Companion Diagnostic Size

Companion Diagnostic Market Growth Projections and Opportunities

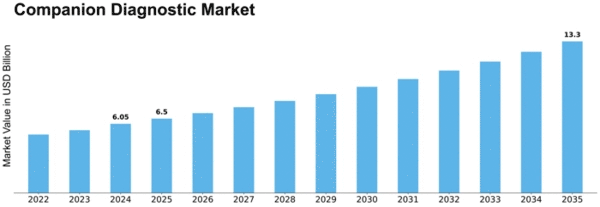

Companion diagnostics is expected to reach $5.71 billion by 2030, growing 11.9% annually. Numerous variables shape the companion diagnostics market's dynamics and development. The rise of tailored medicine drives this tendency. In the move toward personalized healthcare, companion diagnostics are essential for tailoring treatments to particular patients. These diagnostics, sometimes linked to specific pharmaceuticals, improve medical efficiency and safety by identifying individuals most likely to benefit from a therapy. Regulatory considerations are crucial in companion diagnostics. Companion diagnostic items need strict regulatory clearances to create and sell. Pharmaceutical businesses and diagnostic producers often work with regulatory bodies to ensure the safety and efficacy of companion diagnostics with their medicinal treatments. The evolving targeted therapy market also affects market dynamics. Targeted medicines, especially in cancer, increase the requirement for companion diagnostics. These diagnostics simplify and personalize illness care by identifying patient subgroups most likely to respond well to tailored therapies. Economic factors including reimbursement rules and healthcare spending affect companion diagnostics uptake. Economic viability influences companion diagnostics integration into clinical practice. Payment regulations and coverage impact patient access to these tests and their uptake across healthcare settings. varied regions have varied healthcare concerns and objectives, which affects market dynamics. Companion diagnostics demand depends on illness prevalence, targeted therapy availability, and regional healthcare infrastructure. Manufacturers often adjust their methods to meet market needs and regulations. Competition drives innovation and market growth in companion diagnostics. Strategic alliances, important rivals, and market share affect product development and commercialization. Healthy competition spurs the development of new biomarkers, technologies, and diagnostic platforms, giving healthcare providers several companion diagnostics options. Research and development improve companion diagnostics, driving market growth. Discovering new biomarkers, improving diagnostic sensitivity and specificity, and exploring new applications keep the industry competitive. Research-driven innovations improve clinical practice by enabling companion diagnostics for more treatment areas. Awareness and education campaigns can boost industry growth. Increasing awareness among healthcare professionals of companion diagnostics' benefits in guiding treatment choices drives their use. Educational and awareness efforts help companion diagnostics become part of regular clinical processes by building trust in their effectiveness.

Leave a Comment