to improve owner compliance.

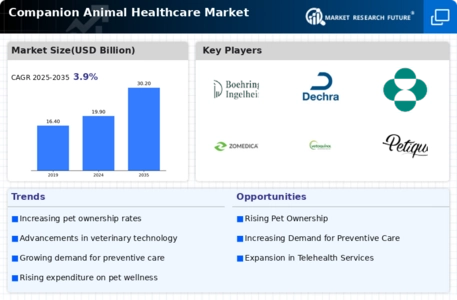

The Companion Animal Healthcare Market is also witnessing a trend towards consolidation, with mergers and acquisitions enhancing the capabilities of leading firms. This dynamic environment fosters a robust ecosystem for companion animal healthcare, ensuring high-quality care for pets.

Europe : Emerging Trends in Pet Health

Europe is witnessing significant growth in the companion animal healthcare market, holding approximately 30% of the global share. The region's growth is fueled by increasing awareness of pet health, advancements in veterinary technology, and supportive regulatory frameworks. Countries like Germany and France are leading the market, driven by high pet ownership rates and a growing demand for premium pet healthcare products and services. The European Union's regulations on animal welfare and veterinary practices further enhance market dynamics. Leading countries in Europe include Germany, France, and the UK, where key players like Boehringer Ingelheim and Virbac are prominent. The competitive landscape is marked by innovation in pharmaceuticals and pet nutrition, with companies focusing on developing specialized products for various health conditions. The market is also seeing a rise in telemedicine and online veterinary services, reflecting changing consumer preferences and technological advancements.

Asia-Pacific : Rapid Growth in Pet Ownership

Asia-Pacific is rapidly emerging as a significant player in the companion animal healthcare market, accounting for about 20% of the global share. The region's growth is driven by increasing pet ownership, urbanization, and rising disposable incomes. Countries like China and Japan are at the forefront, with a growing trend towards premium pet care products and services. Regulatory improvements and government initiatives to enhance animal health standards are also contributing to market expansion.

The competitive landscape in Asia-Pacific is evolving, with both local and international players vying for market share. Key companies such as Nestlé Purina PetCare and Elanco are expanding their presence through strategic partnerships and product innovations. The region is also witnessing a surge in demand for preventive healthcare and wellness products, reflecting changing consumer attitudes towards pet care. This dynamic environment presents significant opportunities for growth in the companion animal healthcare market.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is gradually emerging in the companion animal healthcare market, holding approximately 5% of the global share. The growth is driven by increasing pet ownership, urbanization, and a rising awareness of animal health. Countries like South Africa and the UAE are leading the market, with a growing demand for veterinary services and pet care products.

Regulatory frameworks are evolving, supporting better animal health standards and practices in the region. The competitive landscape is characterized by a mix of local and international players, with companies like Ceva Santé Animale and Virbac making significant inroads. The market is witnessing a trend towards the adoption of advanced veterinary practices and products, driven by changing consumer preferences. As pet ownership continues to rise, the demand for quality healthcare services and products is expected to grow, presenting lucrative opportunities for stakeholders in the region.