Research Methodology on Commodity Plastics Market

Market Research Future (MRFR)'s report on the Commodity Plastics Market has attempted to explore the different aspects of the market in forecasting the future of the market from 2023 to 2030. The research is based on extensive primary and secondary insights from stakeholders such as industry experts, manufacturers, market vendors, and investors.

Research Methodology:

This research was conducted using a combination of primary and secondary research methodologies. A thorough secondary research method was used to gain insights into the global commodity plastic market size and trends. Industry publications such as the Global Plastics Market Guide, Plastics Insight and Plastics Today were consulted to identify the market size, key industry participants, and market share held by each player.

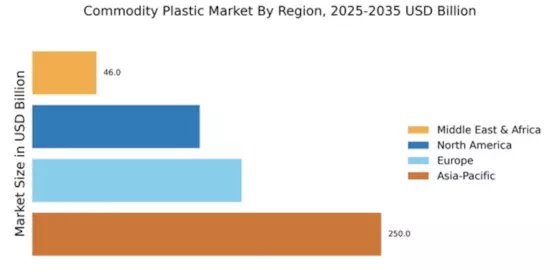

The top-down approach was used to gain insights into the market value and to project market figures and estimates of the various components of the global commodity plastic market. Additionally, regional revenue estimates were derived by using the bottom-up approach, from key industry experts and economic experts in the targeted region.

In addition, interviews were conducted with global, regional, and country-level executives of prominent players in the industry to gain a better understanding of the market forces driving the market and to identify key product and technology trends.

Primary research included conducting surveys with customers, sales and marketing representatives, and industry experts to gain more detailed insights into the market landscape and trends. Interviews were conducted with market participants to gain a better understanding of their perspectives on the industry.

The key data collected from the primary research includes market size, competitive landscape, and market trends. Secondary research includes government publications, trade and industry databases, articles and reports from key tertiary journals, and news and media articles have all been used to gather as much relevant information as possible.

To validate the information gathered, the data was triangulated. Triangulation consists of analyzing both industry and market trends and using other data sources. The data triangulation was used to analyze the data sources to validate the market size, market trends, and company shares in the market.

The data collected was then compared and validated using the Industry Validation Model. The model looks at industry segments, geographic regions, distribution channels, and recent developments. The Industry Validation Model was used to verify the data by two workers and to validate the reliability of the analysis results.

Furthermore, the market numbers were triangulated by gathering data through primary sources and secondary sources, data models were also used to extract the data, and the final data was then validated by the industry experts.

Derived data is verified by using advanced secondary research tools. Market research tools used for this study include Porter’s Five Forces Analysis which identifies the bargaining power of suppliers and buyers and helps to analyze the market competition. The report also uses SWOT analysis to analyze the strengths, weaknesses, opportunities, and threats influencing the market dynamics.

Data were analyzed using market chief forecasting techniques and together with qualitative inputs such as market trends, regional dynamics, and the changing competitive landscape. The report also provides detailed analysis and forecasting of the commodity plastics market segmented by product type, application, and region.

In addition to providing up-to-date market statistics and market trends, the report also provides an in-depth analysis of the competitive landscape and market entry strategies. The report also provides recommendations on how to make the most of market opportunities in the future.